Market Breaks Out – Barely

If you like volatility, then this past week was for you. On Monday, the announcement by Pfizer (NYSE:PFE) sent markets screaming higher. However, it wasn’t like rallies we had seen previously. Instead, it was a fierce rotation from the previous leaders to laggards.

Nonetheless, the market initially surged to all-time highs immediately following the news. But as we will discuss in a moment, the news wasn’t really what it seemed. Subsequently, the market faded into the end of the day. The rotation to value turned out to be very short-lived as markets returned to the reality of rising Coronavirus cases and no “stimulus” on the horizon.

Since the highs of September, the market is now just 0.50% higher today. Like I said, if you like volatility, you have gotten a good dose of it.

Yes, It’s Still A Sellable Rally

Importantly, we had stated last week, the stock market rally had already gotten ahead of itself. To wit:

“However, before you get all excited and go throwing your money into the market, you may want to step back and re-evaluate your risk. If you haven’t liked the ups and downs in the market over the last couple of months, you have too much ‘risk’ in your portfolio.

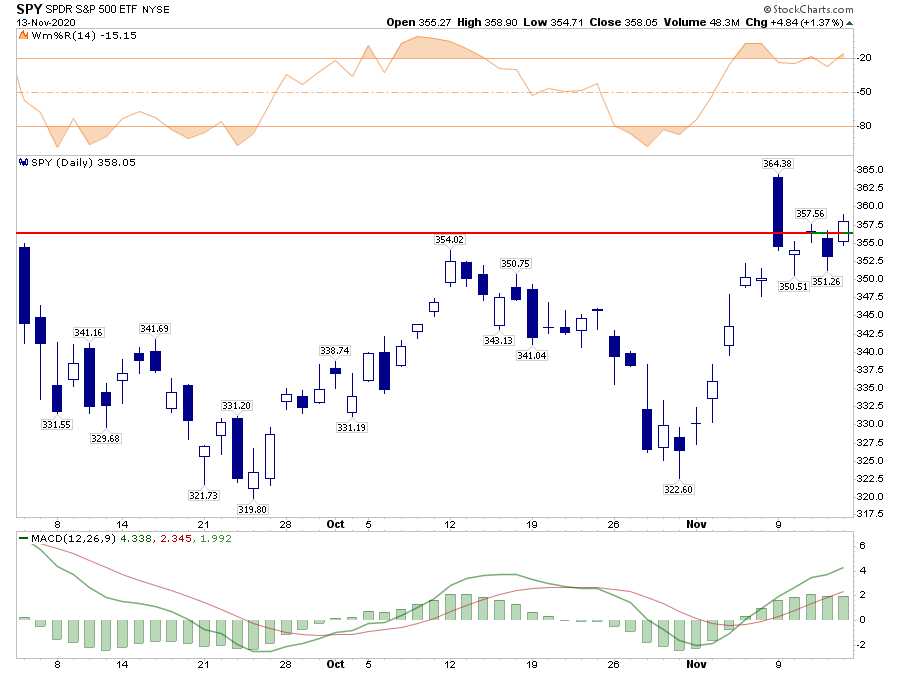

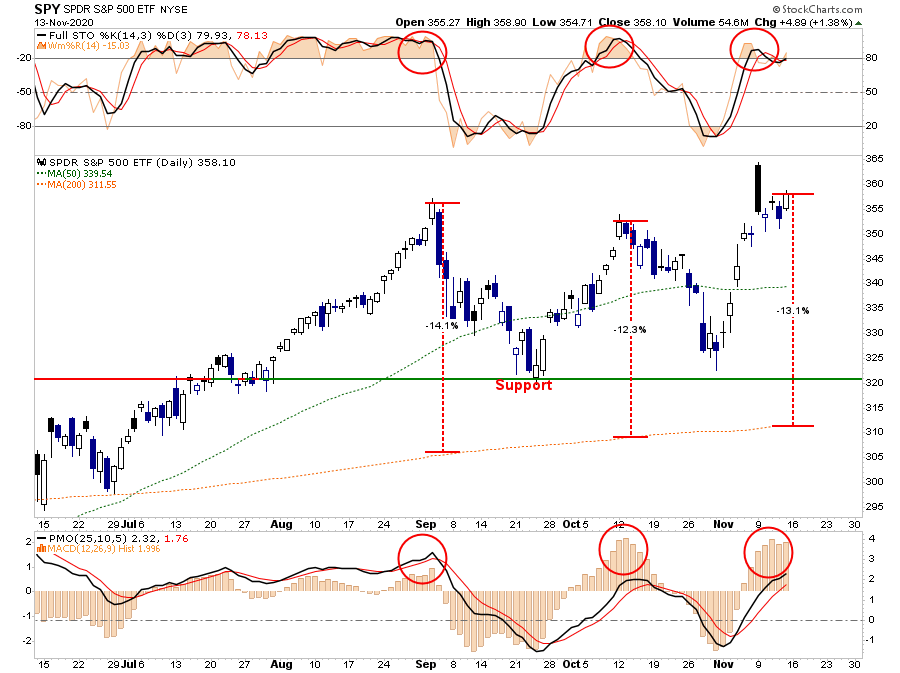

Furthermore, while we did expect this rally and added exposure in our portfolios, the previous ‘oversold’ condition has now been largely reversed. As shown below, the market is now back to more ‘overbought’ conditions, which suggests limited upside from current levels. Also, the deviation from the 200-dma is now back to levels that have previously led to mild, short-term corrections.”

Chart updated through Friday:

The rally from the October lows was a “sellable rally.” The current rally is as well. Given the more overbought condition, we expect a one to two-week correction at the beginning of December as mutual funds make their annual distributions.

While it is feasible, the markets will end the year positively; we will likely see a better entry point first.

However, there is the problem of the surge in virus cases as we head into year-end.

Vaccine Will Arrive Too Late

“Vaccine news” is certainly good and very welcome. However, do not get overly excited. Since the coronavirus emerged in January, almost 200 vaccine candidates have gone into development. Only 15 got to human trials, and there are no approvals for use. The odds of creating a successful vaccine are very low, and most vaccines fail before production.

While Pfizer’s vaccine, so far, seems to be moving along the path, there are several things to consider. Foremost is that while Pfizer did announce the potential effectiveness of their vaccine, it is yet to be peer-reviewed or approved for use by the FDA. While the drug is on a “fast-track” for use by year-end for emergency use, it will not be available for widespread use anytime soon. To wit:

