The University of Michigan Preliminary Consumer Sentiment for July came in at 93.1, down from the June Final reading of 95.1. Investing.com had forecast 95.0.

Surveys of Consumers chief economist, Richard Curtin, makes the following comments:

Confidence in future economic prospects continued to slide in early July, with the Expectations Index now 10.1 Index points below its January 2017 peak. In contrast, consumers' assessments of current economic conditions regained the March 2017 peak, the highest level since the July 2005 survey. Overall, the recent data follow the same pattern repeatedly recorded around past cyclical peaks: expectations start to post significant declines while assessments of current economic conditions continue to reach new peaks. To be sure, the data do not suggest an impending recession. Rather, the data indicate that hopes for a prolonged period of 3% GDP growth sparked by Trump's victory have largely vanished, aside from a temporary snap back expected in the 2nd quarter. The declines recorded are now consistent with just above 2% GDP growth in 2017. Much steeper declines in expectations typically precede recessions. The weakness in the Expectations Index in early July was concentrated among Republicans (falling to 108.9 from June’s 116.0 and February’s 120.1); Democrats continue to hold much less favorable expectations, although the Expectations Index among Democrats has markedly improved (to 63.2 from June’s 62.0 in June and 55.5 in February). Overall, the data indicate an annual gain of 2.4% in personal consumption during 2017. [More...]

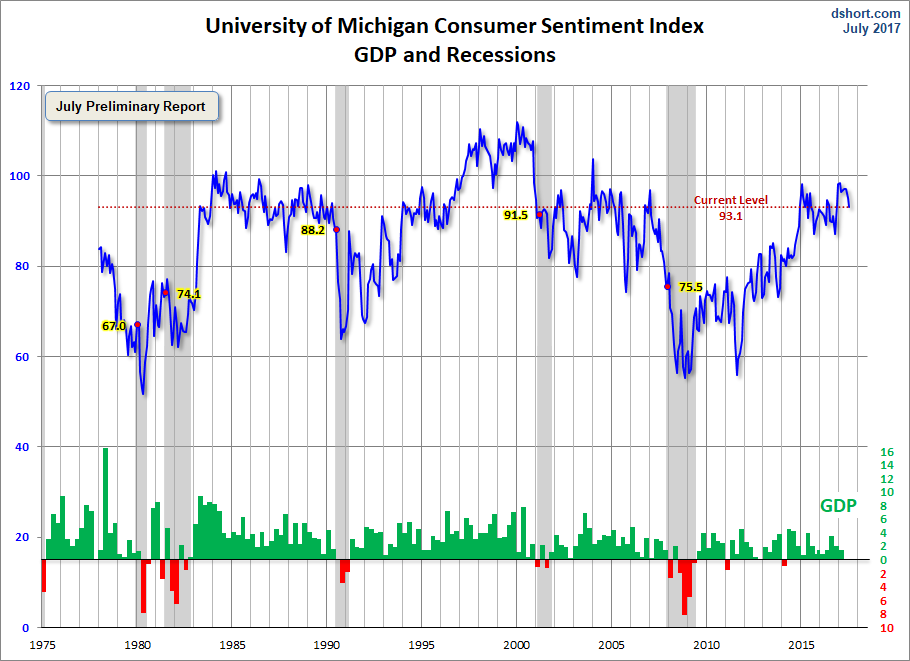

See the chart below for a long-term perspective on this widely watched indicator. Recessions and real GDP are included to help us evaluate the correlation between the Michigan Consumer Sentiment Index and the broader economy.

To put today's report into the larger historical context since its beginning in 1978, consumer sentiment is 8.7 percent above the average reading (arithmetic mean) and 10.0 percent above the geometric mean. The current index level is at the 70th percentile of the 475 monthly data points in this series.

The Michigan average since its inception is 85.6. During non-recessionary years the average is 87.8. The average during the five recessions is 69.3. So the latest sentiment number puts us 23.8 points above the average recession mindset and 5.3 points below the non-recession average.

