- Storage remains ample from abysmal winter heating demand

- LNG processing below par as Freeport has way to go before peak liquefaction

- Gas prices seen stuck in mid-$2 range near term, at least

If there’s one constituency that must have understood how oil bulls felt in the past 24 hours, it would have been their brothers in natural gas. Were we still in the days of open outcry trading, I can almost bet that a few in the gas trading pit would have walked over to the crude side to say a few words of comfort, even land a shoulder.

Not that the grass is a lot greener on this side.

With the dawn of spring just four days away, gas bulls are stuck in the same rut they were in a month ago. Storage of the fuel remains ample as a warm winter prompts Americans to use minimal gas for heating, while the rebuilding of a fire-struck plant limits the liquefaction of gas for export.

Natural gas prices are also stranded in the same mid-$2 range after a false breakout two weeks ago to $3 per mmBtu, or million metric British thermal units.

Thus, Wednesday’s 7% intraday tumble in crude prices on the back of a global banking crisis must have felt somewhat strange to gas traders, who are more accustomed to seeing such volatility on their side than in oil, which has rarely moved more than a couple of percent daily over the past few months.

Gas prices, on their part, tumbled over 5% on Wednesday, continuing to move 10 cents or so on either side of the $2.50 axis.

Technical charts indicated that the front-month gas contract on the New York Mercantile Exchange’s Henry Hub will remain in its current range in the near term at least, said Sunil Kumar Dixit, chief technical strategist at SKCharting.com. He adds:

“After gas futures’ recent retreat from the $3 perch, we continue to see sideways consolidation between $2.69 and $2.39.

In the short term, on a sustained break above $2.69, we may witness an upward mobility towards the recent high of $3.027, which needs to be cleared for the next leg higher to $3.30. If the $2.39 support is decisively breached, look for a further drop to $2.15.”

Ahead of the US government’s weekly gas storage report on Thursday, analysts tracked by Investing.com predict a drawdown of just 62 bcf, or billion cubic feet, for the week ended March 10 versus the 84 bcf consumption in the week to March 3.

Storage stood at a total 2.030 tcf, or trillion cubic feet, as of March 3 — up 32% from the year-ago level of 1.537 tcf and 22% higher than the five-year average of 1.671 tcf, the EIA, or Energy Information Administration, reported.

Ade Allen, an analyst at Rystad Energy, said in comments carried by trade journal naturalgasintel.com:

“The holding pattern for the US natural gas market in 2023 is continuing and shows no signs of ending, even as we exit winter and approach storage injection season.”

Given this week’s forecasts, “some reasonable late-winter withdrawals are possible, but it won’t be enough to move the needle on storage,” Allen added.

NatGasWeather concurred in a weather forecast carried by the same site:

“If prices fail to rally in this environment, it could prove problematic for the bullish case,” NatGasWeather said.

It said production proved strong through most of 2023, as heating demand was below average through January and February across large swaths of the United States This minimized the need for utilities to pull gas from storage. Underground supplies, as a result, are stout for this time of year.

“Supply is still quite strong and surpluses healthy, so it would take prolonged cold for much of April” to meaningfully alter the storage picture, NatGasWeather adds.

In favor of gas bulls though were some promising signs of demand in late-March to mid-April chill.

Said Gelber & Associates, a Houston-based energy markets consultancy:

“While the market continues to look for solid ground to stand on, weather-driven demand is remaining elevated versus the 5-year average due to colder than normal March temperatures blanketed across the entire US, especially the midwest. Above-normal temperatures will be limited to the east coast.”

LNG: Still a Ways to Go for Freeport to Maximize Liquefaction

Freeport, the Texas-based liquefied natural gas plant knocked out by the fire in June, was making steady recovery in production, Gelber said:

