It almost feels like we’re back in the days of John Arnold, the billionaire founder of the Centaurus Energy hedge fund.

Most-active October gas on the New York Mercantile Exchange’s Henry Hub jumped 40 cents on Wednesday morning, officially surpassing their previous cycle high of $4.93 per mmBtu, or million metric British thermal units, from 2018 to a new seven-year high of $5.01.

It was a rally with the sort of volatility reminiscent of the old days when Arnold, along with other big hedge fund names such as Velite Capital’s Dave Coolidge and Sandridge Capital’s Andy Rowe ruled the game.

Dan Myers of Houston-based gas markets consultancy Gelber & Associates recalled that era in a note issued to clients of the firm early Wednesday.

“The last time an October contract surpassed our current highs was in 2008—prior to the shale revolution in a very different market,” Myers wrote.

In that rally 13 years ago, the October contract reached a high of $8.06. The all-time high for gas was $15.78 in December 2005.

While the current run-up is relatively understated, it has the undercurrents of what led to those peaks: frighteningly tight supply of gas going into the winter, with worries that things will only get worse.

“Elevated market pricing today is largely the result of lower-than-average storage,” Myers wrote, noting that total inventories of gas in underground US caverns storage were at a 214 bcf, or billion cubic feet, deficit to the five-year average ahead of winter 2021/22.

Worries About Winter Gas Piling

Thus, “concerns for winter undersupply continue to pile on, fueling the speculative nature of the market,” he added.

Those were the ingredients that powered and sustained a five-year bull market in gas—the so-called golden days of natty (as the market is known colloquially) from the beginning of 2004 to the start of 2009—when prices ranged from $6 to nearly $16.

It was the era particularly where Arnold, a wunderkind to emerge from scandal-plagued US energy trading corporation Enron, stamped his brand.

While Centaurus made huge profits throughout those five years, Arnold truly achieved iconic status in 2006 when he made a killing on the market via a billion dollar-trade that also wiped out rival Brian Hunter of the Amaranth hedge fund. Arnold retired in 2012 but not before testifying in Congress in 2009, drawing more attention to his billions as soaring energy prices, in the aftermath of the financial crisis, prompted a political attack on market speculators like him.

The same year that Arnold bowed out, Velite’s Coolidge made headlines for delivering annual returns of more than 50%, effectively grabbing the natural gas trading crown from the Enron alumnus. Coolidge, a protege of legendary oilman Oscar Wyatt, himself retired in 2015.

SandRidge’s Rowe, a former trader at Citigroup’s Smith Barney, called it a day a year after posting a profit at the tail end of a challenging career.

More hedge funds and banks exited the natural gas market in the years that followed, citing a loss of profitability due to structurally low gas prices.

Since 2014, technological advances in shale drilling of oil and gas have resulted in exponential supply growth, weighing on prices. Just in June last year, the spot month contract on the Henry Hub fell to a 25-year low of $1.43.

Will Big Name Funds Come Back To Gas?

It is not whether the current boom will draw big name hedge funds and other financial institutions back into the game.

But the possibility cannot be discounted as underwhelming production and weather extremities since the start of this year have squeezed gas supplies in storage so much that the market is up by a record 94% from last year.

As though the market isn’t short of bullish factors, short-term production drop-offs as a result of Hurricane Ida have further strained the market since the end of August.

With about 1.7 bcf of US Gulf of Mexico production remaining offline and unavailable to the market, limited supply has offset decreasing power and industrial demand through last week.

