- NY Fed President John Williams spoke on the current state of monetary policy and its impact on markets this morning.

- He stated that the forecasts submitted by Fed officials in December are still a good guide for interest rates this year.

- Williams believes that policy may need to stay restrictive for a few years to bring inflation down to the target of 2%.

Between Fed Chairman Jerome Powell’s big speech yesterday and the President of the NY Fed speaking with the WSJ’s “Fed Whisperer” Nick Timiraos, we’ve heard from the two most important central bankers in the past 24 hours.

According to Williams, the forecasts submitted by Fed officials in December are still a good guide for where interest rates are headed this year.

Policymakers had projected a median of 5.1% for their benchmark federal funds rate by the end of 2023, implying a couple more rate hikes this year. Williams stated that this "still seems a very reasonable view" of what needs to be done this year to balance supply and demand and bring inflation down.

Per Williams, the Fed may need to raise interest rates higher to a sufficiently restrictive level if inflation remains elevated or financial conditions loosen. Williams noted that rates are "barely into restrictive" territory, and there is a lot of uncertainty surrounding the inflation outlook.

He believes that the Fed needs a sufficiently restrictive policy stance and will need to maintain this for a few years to get inflation to 2%.

Wage growth remains "well above" levels consistent with the Fed's 2% goal, and there is still a demand-supply imbalance in the services sector, excluding housing, food, and energy. Williams emphasized that Fed officials must focus on getting this sector consistent with the 2% inflation target.

Fed Governor Lisa Cook also spoke separately on monetary policy, reiterating the need for further interest rate hikes to curb inflation. Cook stated that officials were committed to curbing inflation, and further tightening was warranted, although she favored maintaining a gradual approach.

Traders are also looking ahead to hearing from Fed Member Waller later this afternoon. Still, markets are skeptical that the central bank will tighten policy enough to derail the economy, even if inflation remains stubborn.

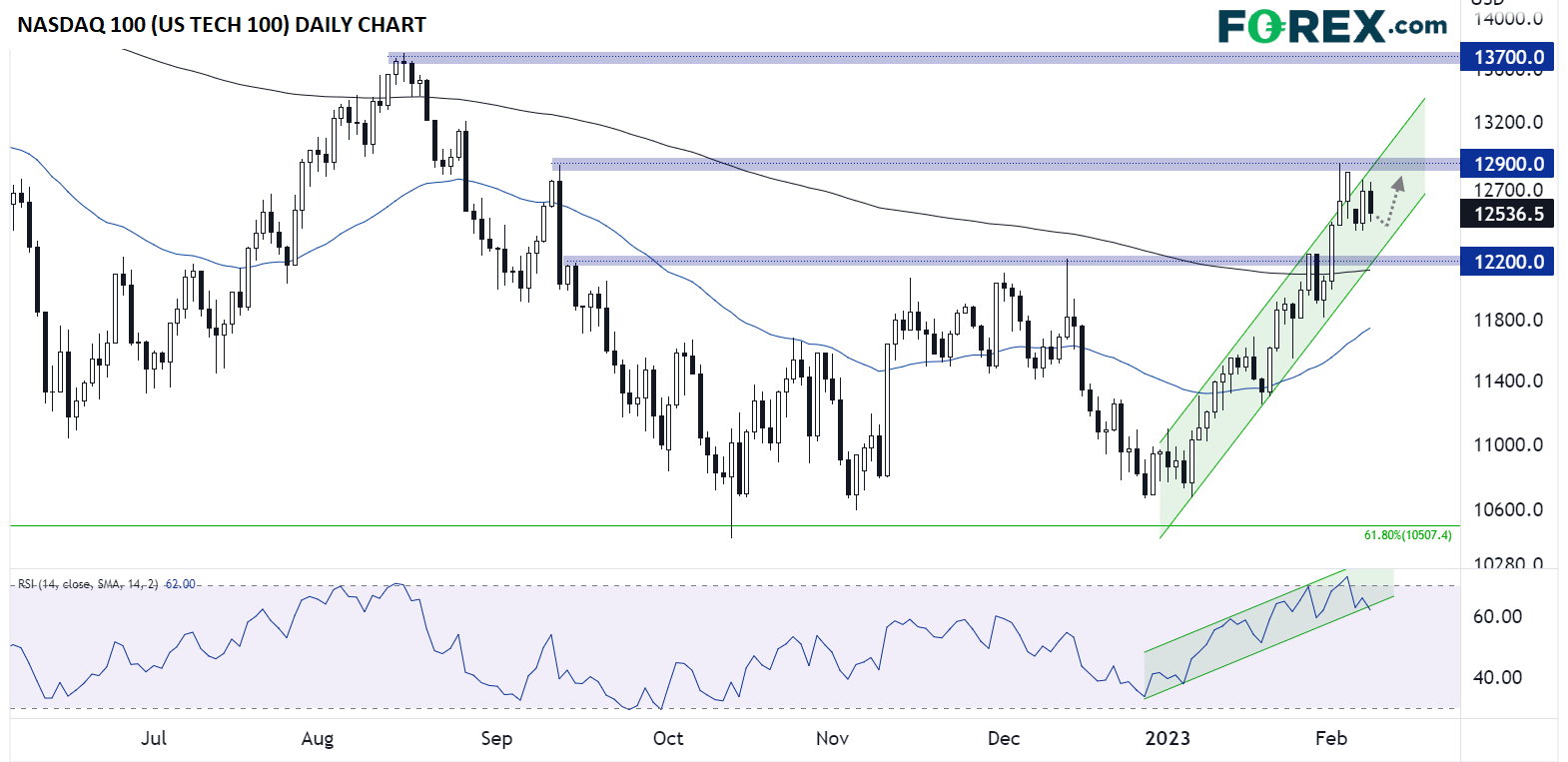

Technical view: Nasdaq 100 (US TECH 100)

Markets have seen a relatively limited reaction to today’s Fedspeak so far, as traders are already looking ahead to next week’s CPI report as the next major release to watch. Major indices are edging lower across the board, but they remain near flat on the week.

Of the major US indices, the Nasdaq 100 looks strongest on a technical basis, with prices still rallying within the tight bullish channel that has guided the index higher throughout the year.

As long as previous-resistance-turned-support near the 200-day EMA at 12,200 holds, the path of least resistance for the tech-heavy index will remain to the upside, with bulls looking for a retest of the September highs near 12,900 and, if that level is broken, a move toward the August highs around 13,700 in play.

Source: StoneX, TradingView