If we could travel back in time to the beginning of 2020, many of us would be surprised at how good things were. Jobs were at an all-time high. Unemployment was at the lowest level in 50 years. And perhaps as a result, consumer confidence was incredibly high. People were spending, and businesses were investing. It wasn’t the best of times—but it was close.

And then came the worst of times: the pandemic. Tens of millions of jobs were lost. Unemployment skyrocketed. Confidence fell sharply. Consumer spending tanked, threatening to take the rest of the economy with it.

Fortunately, thanks to government economic support and the rapid production of vaccines, we are now on the mend. While it would be nice to get back to the best of times, most of us would happily settle for normal. But this begs the question: What will this normal even look like? And when will we get there?

Indeed, that enduring hope for a return to normal has been the story of 2021. So far this year, we have seen job growth jump back to life, and then stall. We have seen confidence jump back close to pre-pandemic levels, but then pause. Business confidence rose to levels higher than before the pandemic. But it has since been beset by labor shortages and supply-chain problems. Markets hit new high after new high, only to pull back on fears of rising inflation. Overall, the first half of the year was one of a straight-line recovery toward the pre-pandemic normal, with a sudden pause in May as the problems of success started to slow the recovery process.

The story of the second half of 2021 will be how quickly and successfully the economy finds its way through the maze of those problems. We will do so—and will be approaching normal by the end of the year. But it will be a complicated process, filled with wrong turns and setbacks. Markets are also likely to end the year higher, as corporate earnings continue to improve. Here, too, it will not be a straight line.

The fundamentals remain sound and are getting better. The end of the year will have us close to the pre-pandemic normal. But we can expect adverse headlines, as well as reactions, between now and then. Let’s take a look at the details on this long and winding road back to normal.

Pandemic A Non-Issue For Economy

With people still getting sick and dying, it’s clear that the pandemic continues. We should not minimize that. From an economic perspective, however, the effects are small and decreasing. For the economy, the pandemic is and will very likely stay a non-issue. Here’s why.

Risks Contained. As of this writing (June 2021), case growth and deaths are back to levels last seen in spring 2020 (i.e., the very start of the pandemic). Now they are headed down instead of up. But even more important? Back then, we really did not know what was happening, how to contain it, or even if we could contain it. Now we have policy measures and vaccines that have demonstrably worked to contain the risks.

Policy Recession Over. In each of the three waves, shutdowns and social distancing contained the virus. After the third wave and as the country reopened, mass vaccinations helped reduce the risks, proving that the vaccines worked. Still, we are not yet at herd immunity and may never get there. But in most states, we have contained the virus enough that even faster local case growth is unlikely to require mass shutdowns again. Absent those shutdowns and with the virus contained, the effect would not be enough to derail the economy again. More than a medical recession or an economic recession, then, this has been a policy recession. We no longer need the policies that generated that recession. Given that, the economy should not be at medical risk for the rest of the year.

And we can see this outlook based on the facts on the ground. Most of the country has reopened, and the rest will open over the summer. The economy is growing again, even as case growth continues to decline. That progress is solid, well-founded, and unlikely to reverse. The story of the past year and more has been about the virus. The story of the rest of 2021 will be about the reopening and return to normal.

The Evolution Of Hiring

With the virus contained, the economy is now recovering. The question has become, though, what if we had a recovery and nobody came? This is the question we find ourselves facing. Job growth rebounded strongly but has since slowed sharply. Employers want to hire—job openings are at record highs—but employees are largely failing to show up. What’s going on?

Unemployment Payments. The initial reaction was to attribute the lack of willing workers to the availability of federally subsidized unemployment payments, which exceeded what an individual could make by working. This is a reasonable conclusion and likely true (at least in part). Yet even if true, it doesn’t tell us much about the rest of the year. Those payments will expire in September at the latest and are already being cut off in many states. So if we want to know what’s going on, we need to examine the evolution of hiring.

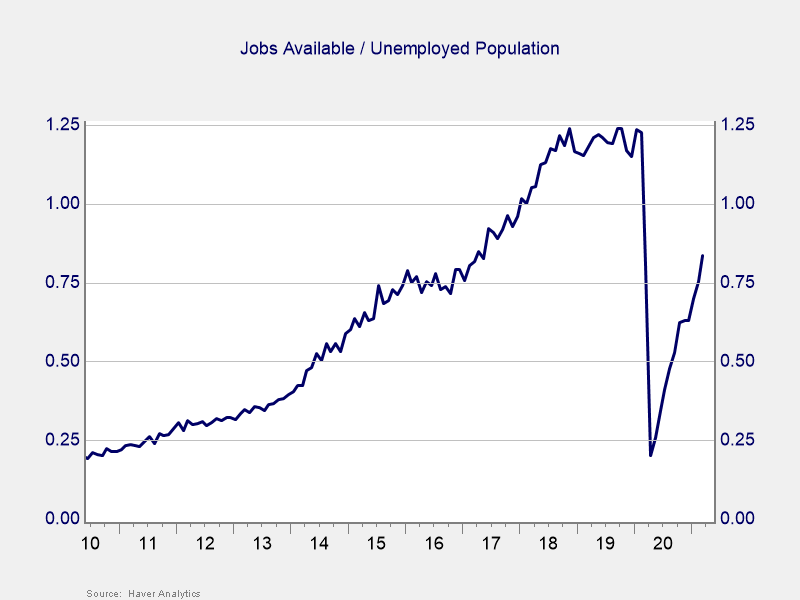

Labor Demand. Let’s first put this situation into perspective. There are lots of jobs available, but there are also many unemployed people. In fact, there are about 80 jobs for every 100 unemployed people (Figure 1). This is not as strong as the labor market was in 2018 and 2019, but it is stronger than at any other point except the 2000 boom. Labor demand is very strong, driven by the reopening and growth, and that is likely to continue.