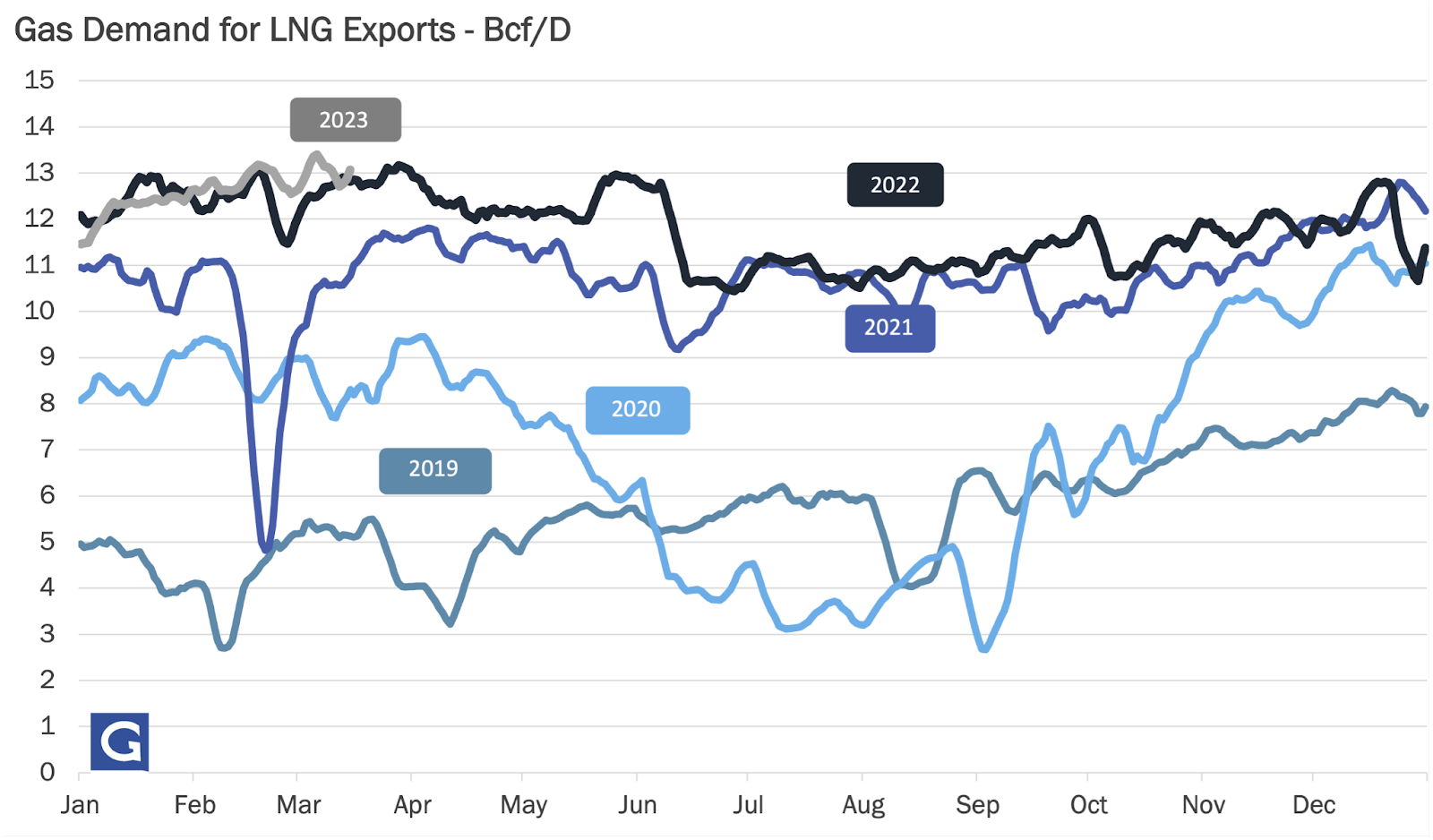

“With Freeport LNG continuing to ramp up, the bulls eyes have been laser focused on major producers to assist in keeping natural gas prices elevated via production pull-backs,” the consultancy said, noting that LNG exports were back to above 13 billion cubic feet daily this week.

Despite being bearish overall on gas over the midterm, NatGasWeather said cooler air and multiple bouts of late-winter storms would likely drive seasonally strong heating demand through the second half of March. The weather models Wednesday were “slightly to moderately bullish the next 15 days,” the firm added.

One of the primary drivers for subdued prices now is South Central storage of gas, where supplies are strong in part because of the below-potential liquefaction at Freeport, Allen said, adding:

“The return of Freeport LNG export volumes and elevated gas burns due to increased competition in the thermal stack has provided some much-needed balance for the region.”

However, the market is not convinced “that will be sufficient as we head into the shoulder season.”

While production fell this week, East Daley Analytics also told naturalgasintel.com that Freeport LNG’s restart “appears to be skewing pipeline samples out of the Haynesville Shale and creating a distorted view of natural gas supply trends.”

The firm said pipeline flows in East Texas and northern Louisiana were at an all-time high in February, but receipts began to trail off at the end of last month and early in March.

Most of the declines have occurred in samples from Energy Transfer’s Tiger and Gulf Run pipelines, East Daley analysts said. To which they added:

“The trend has sparked some speculation that Haynesville producers may have started to shut-in wells in response to lower gas prices. Color us skeptical of the shut-in theory. [East Daley] believes declining samples instead are linked to start-up of Freeport LNG on the Texas Gulf Coast."

With Freeport now cleared to resume commercial operations, pipeline deliveries have ramped recently. Volumes to Freeport jumped by 1 bcf/d from Feb. 27 to March 5, for example. East Daley analysts said they think more gas is being redirected south on Texas intrastate pipelines to Freeport LNG rather than flowing east to northeastern Louisiana.

“The shift of volumes from interstate to intrastate systems, which do not appear in daily pipe scrapes, creates the illusion of declining supply,” the analysts said.

***

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold positions in the commodities and securities he writes about.