No doubt, Natural Gas, being the most liquid commodity of the World, behaves very surprisingly most of the time. Volatility will be at the top during the upcoming weeks due to the following facts:-

- Supply side of the natural gas export is on high side and production of dry natural gas is on regular increasing pace which makes the scenario more bearish for the Natural Gas futures price before the advent of winter.

- Advent of winter will definitely impact an incremental demand for Natural Gas which is always be a regular phenomenon, but a small shift in weather announcement for warm temperature for a few days amid winter forces the masses, involved in Natural Gas trading to forget long term fundamentals all of a sudden and finally a massive selling spree starts even during the winter.

- Best method to trade natural gas futures is to keep a strong vigil on what is supposed to be or is looking alike according to fundamentals, rather than what is in the rearview mirror, because the natural gas behaves in very surprising manners not only in winter but during the summer season too just due to a little shift in sudden weather announcements for reverse weather conditions, which results in formation of steep moves in opposite direction all of a sudden.

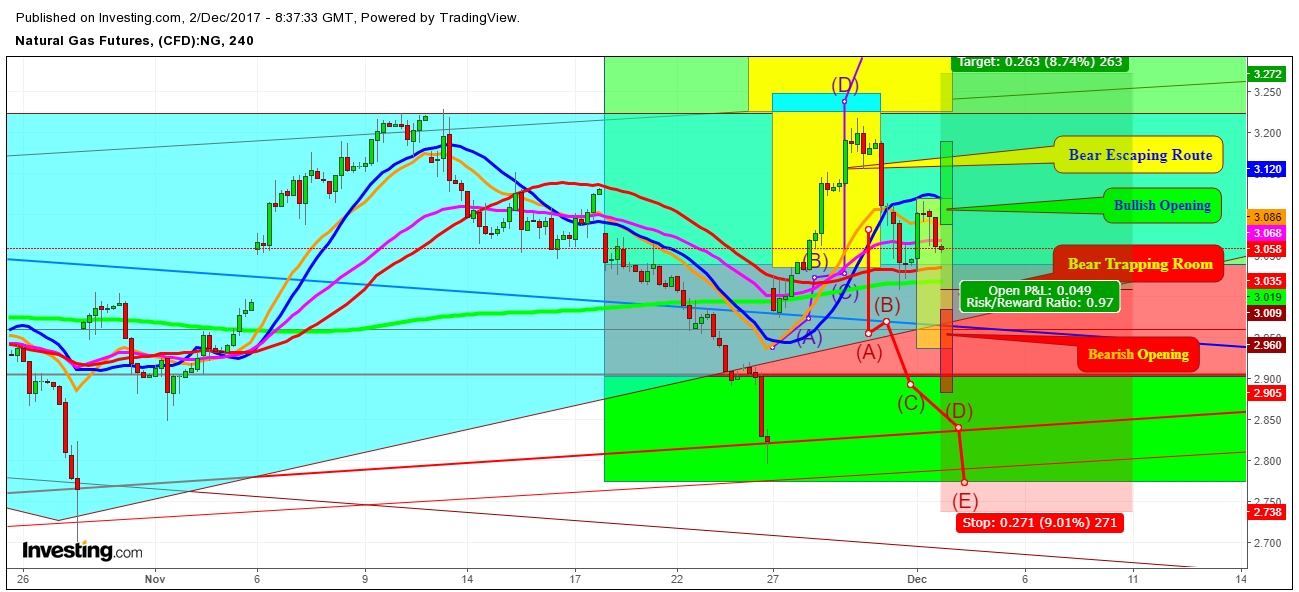

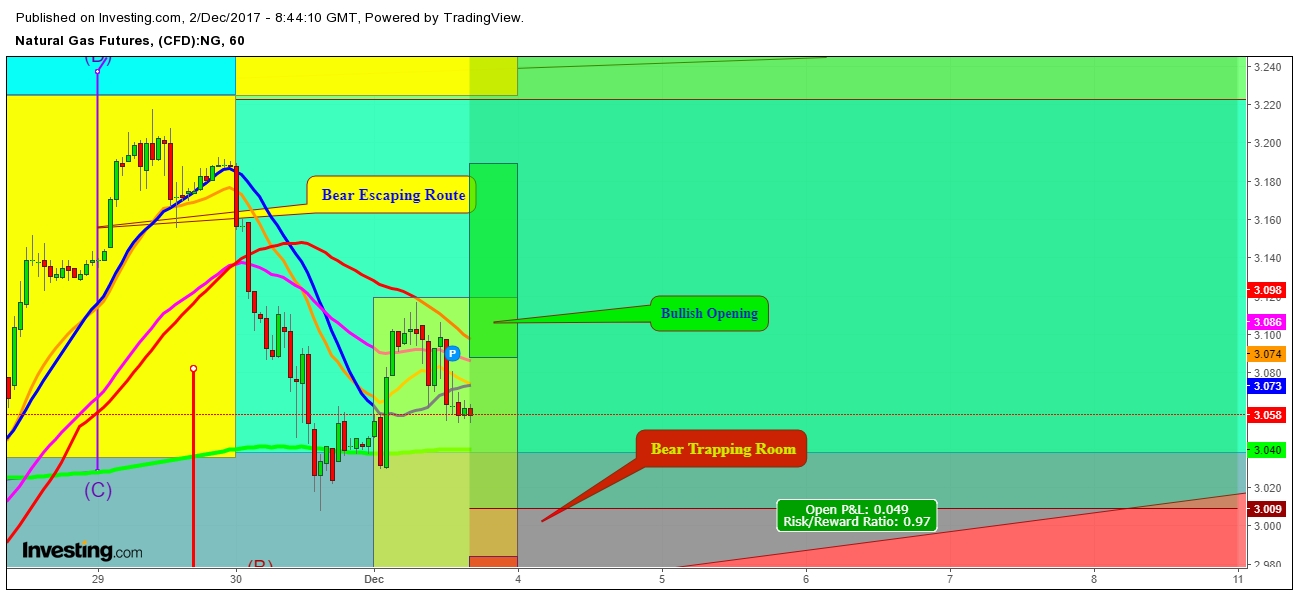

Amid growing volatility during the upcoming days before the Mother Nature raises chill ahead during the upcoming days, I feel an urgent need for a thorough analysis of the movement of Natural Gas futures price with all possible angles. I find that the seasonal demand seems to be heading towards turning bullish zones. I expect the upcoming impending inventory announcements of more withdrawal of Natural Gas from the Week of December 21st, 2017; which makes every sudden downward move a good opportunity to go long not only for the short term, but also for the long term perspectives too. On the other hand, a short position, without accompanying a hedge position simultaneously, seems too risky to move ahead before the advent of winter.

Shifting weather announcement based decisions seem to lose reliability before the advent of winter. And finally, a trader or investor finds himself/herself standing on the wrong side, even on the very next day. So, the need of the hour is to be on high alert instead of wasting time in criticizing an analyst.

My critics should not be worried any more after reading this analysis because I am not going to shift my opinions what I have expressed in my last few analyses. My valuable reader would be surprised to see my views on fundamentals what I hardly mention in detail every time, but this never means that I do not analyze them. Fundamental analysis always is my first preference before analyzing the prevailing fundamentals in technical charts. I just try to present all the prevailing fundamentals and technical to predict a move in advance only through the simple charts. I always try to stand only on the one side instead of shifting my position rather tries to be far away of dubious views with a little shift in weather.

On analysis of not only the movement of natural gas futures price since the submission of my last analysis, which has not yet been published till the time of writing this one, but also after having thorough analysis of the current fundamental, I conclude an expected propositional trading zones for the Week of December 3rd, 2017.

Good Luck!

Disclosure: This content is for information and educational purposes only and should not be considered as an investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital be involved which you are prepared to lose.