Figure 1. Labor Demand Is Strong

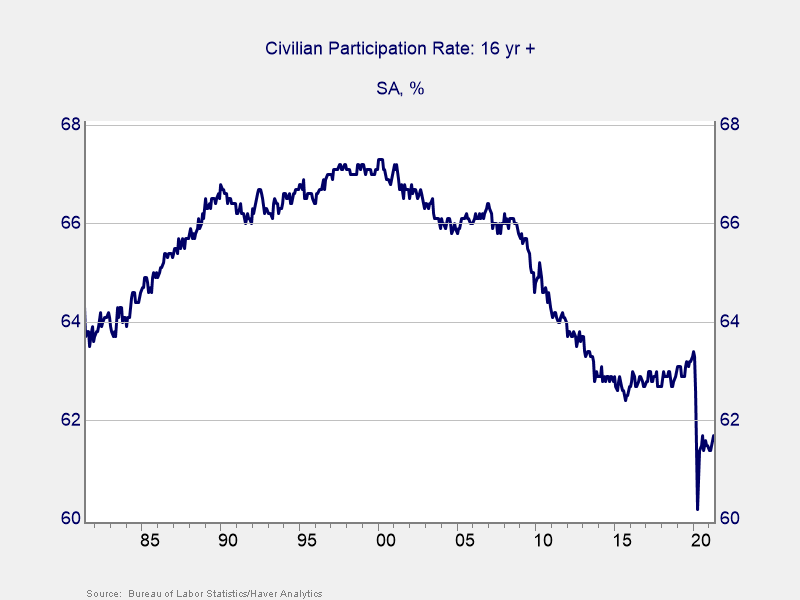

Labor supply. If it were up to employers, we would see the economy back to normal quite quickly. The problem here is with the supply—with the workers (not) coming back to work. You can see that quite clearly in the participation rate in Figure 2.

Figure 2. Labor Force on the Decline

Almost 2% of the adult population (about 4 million people) have dropped out of the labor force. This could be for demographic reasons, like baby boomers deciding to retire or millennials deciding to stay in school. It could also be for more practical reasons, such as lack of child care or fear of the pandemic. Any way you slice it, there has been a decline in the labor force itself. This decline explains much of the shortfall in workers. It can also give us some guidance on what will likely happen over the rest of the year.

A return to the workforce. The first clue here is what happened from 2015 to 2018 (see Figure 2 above). Worker participation declined sharply from the financial crisis through 2015, for the same reasons we have seen more recently. But when growth and wages picked up, people wanted back in to the workforce. Will we see this again?

We very probably will. Figure 3 looks at people who are not in the labor force (the ones we have just been discussing) and whether they want a job. You can see that about 6.5 million of those people now want a job, which would largely fill most of those job openings. It’s true that the chart is trending down, but it is largely in line with the jobs created each month. There are good reasons to believe the damage to the labor market is being reversed.

Figure 3. Who Wants a Job?

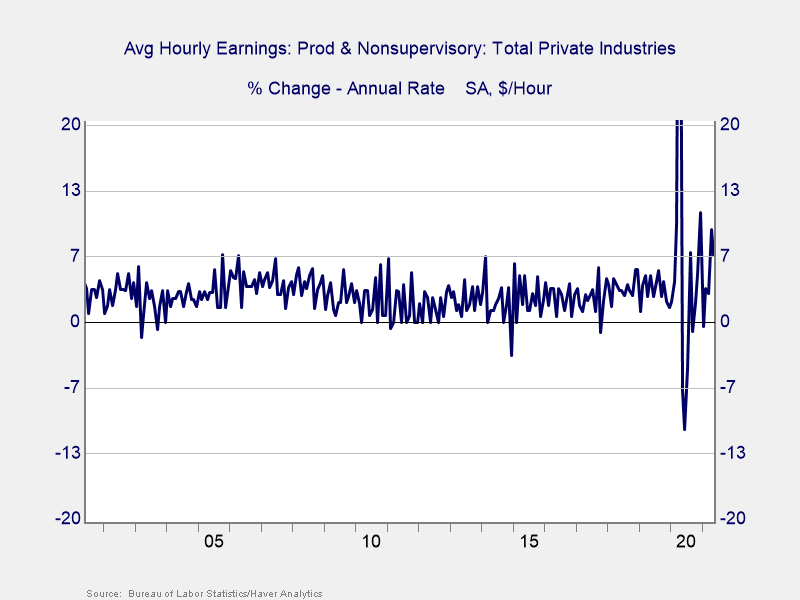

Wage growth. Labor is, of course, a market. Shortages can be reversed with a higher price. In this case, that higher price equals wages. Figure 4 shows wages for production and nonsupervisory workers. These are the workers who have been hit hardest by the pandemic—and who are in the shortest supply. Wage growth has moved to 20+-year highs as companies scramble for workers. This jump explains why many of those 6.5 million people who are out of the labor force want to come back. This trend will continue, luring people back to employment at higher wages.

