Yesterday, investor morale was boosted by the Fed officials and by better-than-expected US initial jobless claims. Oil took a deep dive and the European Commission upgraded its economic growth forecast for the EU economy.

Risk Sentiment Improved

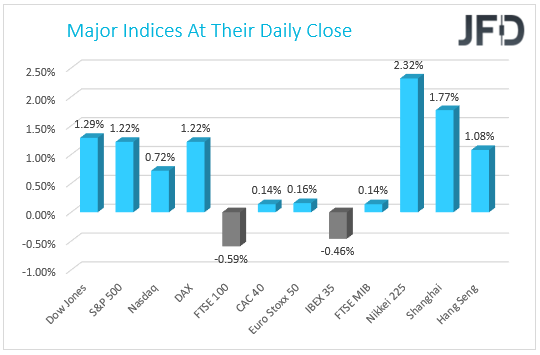

Yesterday, most of the EU indices managed to close in positive territory, boosted by reports that the EU economy could grow faster than expected in 2021 and 2022. This is due to an increase in vaccinations and the removal of lockdowns. The European Commission have upgraded their forecasts in relation to the EU economy. Also, the positivity partially comes from the EU’s new recovery fund, called the Next Generation EU, which includes around 750bln euros, where approximately half of it should be distributed as grants.

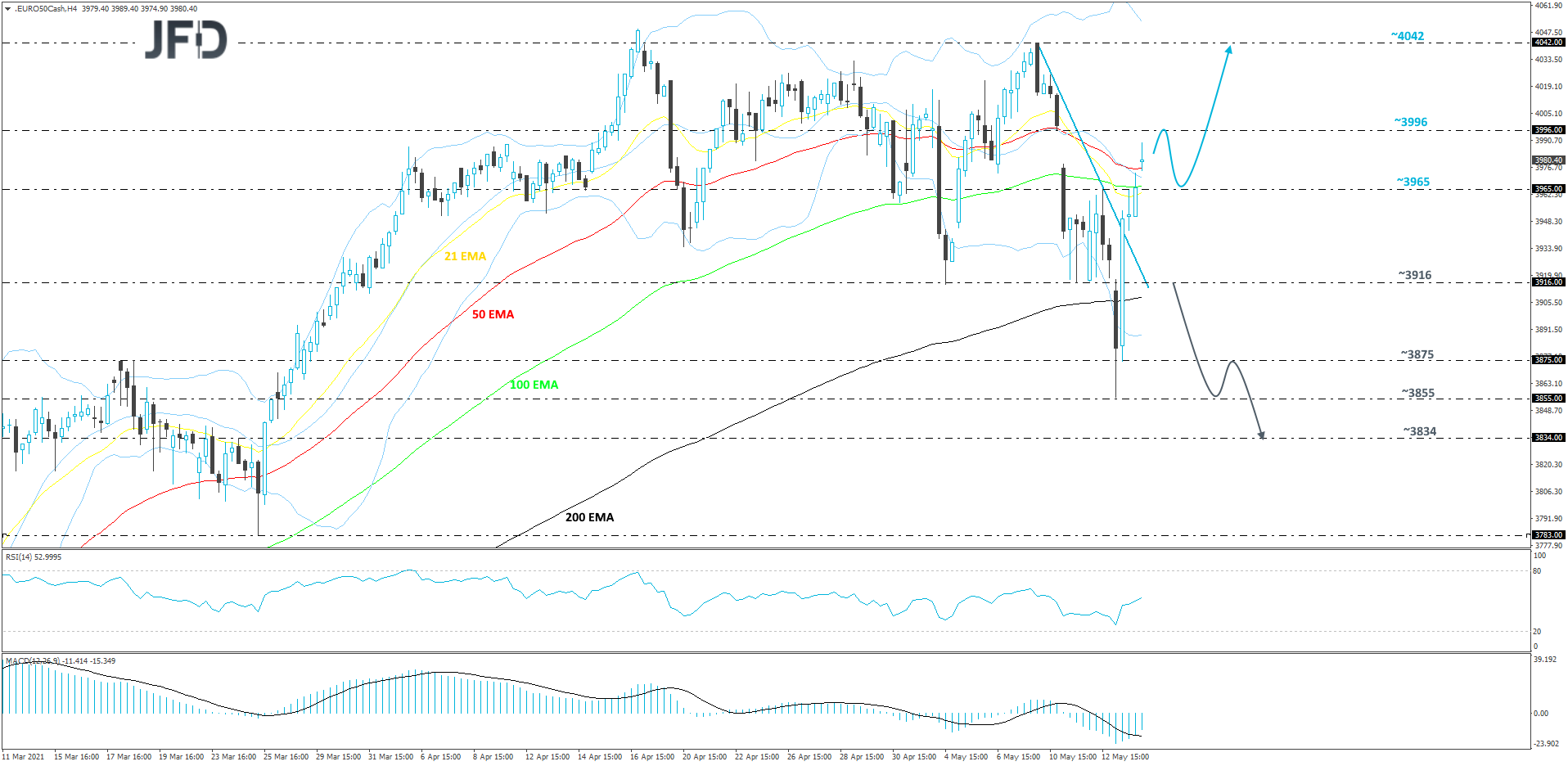

EURO STOXX 50 Technical Outlook

Euro STOXX 50 reversed sharply to the upside yesterday, breaking above a short-term tentative downside resistance line taken from the high of May 10. This morning, the index continues make its way higher, as it climbs above all of its EMAs on our 4-hour chart. The price is also still trading above the 3695 hurdle, marked by the inside swing high of May 12, which could be seen as a positive. As long as it remains above that hurdle, we will aim slightly higher in the near term.