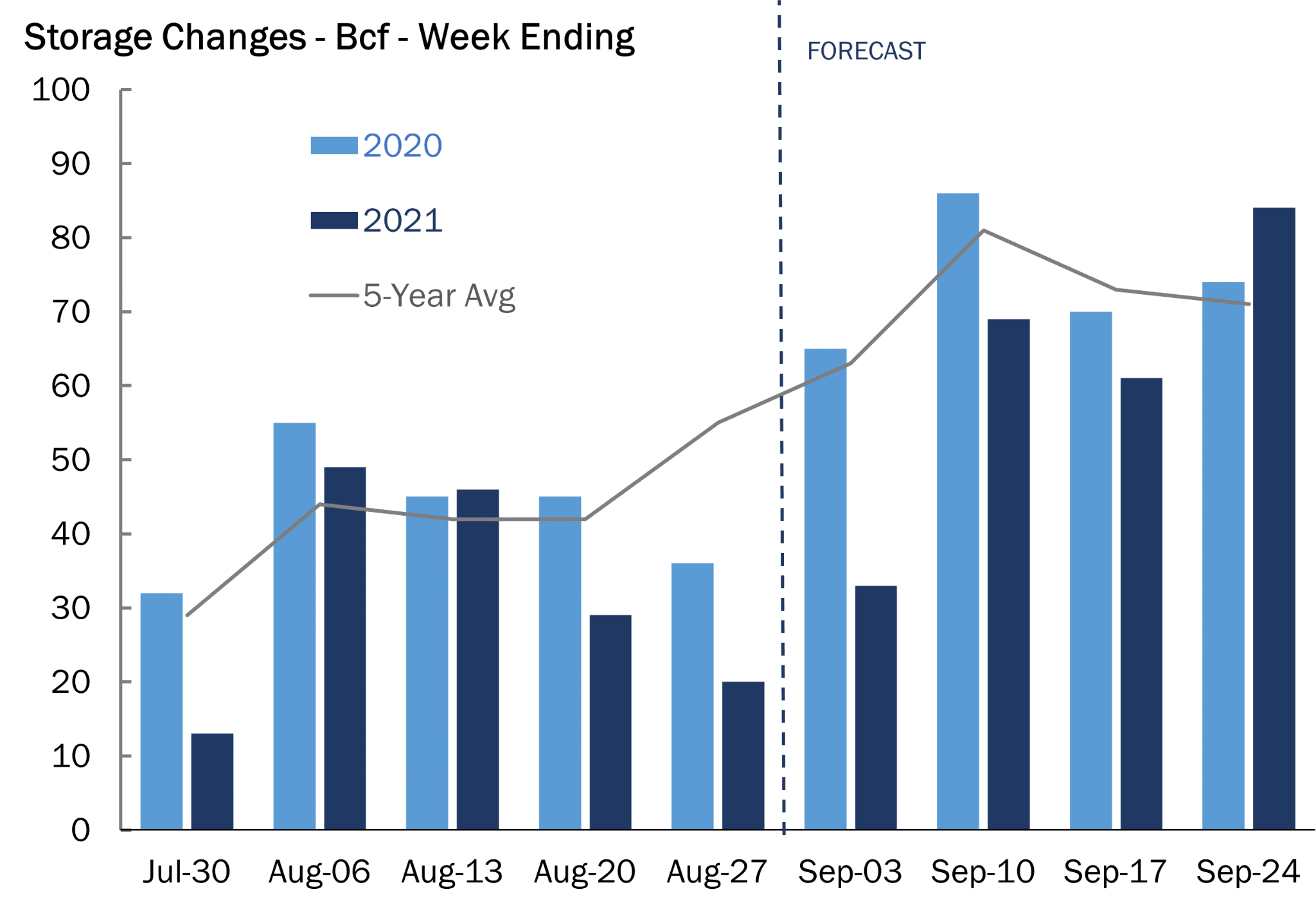

Source: Gelber & Associates

In that environment, comes today’s weekly update of gas-in-storage numbers from the US Energy Information Administration.

According to a consensus of analysts tracked by Investing.com, there was an injection of just 20 bcf into storage for the week ended Sept. 3, matching the build from the week to Aug. 27.

But that would still be markedly lower than the five-year average injection of 65 bcf.

“Today’s price rally is a byproduct of market expectations for a low injection tomorrow,” said Myers, commenting on the underwhelming build the EIA is likely to report for last week.

International Price Implications

High natural gas prices will have little effect on LNG exporters, whose margins have risen well above $12 as European and Asian prices spike above $18/MMBtu.

Gas that manages to remain within the United States will have a tough time competing against coal and other renewables for the meantime.

Within the past week, gas generation in the SPP and MISO centers has significantly decreased, allowing the proportion of coal to thermal energy usage to gain well over 5% in the last two weeks.

Fuel switchers will continue to prioritize other fuels over natural gas, depending on the level of alternate generation capacity available to them.

Producers, on the other hand, will continue to steadily launch additional infrastructure into the field, hoping to capitalize on the higher prices at hand.

The steadying force of production would provide some balance to the current market, and decrease the current gap in storage. However, as always, it is uncertain when production will awaken from its slumbering state.

The EIA tried to hazard a guess on Wednesday, forecasting in its latest Short-Term Energy Outlook that prices were expected to average $3.50 by next year amid a production hike and drop in LNG exports.

“We expect the Henry Hub spot price will average $4.00/mmBtu in 4Q21, as the factors that drove prices higher during August lessen,” the EIA said in its Short-Term Energy Outlook Report for September.

But before any further contraction, the market was expected to see another hike to $4.25 by January amid the peak period for winter heating demand, the EIA said.

Only after that, prices were expected to “generally decline through 2022, averaging $3.47/mmBtu for the year,” the agency said.

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold a position in the commodities and securities he writes about.