Figure 4. Will Higher Wagers Lure People Back to Workforce?

The question many are asking about employment is, will we get back to normal? Perhaps the question we should be asking, though, is what is normal?

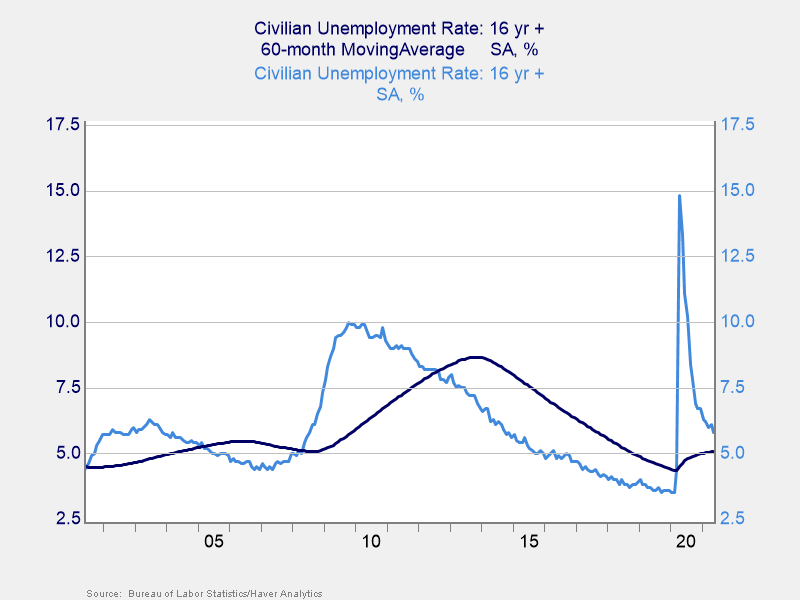

Unemployment Level. Some would define “normal” as the record-low unemployment levels we saw in late 2019. Maybe so. But a better target might be the five-year average unemployment level. As you can see in Figure 5, that level is about 5%. As a target, this would be much better than most of the past 20 years. It would therefore reflect strong but not record-setting performance. If we get back to 5 percent unemployment, I would call that normal. And we very likely will.

Figure 5. Hitting Unemployment Target

Using current numbers, we need to add about 1.3 million jobs to get back to that level. Over the past six months, job growth has been about 350,000 per month. This means we should get to that definition of normal in the next four months. By year-end, we should be doing even better and starting to approach prior employment highs.

Consumers Feeling Good

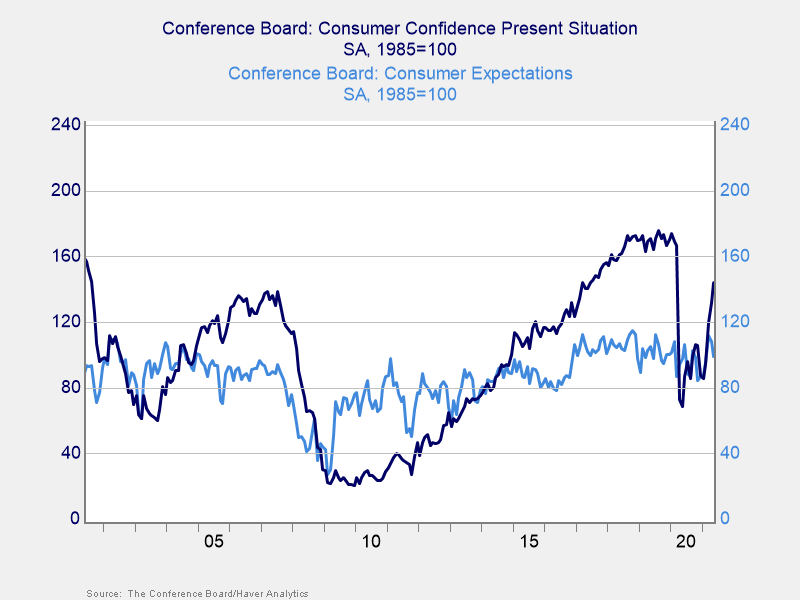

So, we know jobs are likely to be back to normal by year-end and wage growth is rising and likely to keep doing so. With this as a backdrop, consumers—the largest sector of the U.S. economy—are well-positioned to keep driving growth. The missing factor here? Confidence. People may have money to spend, but they will only do so if they feel good about the future.

Consumer confidence. Fortunately, they do. Present-day confidence, represented by the dark line in Figure 6, is above all levels except immediately before the pandemic. Expectations are also at high levels historically. For the rest of the year, more people will be working. They are feeling good about themselves—and the future.