A further push north could bring the index to the 3996 hurdle, marked by an intraday swing low of May 10, where the price may stall for a bit. However, if the bulls are still feeling comfortable, they might overcome that obstacle and target the 4042 level next. That level marks the current highest point of May.

On the downside, if the price falls back below the 3916 zone, marked near the lows of May 4 and 11, that could invite more sellers into the game, as the bulls might get scared-off temporarily. Euro STOXX 50 may drift to the 3875 obstacle, or to the 3855 area, which is the current lowest point of May. If the buyers are still nowhere to be found, the index could continues sliding, potentially aiming for the 3834 level, which is marked by the inside swing high of Mar. 24.

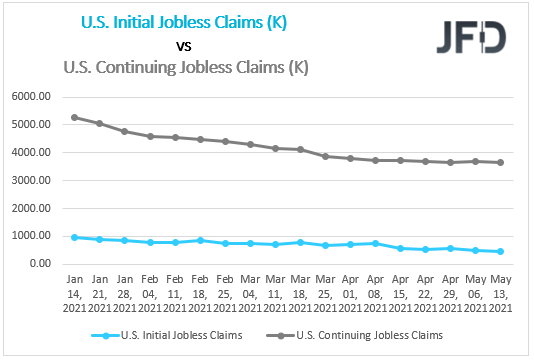

The US equity markets made their way higher yesterday, recovering some of its losses made during the first half of the week. The DJIA and the S&P 500 both gained slightly more than 1.2%, whereas NASDAQ 100 failed to maintain a 1% gain and closed only with a +0.72% gain. The positivity rolled in from the initial jobless claims data, where the actual figure showed that there were les people filing for unemployment benefits than it was initially expected. The initial forecast stood at 490k, whereas the reading came out at 473k.

Although the decline was not as significant as it would be preferred, nevertheless, it is still a decent number, showing that the labour market is slowly stabilising. Also, the Federal Reserve officials were able to boost investor morale, by stating that price pressures after the re-opening of the economy will prove to be transitory. The Fed officials calmed the market down, by saying that the employment rate is the priority for the central bank. Employment will have to pick up substantially and remain sustainable, before any policy changes could take place.

Oil dropped around 3%, as the Colonial Pipeline in US restarted its operations, after being closed last Friday. Also, the OPEC+ continued easing their production cuts, as oil demand started picking up due to lockdowns being removed across the globe. The cartel believes that demand will be quick to pick up, that’s why they are pumping an extra 350000 barrels per day. But despite the positive prognosis surrounding the oil demand, the price fell because of that oil supply increase right now. And although demand for oil should stabilise the price, that has not come yet. Oil price might remain under some bearish pressure, at least in the near term.

USD/CAD Technical Outlook

Yesterday, USD/CAD broke above its short-term tentative downside resistance line taken from the high of Apr. 21. And although the pair made its way a bit higher, it received a hold-up near the 1.2180 barrier. In order consider a further move higher, at least in the near term, a push above that barrier is required. Until then, we will remain cautiously-bullish.

If, eventually, the rate pops above that 1.2180 zone, this may attract more buyers into the game, possibly opening the way for further advances. We will then target the 1.2251 obstacle, a break of which could set the stage for a move to the 1.2350 level, marked by the current highest point of May.

Alternatively, if the pair ends up sliding back below the aforementioned downside line and falls below the 1.2078 zone, marked by the lows of May 10 and 11, that might spook the bulls from the field, allowing more bears to join in. USD/CAD may drop to the 1.2006 territory, marked by an inside swing high of May 14, 2015, a break of which could clear the way towards the 1.1920 area. That area is marked by the lowest point of May 2015.

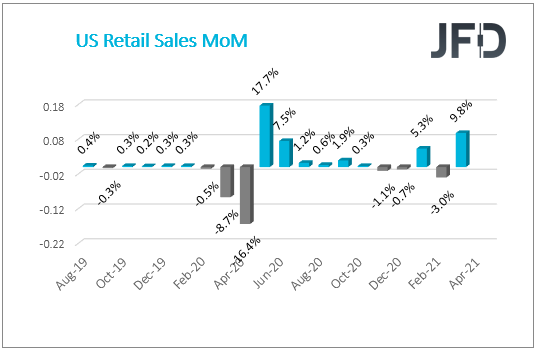

US Retail Sales

Today will be a relatively quiet day in regards to the economic data. The main event will be the release of the US retail sales figures for the month of April, both core and headline. The core MoM retail sales figures are forecasted to have fallen drastically, going from +8.4% to +0.7%. The MoM headline one is also expected to decline heavily, going from +9.7% to +1.0%. If that’s the case, this could have its negative effect on the US dollar and on some retail stocks. Since the beginning of the pandemic, retail sales figures have been on a choppy ride, with huge swings in either direction, comparing to the pre-pandemic movement.

In addition to the retail sales, US will also deliver its industrial production figures, both MOM and YoY for the month of April. Currently, there is no forecast for the YoY reading, but the MoM one is expected to go down by a bit, from +1.4% to +1.0%. Also, the University of Michigan will release its preliminary consumer sentiment for May. That reading is believed to have improved slightly, going from 88.3 to 90.4.

As For The Rest Of Today's Events

Canada is expected to the show its manufacturing sales figure on a MoM basis for the month of March. The forecast currently stands at +3.5%, which is a decent increase from the previous -1.6%.