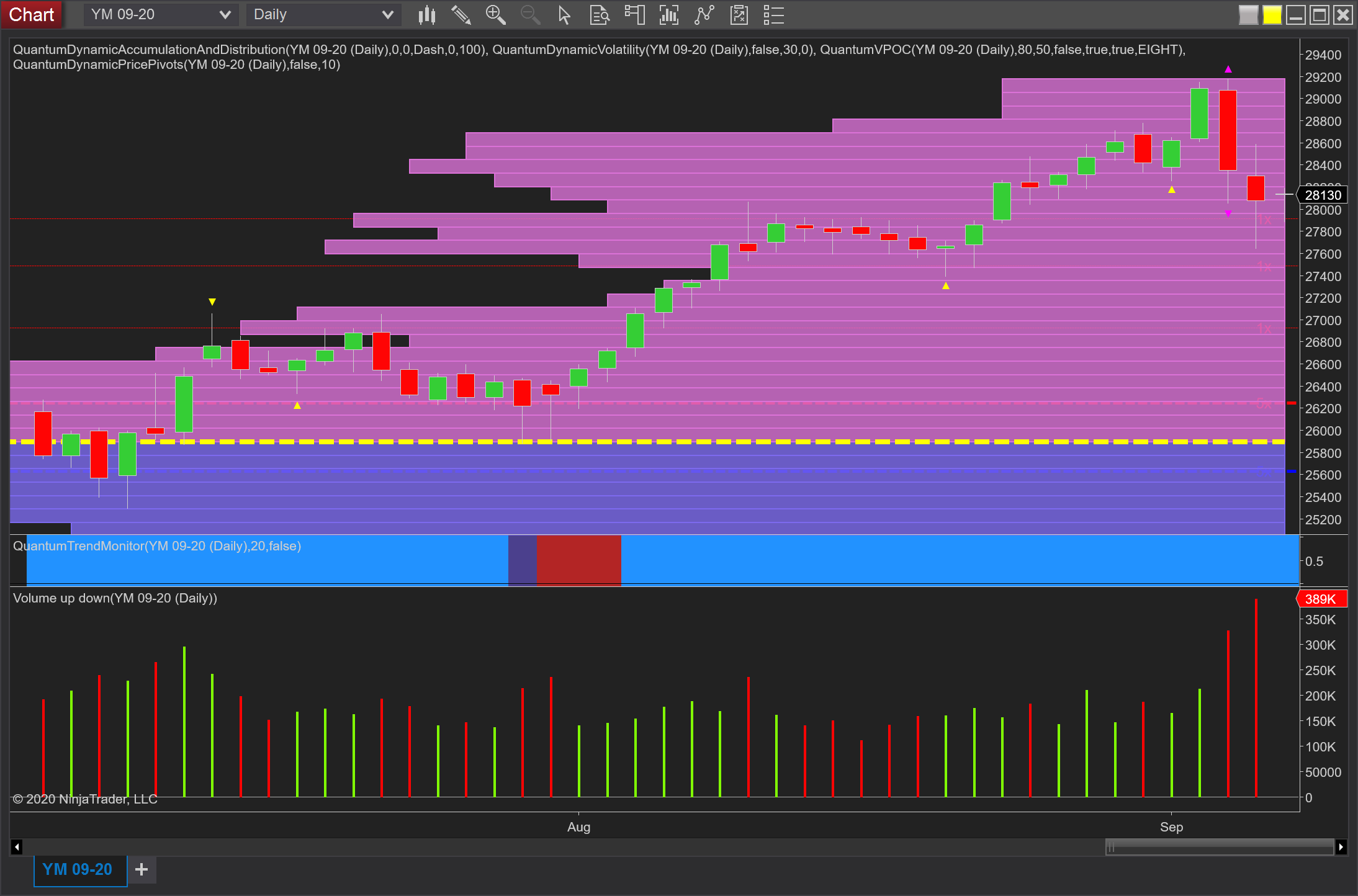

An interesting end last week for US equity traders and investors, probably more so for the former and less so for the latter who are no doubt grateful for a relatively quiet day yesterday with the US and Canada on holiday. And whilst all three indices are exhibiting similar price action, I want to focus on the daily chart for the YM emini, and as always volume reveals the true picture and the way ahead.

As we can see from the chart, Thursday’s sharp sell-off was dramatic and terrific for index traders, but note the closing volume on the day, which whilst ‘high,’ was not as high as we might have expected given the range of the candle and certainly not extreme. In addition, the wide spread down candle also triggered the volatility indicator, with the purple triangles at the top and bottom of the candle not only signalling the price action had moved outside the average true range but also flagging the likelihood of congestion back within the spread of the candle or even a reversal higher.

Friday’s price action, therefore, came as no great surprise with the contract closing with a doji candle but on very high volume, with the body of the candle closing within the spread of the previous day. And whilst the Doji candle signals indecision and represents the battle between buyers and sellers, what is perhaps more significant is the fact the market recovered well off the lows of the day.

Had the selling pressure continued from the previous day, this candle would have closed as a wide spread down candle. The fact it did not tells us the buyers moved in strongly, as was the case for both the NQ and ES emini contracts, which too had plunged early in the session, only to recover a large percentage of these losses later in the session. The price action and volume also confirmed the market makers were stepping in to buy as panic selling ensued.

Given this scenario, what we can now expect to see is a recovery in the short-term with the last few days simply a chance for the market makers to trigger panic selling freeing up stock for a further advance and extension of the longer-term bullish trend.