Figure 6. Consumers Confident About the Present—and the Future

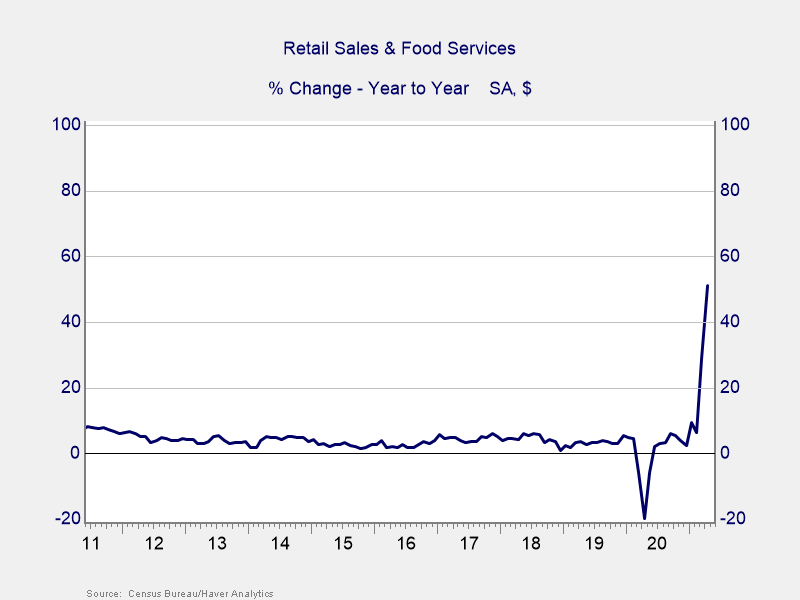

Retail sales. And that confidence means consumers will—and are—spending. As illustrated in Figure 7, retail sales are at all-time highs and continue to accelerate. While the acceleration will likely slow, the gains will continue. In the end, the consumer will keep pushing the economy forward.

Figure 7. Retail Sales on the Rise

Businesses And Problems Of Success

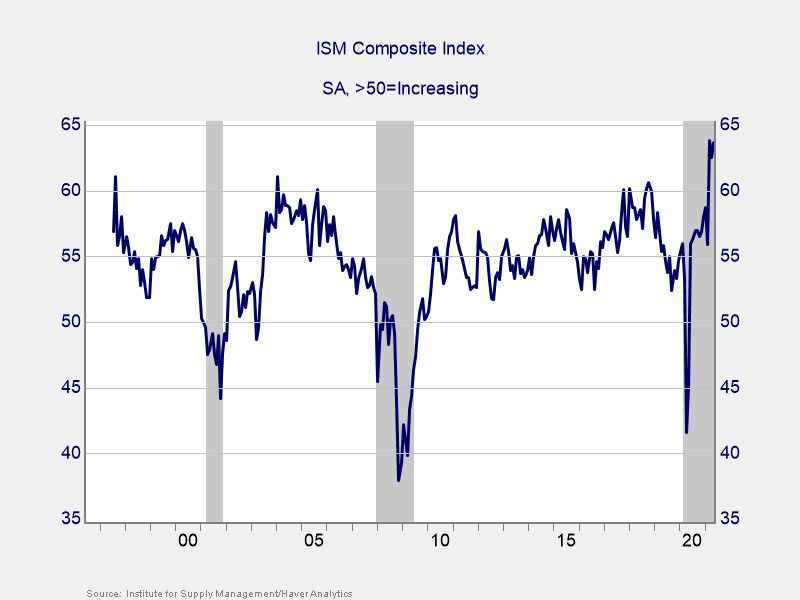

This consumer-driven economic acceleration is what businesses expect. As Figure 8 shows, businesses are more confident now than they have been in the 20+-year history of the data. The economy is recovering, consumers are spending, and the government continues to stimulate. There are many reasons to be cheerful. Now, however, instead of the usual problems of weakness that businesses face, the most pressing issues are those of success.

Figure 8. Businesses More Confident Than Ever

Labor shortage. As discussed above, the biggest of those problems is the perceived labor shortage. From a business perspective, this is more a problem of cost than availability. Push the wages up, and the workers will come (as we are seeing). Labor shortages, then, are likely to pass by the end of the year, albeit at the cost of higher wages.

Supply chains. A bigger and likely more lasting problem is that of supply chains. When the pandemic began, suppliers shut down many facilities. At the time, they couldn’t predict when or if demand would recover. Now that demand has recovered much faster than almost anyone had thought, they have been caught short. Businesses are facing shortages of pretty much everything. Their ability to supply their customers’ needs simply isn’t there. Customers—who need the goods—are putting in larger orders and paying higher prices to get what they need.

Lumber is a good example of this supply-chain problem. The rapid expansion of the housing industry depends on the availability and cost of lumber. As builders have ramped up construction, lumber prices have responded. The cost inflation in this and other commodities is real and likely to last for some time, even until the end of this year. At the same time, lumber prices have dropped sharply from their peak in early May. This drop suggests that the cause of that inflation—the mismatch of supply and demand—will not last forever. As suppliers across industries get their acts together, those shortages will fade, along with the inflation. That looks to be happening for lumber now and will happen for other inputs later.

