Natural gas and WTI crude oil futures have shown an inverse correlation amid growing hopes of an economic recovery.

On Friday, natural gas declined 5.40%, while WTI crude oil jumped 2.76%, indicating directional moves during the upcoming week despite increasing rig count.

During the last week, energy firms in the US added oil and natural gas rigs for a second week in a row, as relatively high oil prices encouraged firms to drill more.

The oil and gas rig count, an early indicator of future output, rose 9 to 779 in the week to Nov. 11, its highest since March 2020, Baker Hughes said in its closely followed report on Friday.

According to EIA short-term reports, there is a short-term surge in production and demand for oil and gas. That raised concerns about the price movements of both energy components during the last week.

President Joe Biden's administration plans to toughen a crackdown on oil and gas industry methane leaks as part of a "relentless focus" on preventing planet-warming emissions, officials said on Friday at the COP27 climate talks.

On Wednesday, EIA reported a build of 3.925 M, a much more than expected level, confirming a surge in selling sprees on every upward move above $93.

On Thursday, the EIA storage report showed a build of 79 Bcf, much larger than the 5-year average of +20 Bcf. It was much warmer than usual over the eastern 2/3 of the US while mild over the West.

According to weather reports, the eastern half of the US will remain warmer than usual, while the West will be cool to cold as chilly weather systems sweep through with rain and snow from Saturday-Wednesday.

Tropical cyclone Nicole is currently making landfall in Florida, where it will turn northward and track over the Southeast. Heavy rains and strong winds could cause weakness in natural gas prices during the upcoming week.

This weather scenario shows that the demand for natural gas could remain low during the first three trading sessions of the upcoming week and could tilt suddenly during to last two trading of the next week.

This could generate wild price swings as Friday’s close by natural gas indicates a gap-down opening on the first trading session of the next week.

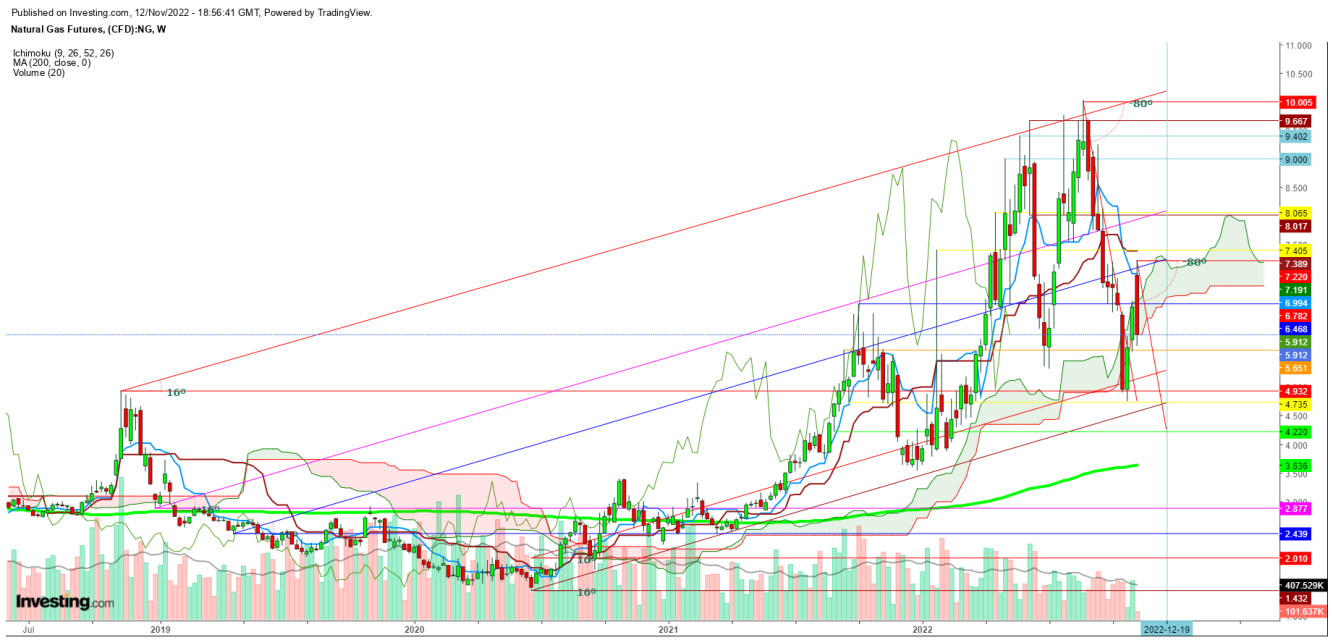

Natural Gas - Technical View

In the weekly chart, natural gas has formed a significant bearish candle, which explains the sudden surge in the selling spree during the last week.

This could push the prices to $4.748 next week if the week starts below the lower end of the ‘Ichimoku Clouds’ as a bearish crossover in the weekly chart indicates bearish pressure extending over the upcoming weeks.

