- Biden-McCarthy talks end with no deal but both sides remain hopeful

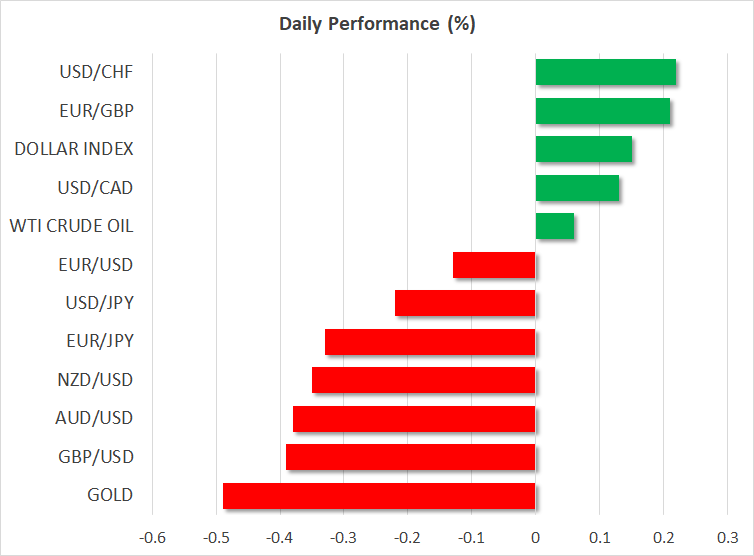

- Stocks subdued but dollar edges up as Fed rhetoric stays on the hawkish side

- Euro slips as mixed PMIs unable to lend much support

No breakthrough yet in debt ceiling talks

Pressure is building in Washington as there is yet to be any major breakthrough in the negotiations to reach an agreement on raising the US debt ceiling. While both President Biden and House Speaker Kevin McCarthy have reiterated that a default is “off the table”, Monday’s round of talks ended without a deal, although both described them as “productive”.

Time is fast running out for all parties to agree to a resolution to the debt standoff amid repeated warnings by Treasury Secretary Janet Yellen that the government could run out of cash as early as June 1. With any deal requiring several days to get through Congress before it reaches the President’s desk, negotiators have a very short window to work with.

A few bright stars lead Wall Street higher

The looming deadline is dampening spirits on Wall Street, yet the outperformance of some heavyweight stocks such as Alphabet (NASDAQ:GOOGL) and Microsoft (NASDAQ:MSFT) has been enough to pull the major indices higher. The S&P 500 is trading near nine-month highs, while the Nasdaq 100 closed at a fresh one-year high on Monday.

Not even a slide in chipmakers would keep the tech-heavy Nasdaq from extending its year-to-date gains, which now exceed 25%. Micron Technology (NASDAQ:MU) led other semiconductor stocks lower yesterday after Beijing banned the company from taking part in big infrastructure projects in China, casting doubts on claims by Biden that relations between the two countries are set to improve.

The Fed’s hesitation to pause

The risk of a US debt default is not the only thing that equity traders need to worry about as Treasury yields have started to creep up again amid renewed hawkishness coming from the Fed. The 10-year yield is approaching 3.75% to levels last seen when the banking crisis first began to unravel.

Fed Chair Powell may have indicated that he is ready to pause but other FOMC members appear to be less convinced that inflation is coming down fast enough. St. Louis Fed chief, James Bullard, remains the most hawkish, yesterday suggesting that another 50-bps hike might be needed this year, although he is not a voting member in 2023.

However, his counterpart at the Minneapolis Fed, Neel Kashkari, was more worried about a potential credit crunch from the banking turmoil that may yet play out. Though, Kashkari also pointed out that pausing in June would not necessarily mean taking the rate hike option off the table.

Dollar emboldened by Fed repricing, European PMIs disappoint

What’s becoming clear is that even if the Fed does pause in June, it will not be signalling that it is completely done with rate hikes. Moreover, investors finally seem to be listening to all the hawkish grumblings and rate cut expectations have receded substantially over the past few days, with only one 25-bps cut now fully priced in by December.

This is keeping the US dollar elevated at two-month highs and other majors like the euro and pound stuck on the backfoot. Today’s flash PMI releases for May have been somewhat underwhelming for European economies. The services PMIs disappointed in France and the UK, and although Germany’s services output surged in May, the manufacturing PMI fell to a 36-month low.

Nonetheless, the euro is attempting to hold onto the $1.08 handle and the pound might just manage to stay above $1.24. However, an even bigger test is anticipated for sterling tomorrow from the latest UK CPI data.

The yen on the other hand was broadly firmer following upbeat PMIs out of Japan earlier today.