Markets buoyed by trade war optimism after Chinese tariff concession

European markets are being guided higher ahead of the open on Wednesday after China reportedly agreed to cut tariffs on US cars – from 40% to 15% – in a gesture aimed at de-escalating the trade war between the world’s two largest economies.

While the details of the cut are not yet known, the move reverses the tariff hike in July in response to those imposed by the US, which is hopefully a sign of more unwinding to come. It’s too early to be optimistic though as tensions remain high, with the arrest of Huawei Technology Co Ltd (SZ:002502) CFO Meng Wanzhou further complicating the relationship, although Trump has suggested he could intervene, which makes the timing of the arrest all the more suspicious.

Trump tantrum puts government shutdown firmly on the table

Domestic issues could be more challenging for the President, after a discussion in front of the cameras with Nancy Pelosi and Chuck Schumer over border security – or more specifically the wall – turned sour. Trump appeared to be goaded into claiming that he would be proud to shut down the government, what Pelosi termed a Trump shutdown for the holidays. Fortunately, markets have become less sensitive to the prospect of a government shutdown in recent years, although in their current state it’s hard to say how they’ll respond this time around.

Brexit soap opera rumbles on as May faces leadership challenge

I’m sure Theresa May would happily trade places with Trump right now, with the UK Prime Minister facing the prospect of a no confidence vote on her return from Brussels. Reports suggest the delayed vote was the last straw and 48 letters have apparently been received – although we have heard this repeatedly before – meaning she now faces a vote that could bring her chaotic tenure to an abrupt end.

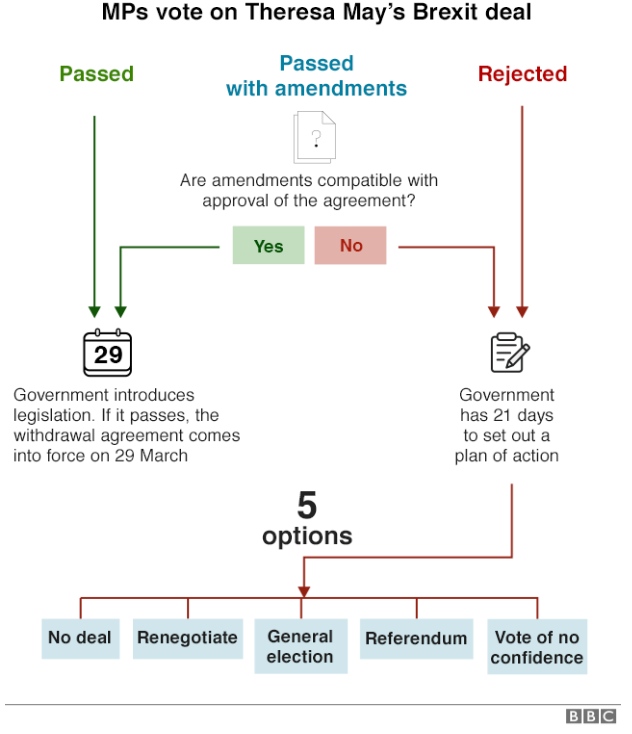

Source – BBC

Even if the letters have been collected though, that doesn’t mean she’ll lose the vote and if she doesn’t, this could actually empower her as the threat of a challenge that’s hung over her head for so long would instantly go away for another 12 months. Assuming of course that she doesn’t survive by a fine margin at which point there could be calls for her to step down, something I’m not entirely sure she’d do.

Still, the soap opera that is Brexit goes on and it seems with every passing day the chaos is being ramped up a notch which is starting to taking its toll on the currency. The pound dipped below 1.25 against the dollar on Tuesday for the first time since April last year and in the near term at least – unless May arrives home jubilantly waving a concession on the backstop – it’s tough to build a bullish case or the currency.

GBP/USD Daily Chart