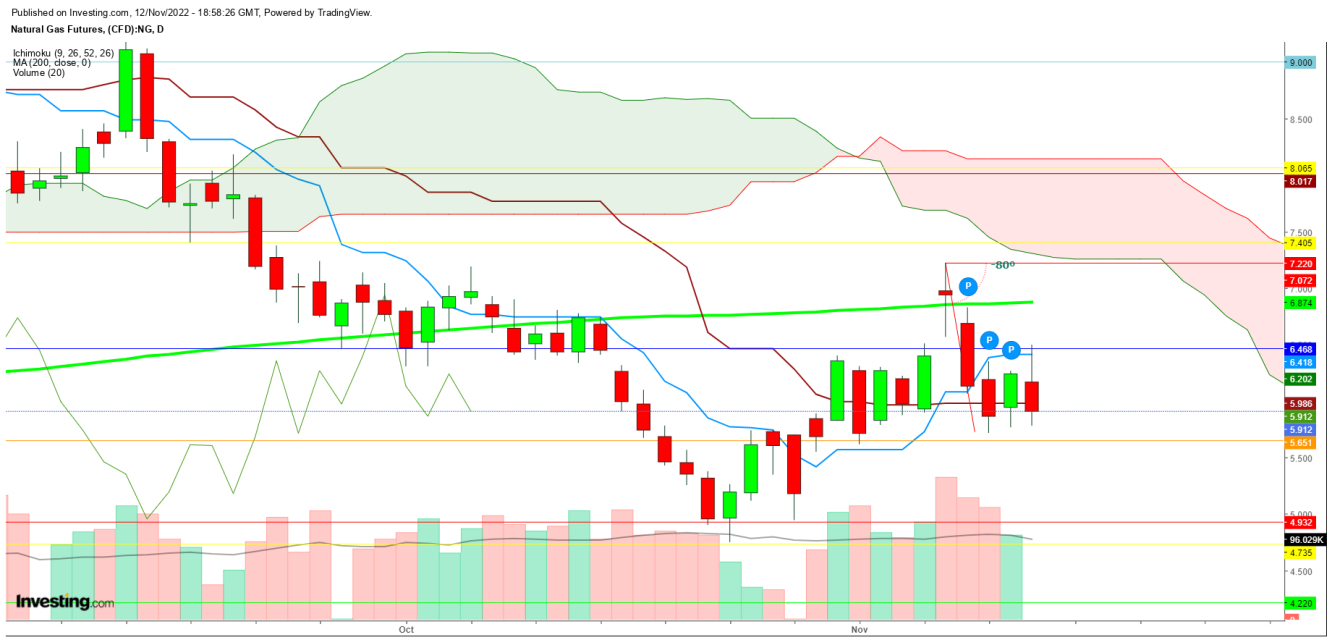

In the daily chart, the ‘Exhaustive Candle’ formed last Friday is evidence that there could be a confirmation candle on Monday and a follow-up candle next Tuesday, as the demand for natural gas could remain low up to Wednesday.

The reversal could prolong the current exhaustion until next Thursday and Friday, but the overall trend looks weak as the weekly demand and supply equation still favors the bears.