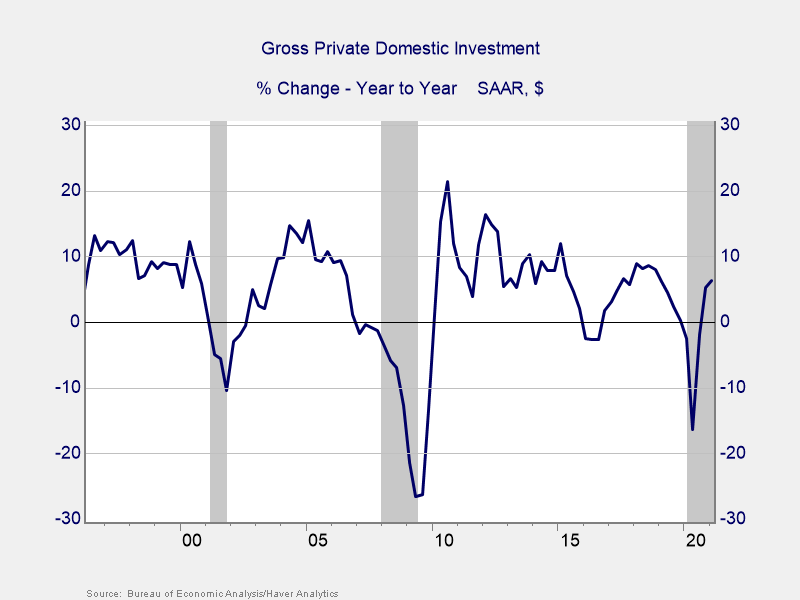

Investment. For suppliers to get back in the game, they will need to expand and retool their facilities. In other words, they will need to invest. Looking at Figure 9, we can see they’re doing just that. Business investment is bouncing back from the initial pandemic decline, and this trend still has room to run.

Figure 9. Business Investment Bouncing Back

Looking forward to the end of 2021, we can see that rising investment will help the economy. The supply-chain problems will also fade over the course of the year, as high prices draw new supply to the market, just like the labor market. As such, we should be approaching normal by year-end in the world of business.

The Government Tailwind

“I’m from the government, and I’m here to help.” While the original tenor of this quote was sarcastic, it rang quite true in the pandemic. Just as government policy created much of the economic damage, it has also mitigated that damage—and is likely to keep doing so. That support is what has brought us to the strong growth we are seeing today. Looking forward to the rest of the year, there are two major components of government support we need to consider: (1) stimulus and spending and (2) tax increases.

Stimulus And Spending. The real question here is not whether there will be federal stimulus but, rather, how much. Between the Democrats and Republicans, it looks like there will be, at a minimum, hundreds of billions in infrastructure spending and other programs. Of course, the final results are uncertain and subject to politics. Still, it seems the government will remain a tailwind for the economy and not turn into a headwind.

Tax Increases. The conclusion is less clear on the tax side. On balance, the net effect should be neutral or mildly positive. First, it is unclear whether any tax increases will pass, much less how large they would be. Any damage there is likely to be constrained. Second, tax hikes for higher incomes are likely to be coupled with tax decreases, or increased subsidies, for lower incomes. With higher-income people spending less of their post-tax income, this could have a net positive effect on spendable income, which would be a tailwind.

Third, while the subsidies are hitting now, tax changes would not take effect until 2022. So looking at the rest of 2021, the government is likely to continue to be a positive factor for the economy.

Economy Closing In On Normal

The three major components of the economy—the consumer, businesses and the government—are in the midst of the healing process. All have significant short-term challenges, yet those challenges are being navigated. Job growth is slower than we would like, but it continues. More and more people are looking to return to the labor force to take those jobs. Consumer confidence and spending are strong. Businesses are snowed under by consumer demand, but they are figuring out how to sell even more (which they will). And the government is getting behind the other sectors and pushing hard.

Normal could be viewed as where we were before the pandemic (which, by historical standards, was probably akin to a boom) or something more modest. Either way, we are already close in many ways to normal and are still headed in the right direction. We should be at or “past” normal by the end of the year.

What About The Markets?

The economy is growing and returning to normal. Given that, to forecast what the financial markets are likely to do, we have to look back to normal factors. One of the most important of these is Federal Reserve (Fed) policy. To understand that policy, let’s look at the Fed’s two mandates: inflation and employment.

Inflation. It is never “different this time.” But in one significant aspect of Fed policy, it actually is. Over the past several decades, the Fed has focused on inflation as the big problem. It has been proactive in changing policy to forestall even the hint of inflation. In recent years, however, and especially during the pandemic, inflation fell off the radar, as there were no signs of it. When employment collapsed at the start of the pandemic, the Fed swiftly changed its focus to its second mandate—employment—where it remains today.

Fed policy is now centered around employment rather than inflation. This focus explains the current policy stance, in which rising inflation numbers have been ignored as the Fed keeps policy rates low. The Fed has stated that it intends to keep policy loose until employment returns to pre-pandemic levels, meaning at least through the end of this year. In a very real sense, the Fed is also committed to being a tailwind for the real economy.

