US stocks opened down hard today, in part because China released some truly horrendous trade numbers over the weekend, but also because the imminence of a US interest rate increase is starting to sink in. For anyone with rudimentary math skills, higher interest rates are a clear and present danger to what is now a variable-rate (and therefore really fragile) world.

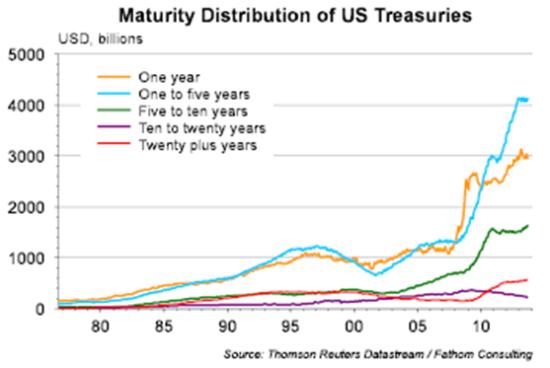

Last year, financial analyst David Templeton published a chart that illustrates one aspect of the problem:

Note the surge in debt coming due in less than 5 years. Over the past decade the US has been borrowing short-term to take advantage of historically-low rates, thus minimizing its interest expense — but at the cost of having to refinance several trillion dollars each year as its mountain of short-term paper matures. This is fine as long as rates stay low. But let rates rise, and each refinancing is at a higher rate and the government’s total interest expense starts to soar. Templeton notes that “With the outstanding debt now totaling over $17 trillion, a one percentage point rise in interest rates equates to an additional $170 billion in interest payments on the outstanding debt.”

The case can be made that since the Fed owns a big chunk of this paper, it can just forgive the interest, so no harm no foul. This is true for some but by no means all of the federal debt. And in any event, Washington represents just a tiny part of the variable rate world’s balance sheet. Most other governments finance themselves in the same hope-and-pray fashion, and tens of trillions of dollars of commercial paper and other loans are linked to indexes like Libor, Euribor and the prime rate, all of which will rise with general interest rates.

Life, in short, gets harder for every segment of the borrowing community when short-term interest rates go up. And outside of the Fed’s reality distortion field, life is already understood to be extremely hard. Greece is broke and getting broker as Middle East refugees flood its beaches. China’s imports fell by 16% last month, implying that global trade — especially in raw materials — is cratering. Portugal is about to install a far-left, anti-austerity coalition government and its bond market is panicking. The US dollar is near its 12-month high, once again threatening to blow up that fabled $9 trillion of emerging market dollar-denominated debt. And Japan, which needs rising inflation to offset its soaring debt, is getting this instead:

No surprise, then, that given a weekend to think things over, traders have decided to focus on the damage that higher rates will do to an already-fragile (or moribund) financial system. And since the event itself won’t happen for another month, there’s a lot of time to obsess.