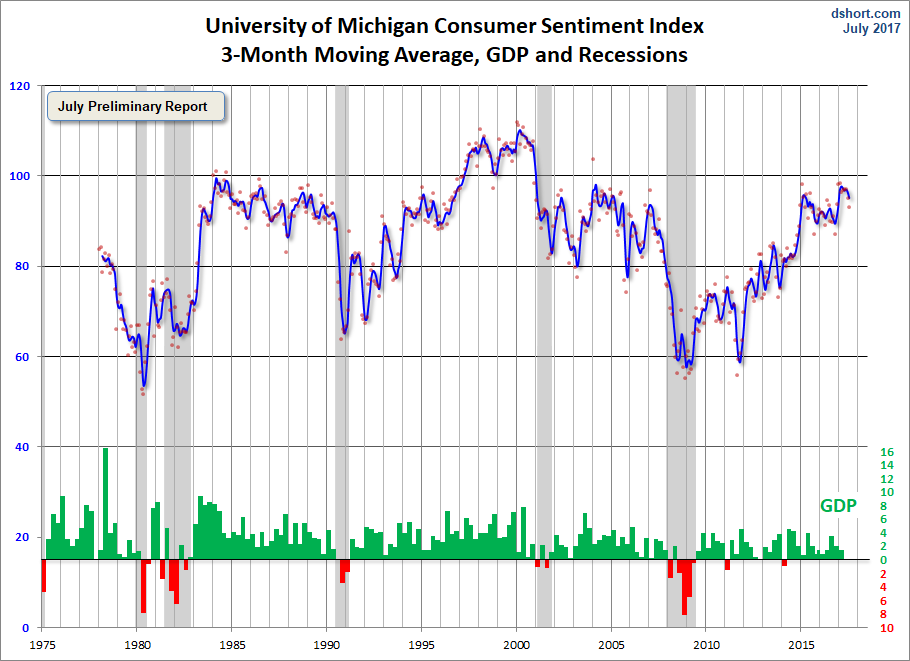

Note that this indicator is somewhat volatile, with a 3.0 point absolute average monthly change. The latest data point saw a 2.0 percent change from the previous month. For a visual sense of the volatility, here is a chart with the monthly data and a three-month moving average.

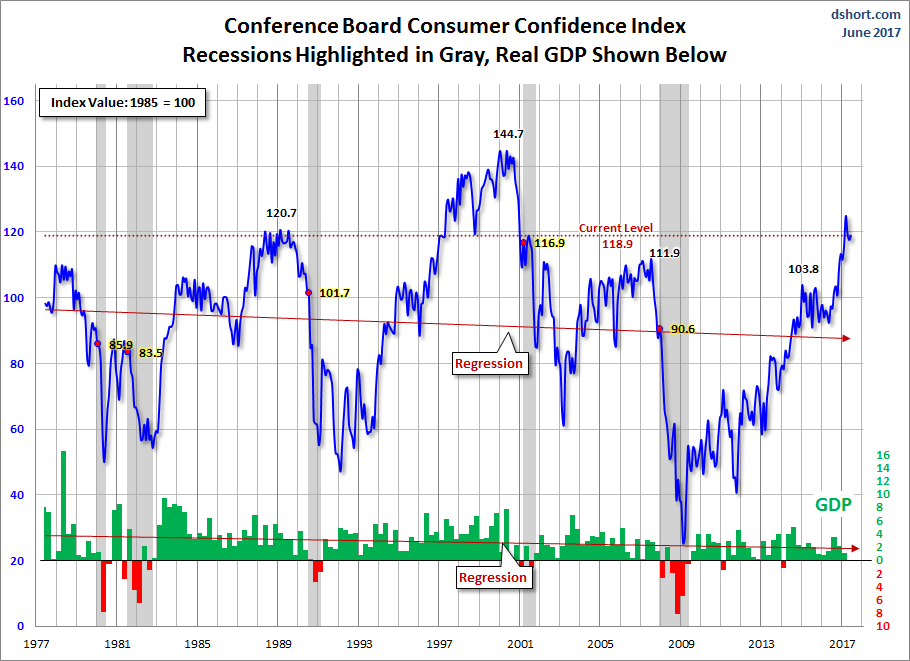

For the sake of comparison, here is a chart of the Conference Board's Consumer Confidence Index (monthly update here). The Conference Board Index is the more volatile of the two, but the broad pattern and general trends have been remarkably similar to the Michigan Index.

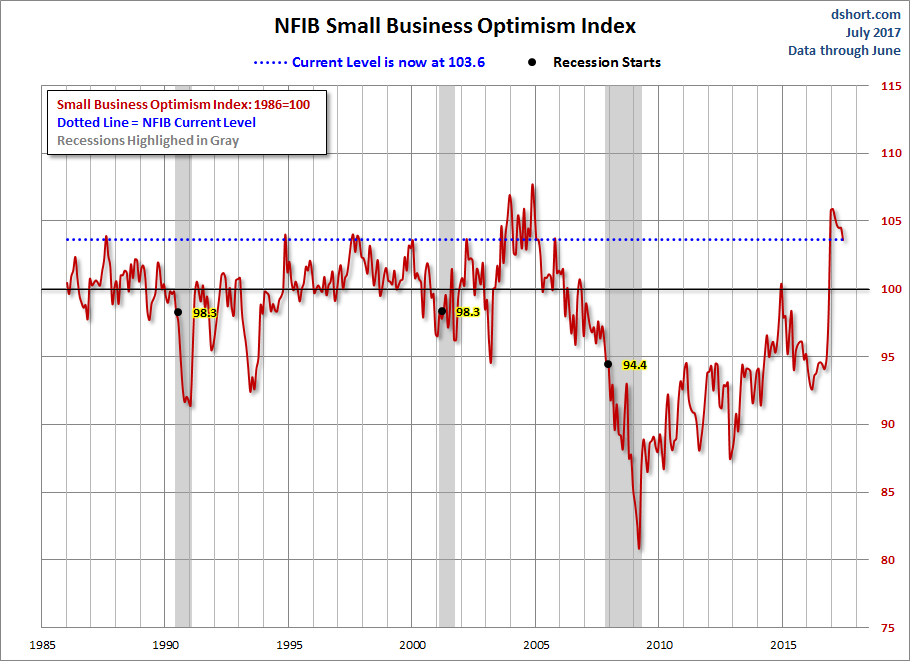

And finally, the prevailing mood of the Michigan survey is also similar to the mood of small business owners, as captured by the NFIB Business Optimism Index (monthly update here).

The general trend in the Michigan Sentiment Index since the Financial Crisis lows has been one of slow improvement.The survey findings since December 2015 saw gradual decline followed by a bounceback later in the year with its interim peak in January of 2017.