Much of the concern around inflation takes this Fed stance seriously. In fact, the most recent inflation data, taken at face value, makes a real case for higher rates. The failure of the Fed to act, or even signal that it might act, has raised fears that inflation will run out of control.

Those fears are overstated. Why? First, when you look at the year-on-year increases, much of the gain comes from a handful of non-repeating categories. Core inflation is much lower. Second, those year-on-year changes are from the nadir of the pandemic. When you look at two-year changes, inflation is still within the range of recent history. In other words, inflation is simply bouncing back from the recent pandemic drop.

Another reason why inflation will be transitory is the supply-demand mismatch discussed earlier. Current price increases are largely tied to that mismatch. As it eases, the price increases will ease as well.

Employment. If you consider inflation transitory—which the Fed does and which makes sense—then the very high number of unemployed is now the bigger problem. The Fed has stated very clearly that this is its view. As such, it will remain focused on unemployment for the remainder of the year.

Just as governmental fiscal policy will be a tailwind for the rest of 2021, so too will monetary policy. Expect continued monetary stimulus and low rates until next year.

Fixed Income In Healthy Spot

Rates Rolling Over. After some doubts, financial markets seem to have reached the same conclusion. A rapid increase in rates at the end of last year and the start of this year has rolled over. The Fed’s message seems to have gotten through, and perhaps the idea that inflation will indeed be transitory has taken hold.

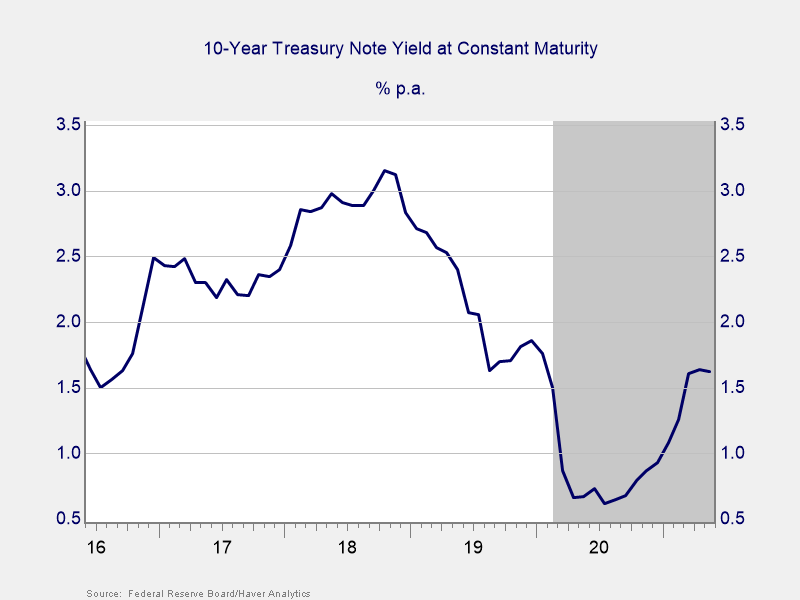

Beyond the Fed and inflation, rates are likely to stay in the current range through the end of the year (see Figure 10). If the economy is normalizing back to pre-pandemic levels, then we should expect rates to do the same. Looking at the chart below, that is exactly what’s happened: rates are now at the levels we saw through the second half of 2019.

Figure 10. Rates Returning to Normal

With inflation likely to trend back down toward year-end, rates are likely to be constrained on the upside and may decline further. That leaves fixed income in a reasonably healthy spot. Yields are high by recent standards, with the prospect (but not the certainty) of modest capital appreciation.

Good Prospects For Stock Markets

Unexpected Earnings. Stock markets have even better prospects through year-end. The economy is likely to keep growing at a fast pace, and the government will continue to provide fiscal and monetary stimulus. As such, corporate earnings are likely to keep growing—and to push markets higher. First-quarter earnings came in well above expectations. In fact, analysts are now adjusting estimates upward for the rest of the year.