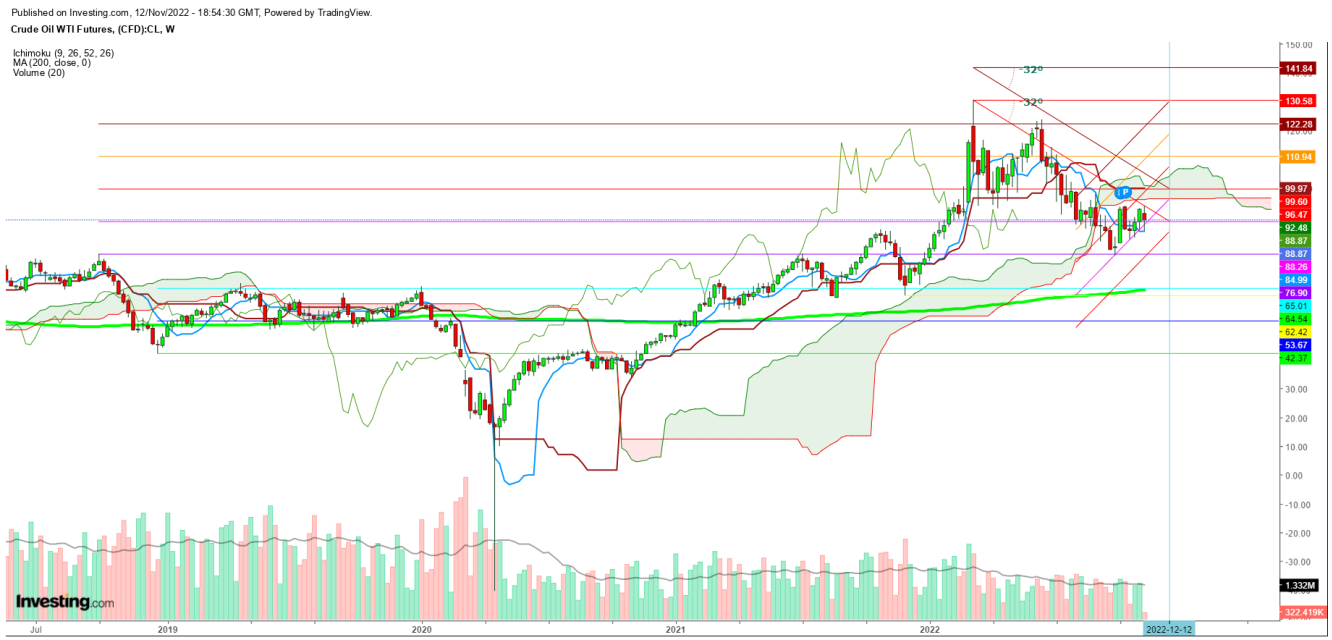

WTI Crude Oil - Technical View

In the weekly chart, WTI crude oil has faced stiff resistance below the lower end of the ‘Sliding Slope’ since the peak on Mar. 7, 2022, at $130.58.

On the other hand, the prices have maintained an uptrend after testing a recent low on Sep. 26, 2022, at $76.38 and finally showed a solid attempt to move upward after finding sufficient support at 9 DMA, which is currently at $88.995.

In case of an upward move from the current levels, immediate resistance is seen at $96.47 at the lower end of the ‘Ichimoku Clouds,’ and the next significant resistance will be at 26 DMA, currently at $99.965.

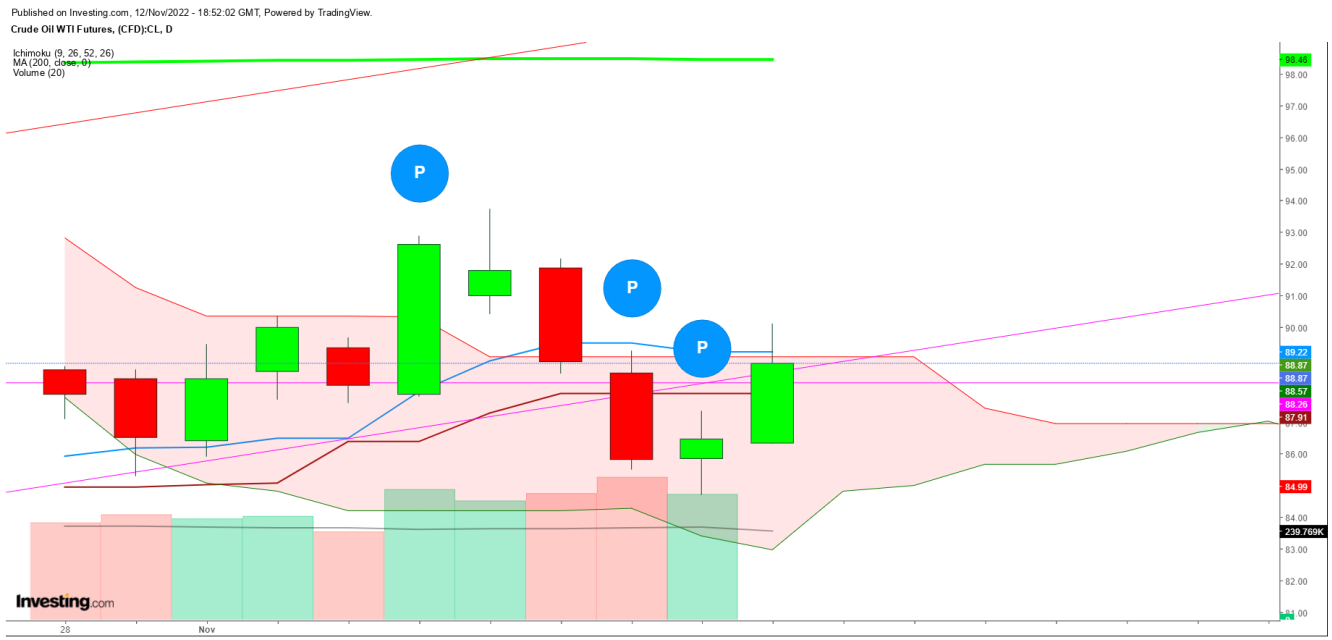

In the daily chart, the prices hit a high at $93.78 on Nov. 7 and encountered a sharp selloff since the formation of this ‘Exhaustive Candle’ followed by two bearish candles on last Tuesday and Wednesday.

Last Thursday, WTI crude oil started a reversal after testing a low at $84.70, followed by a ‘bullish’ candle on Friday, before closing the week just below the upper end of the ‘Ichimoku Clouds’.

This ensures a breakout move awaits if WTI crude oil finds a sustainable move above the upper end of the ‘Ichimoku Clouds’ on Monday and Tuesday.

Disclaimer: The author of this analysis does not have any position in Natural Gas and WTI Crude Oil. Readers are advised to take any position at their own risk, as Natural Gas is one of the most liquid commodities in the world.