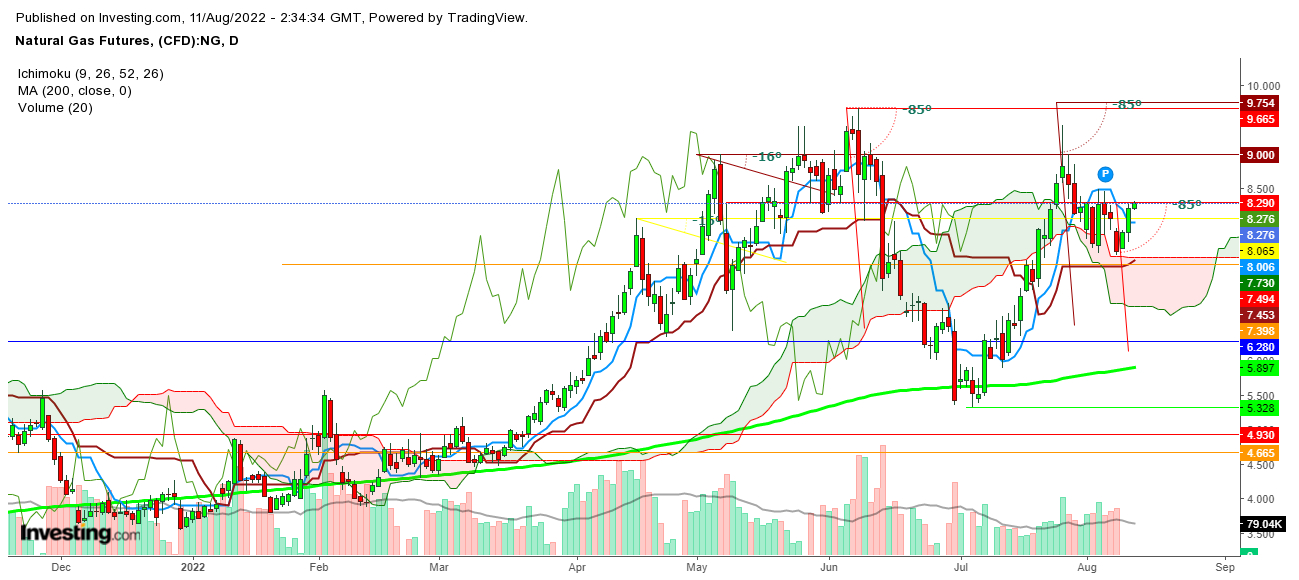

The natural gas bulls found themselves trapped above 7.777 as the rest of the upward move was only short-covering. Natural gas prices plummeted on Wednesday as the futures could find stiff resistance at $8.3. Exhaustion could continue on Thursday as the announcement of weekly inventory could favor natural gas bears.

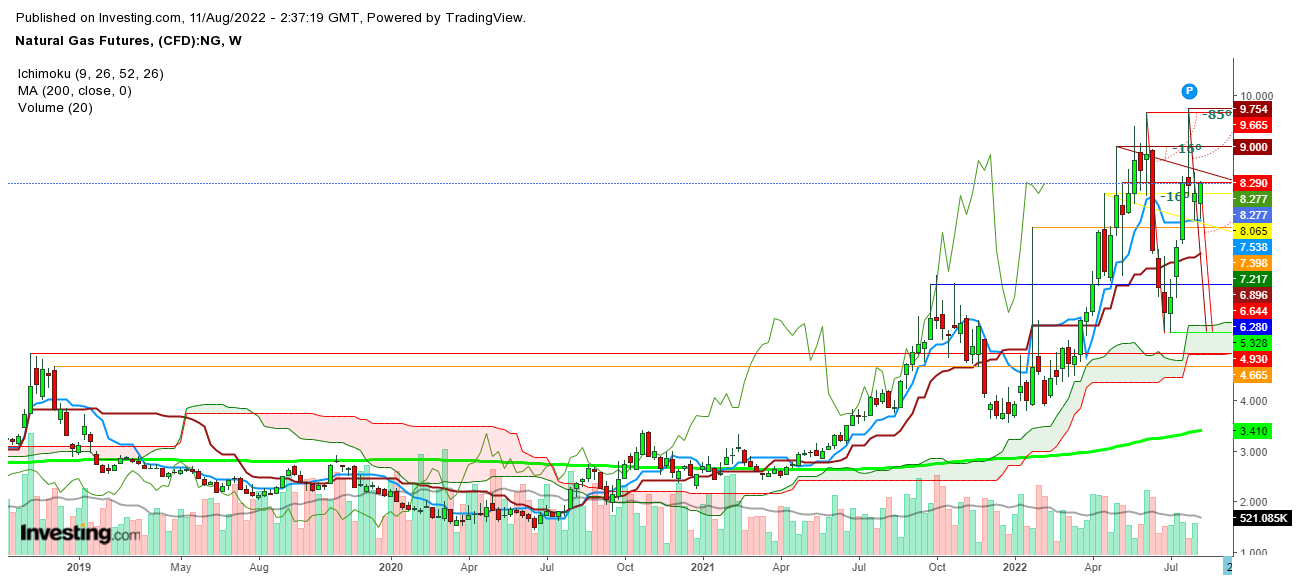

Technically speaking, in the weekly chart, despite rallies during this week and the last week from the immediate support at 9 DMA, the natural gas futures could find it difficult to sustain above $8.3, the base of the big exhaustive candle formed during the last week of July 2022.

In the daily chart, natural gas has a high at $8.309 and currently trading at $8.279 looks like exhaustion that may continue on Thursday and Friday.

The bulls could hit $8.481 on the upper side as the big price swings are still in the fray, but a steep fall would follow this move, as witnessed on Aug. 3, 2022.

On the lower side, a breakdown below $8.065 could encourage the bears to push the prices up to $7.5 till this weekly closing.

Finally, I conclude that a breakdown below $8.065 will be the first indication of the advent of trapping bulls above $8 as the bears are still in the driver's seat.

Disclaimer: The author of this analysis does not have any position in natural gas futures. Readers are advised to take any position at their own risk, as natural gas is one of the most liquid commodities in the world.