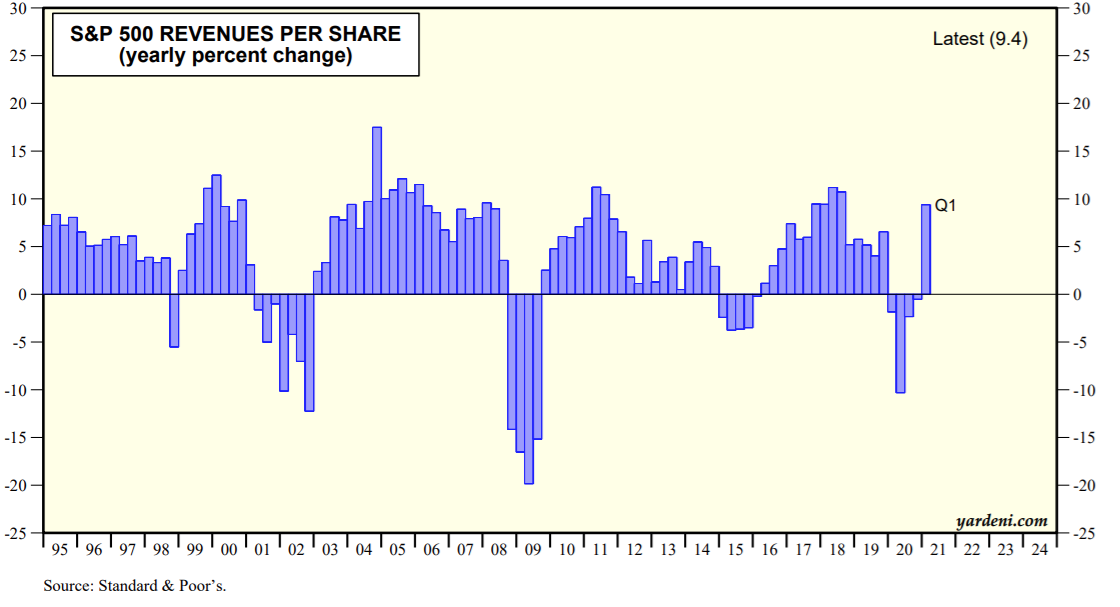

There are two main factors supporting this upward trajectory. The first, of course, is that a growing economy means sales will rise, as we saw in the first quarter (Figure 11). Indeed, sales will keep increasing through the rest of the year, although possibly at slowing rates.

Figure 11. Growing Economy Reflected In Rising Sales

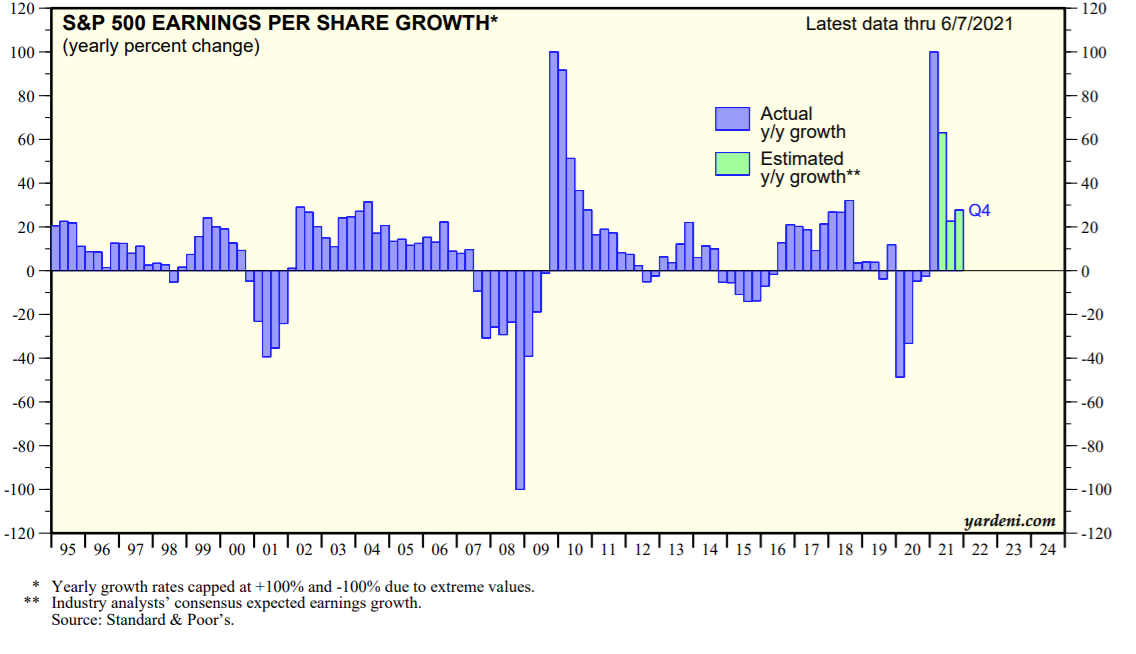

The second factor is that companies have become more efficient as a result of the pandemic. Thus, they have been able to grow earnings even faster than revenue (Figure 12). Yes, revenue growth is strong and likely to get stronger. But earnings growth has been even better than that.

Figure 12. More Efficient Companies Leading To Strong Earnings Growth

First-quarter earnings growth was more than 50% year-on-year. This growth was well above the expected level. Six of seven companies beat expectations. Again, this was well above the usual number, and the beats were by more than 20 percent. It was a blowout earnings season, driven by a recovery that was much faster than expected.

Even before the first-quarter data came in, analysts expected strong earnings growth for the rest of the year. Now, their estimates are even higher, coming in at double-digits-plus in the three remaining quarters. Given the size of the underestimates so far, there is likely more chance of an upside surprise, with meaningful gains through the rest of the year. Whether those actually happen depends on changes in valuation levels.

