Despite wild price swings, natural gas bulls feel exhausted after waging a long war as Russia feels now since its invasion of Ukraine.

Undoubtedly, Russia’s invasion tilted the whole global economic equation with a steep surge in inflation that gripped the energy prices on priority as Russia started to threaten supply disruption of crude and natural gas to European nations that imposed sanctions on Russia.

On the other hand, Russia started to sell oil and gas at discounted rates to some Asian countries to use energy as a powerful tool to influence global politics. This was more or less a self-destructing step that is constantly damaging the Russian economy.

No doubt that this attempt to weaken the sanctions-imposing countries by Russia compelled the European countries to look for new energy sources to fulfill their needs for the coming winters have started to show its effect on the oil and gas prices.

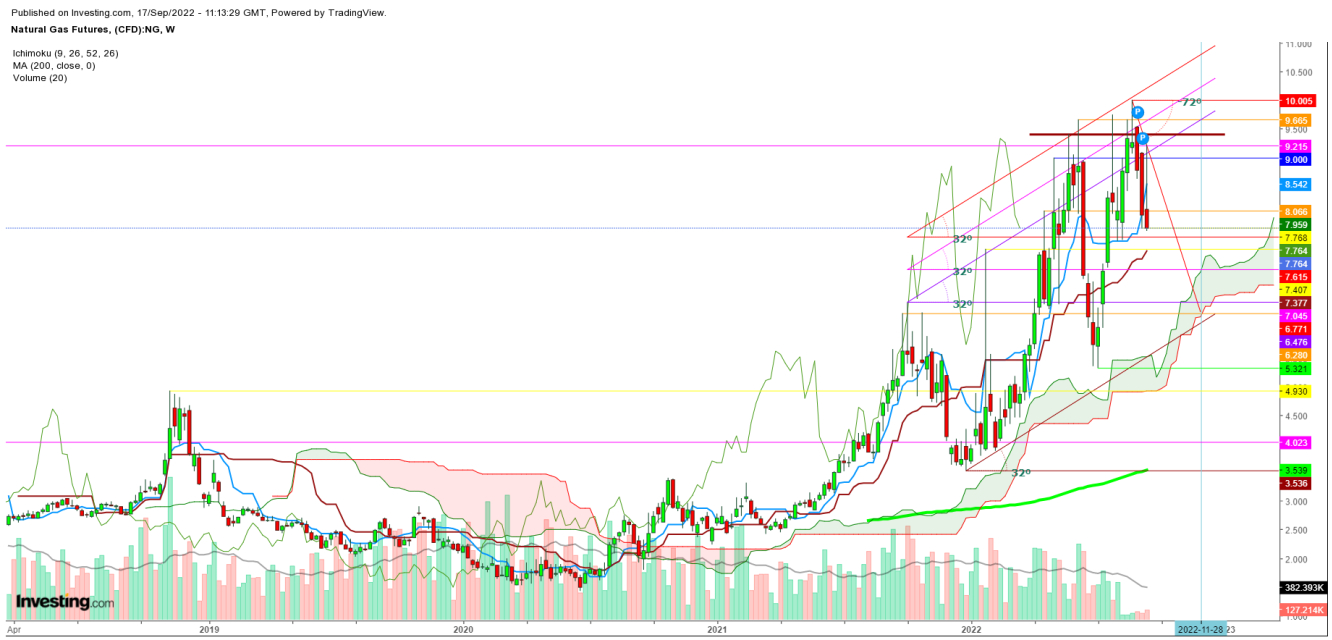

Natural gas prices on the monthly chart have witnessed sharp selling bouts above $9.4 since May 2022. Undoubtedly, the futures formed two peaks, first at $9.664 on June 8 and second at $10.005 on August 23, 2022, amid wild price swings as the price continued to find stiff resistance at $9.418 during this period.

With Russian exhaustion in Ukraine, prices seem to follow the same as the warm weather looks not too supportive for the natural gas bulls at this time of the year as the inventory build-ups continue to be on the higher side.

In a weekly chart, futures found the first ‘Exhaustive Candle’ during the fourth week of August. Soon after the formation of the last seasonal peak at $10.005, and the follow-up candles are showing constant selling sprees since then.

The last weekly candle looks evident enough to show the quantum of a steep surge in selling sprees that may continue during the upcoming weeks, as last Friday’s closing level confirms a gap-down opening on the first trading session of the upcoming week.

In a daily chart, futures tried to defy the formation of a ‘Bearish Crossover’ during the last week by attempting to cross the stiff resistance at $9.5, which finally triggered one more selling spree on Friday.

Finally, I conclude that the weekly closing futures at the upper end of ‘Ichimoku Clouds’, makes the price-action highly uncertain. I find that a potential breakdown by the natural gas price below the lower end of the ‘Ichimoku Clouds’ will confirm the advent of price evaporation that may drag-down the price to hit $6.418 during the upcoming week.

Disclaimer: The author of this analysis does not have any position in natural gas and WTI futures. Readers are advised to take any position at their own risk; as natural gas is one of the most liquid commodities of the world.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Natural Gas: Price Evaporation Likely Amid Wild Price Swings

Published 09/17/2022, 08:55 AM

Updated 07/09/2023, 06:31 AM

Natural Gas: Price Evaporation Likely Amid Wild Price Swings

Latest comments

Concur👍

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.