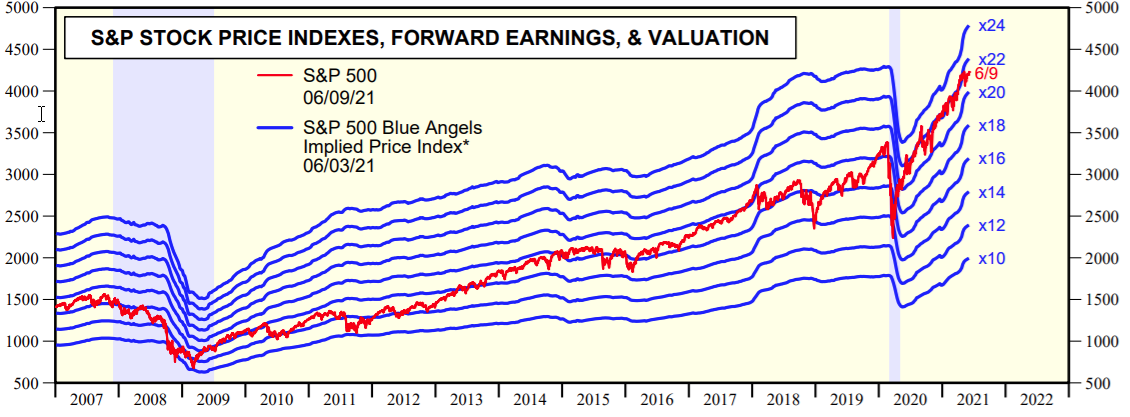

Valuations. Over the past several years, a combination of high consumer confidence and low interest rates has kept valuations elevated. With consumer confidence likely to remain high and with interest rates likely to remain low, valuations should stay within current ranges.

Those ranges have been consistent through the pandemic and recovery. They’ve stayed between 20x and 22x expected next 12-month earnings. Right now, the S&P 500 is roughly in the middle, at around 21, which seems like a reasonable target number.

Figure 13. Valuations On Target

Given projected earnings growth and valuations remaining at around current levels (between 20x forward earnings estimated at 212.42 at year-end), the S&P 500 is likely to end 2021 between 4,250 and 4,700, with 4,500 as a reasonable target. This would indicate modest further appreciation from current levels to the end of the year.

The International Story

The Base Case. If the U.S. is likely to continue its growth path, what about international economies and markets? Here, the story is similar. While the virus has ravaged economies around the world, vaccinations are starting to take hold. Even in countries without good vaccination programs, economies are adapting. Growth has slowed worldwide, but it looks likely to pick up again. Policy stimulus from central banks should continue to help developed markets in Europe. Plus, China’s government is providing support to the economy and markets. As with the U.S., there are reasons to worry. But there are also signs that growth may be picking up, and that remains the base case.

Higher Reward, Higher Risk. From a market perspective, valuations are generally cheaper abroad than in the U.S. This difference could lead international markets to outperform U.S. markets. That said, the risks are higher there as well. The pandemic is far from resolved in many countries, especially in emerging markets. It will continue to weigh down growth and markets. Overall, international markets are likely to show higher reward and higher risk than U.S. markets for the balance of 2021. The results will be dependent on how successful those countries are in containing the pandemic.

The Long Snd Winding Road

The headlines continue to scream about politics, inflation and so forth. Yet, the fundamentals continue to improve. The pandemic now looks to be under control. Absent some new development, it will complete the transition from crisis to chronic by year-end, eliminating it as an economic risk. Hiring will continue to absorb those still looking for work, with the usual ups and downs on a monthly basis. This will bring us close to normal—if not back to record-low unemployment—by the end of the year. Higher employment and wages will boost consumer confidence and should drive continued expansion for the rest of the year. With consumers working and confident, the consumer sector of the economy (i.e., the largest sector) is poised to keep growing.

On the business side, some potential setbacks are clear—labor and material shortages. Still, confidence remains high as companies move to address those problems. In most cases, they will do so by year-end. Moreover, once they are addressed, companies will be better able to expand at a more profitable pace. The first-quarter earnings results reveal that industry is more efficient, more profitable, and better able to take advantage of future growth than before the pandemic. Of course, there will be problems and adjustments. But by year-end, the business sector should also be close to normal.

One big potential upside risk here is the rest of the world. Even as the U.S. has emerged from the pandemic, the rest of the world is well behind us. With vaccine supplies ramping up internationally, that situation should start to change through the balance of 2021. And we should start to see the economic effects of that improvement. What we have done in the U.S. can and will be replicated around the world, with beneficial consequences for everyone. About the time the U.S. finally closes in on normal, the rest of the world should be entering the fast recovery phase, which will help keep us all going.

But that is a story for 2022, not 2021. For now, the road ahead is still climbing. As we gain altitude, we will hit setbacks, but they will be overcome. Throughout the pandemic, the enduring hope has been that we will get through this. By the end of 2021, I believe we will have done just that.

Disclosures: Certain sections of this commentary contain forward-looking statements that are based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. All indices are unmanaged and are not available for direct investment by the public. Past performance is not indicative of future results. Diversification does not assure a profit or protect against loss in declining markets. The S&P 500 is based on the average performance of the 500 industrial stocks monitored by Standard & Poor’s. Emerging market investments involve higher risks than investments from developed countries, as well as increased risks due to differences in accounting methods, foreign taxation, political instability, and currency fluctuation.