“But the vaccine’s complex and super-cold storage requirements are an obstacle for even the most sophisticated hospitals in the United States and may impact when and where it is available in rural areas or poor countries where resources are tight.

The main issue is that the vaccine, which is based on a novel technology that uses synthetic mRNA to activate the immune system against the virus, needs to be kept at minus 70 degrees Celsius (-94 F) or below.”

Furthermore, they are only in Phase-3 of their drug trials. As noted, a very high percentage of drugs fail in Stages 3 and 4. Pfizer will have to start Phase IV once the FDA approves the drug. That phase will incorporate testing the drug in limited use on several hundred or thousands of patients. This phase will take quite some time to accomplish, and if unknown side-effects appear, it could stop the production of the vaccine altogether.

Not As Easy As It Sounds

Lastly, even if Pfizer gets through Phase-IV and begins to produce the drug, and solves the “freezer” problem, it is unlikely to be seen by most of the population for many months. As noted by the Wall Street Journal:

“However, it could be many months before any vaccine is administered to enough people to ease the need for lockdown measures that have been recently reimposed across the West. Duke Global Health Innovation Center estimates that there won’t be enough vaccines to cover the world’s population until 2024.

Of course, such also assumes you can get people to get vaccinated.

“While previous vaccination programs have spread over years and focused on specific demographics such as children or the elderly, governments are hoping to do something they never have done before and inoculate a majority of the population in a matter of months.

Even for rich nations with developed vaccination programs, that presents a host of problems including building new databases to track who is getting the shot, working out ways to encourage mass uptake among younger people, ensuring adequate supply and running large-scale inoculation centers where the shots can be safely and quickly administered.

Those challenges mean that even if a vaccine is soon approved, it could be many months before it is administered to enough people to ease the need for lockdown measures that have been recently reimposed across the West.” – WSJ

Shutdowns Aren’t The Solution.

For the markets, the race against time is likely already lost. There is currently “no stimulus” bills in progress in Congress. The “virus” is surging across the country, with cities once again calling for lockdowns and reversals of opening progress. Such is very bad economically and will further delay openings.

As discussed Thursday in our “3-Minutes.” another shutdown would be economically damaging and would not solve the pandemic.

As noted, the pandemic’s surge, shutdowns, and lack of stimulus are terrible for corporate earnings and, ultimately, the market. With markets extraordinarily overbought and deviated from long-term means, the risk of a correction is more than elevated.

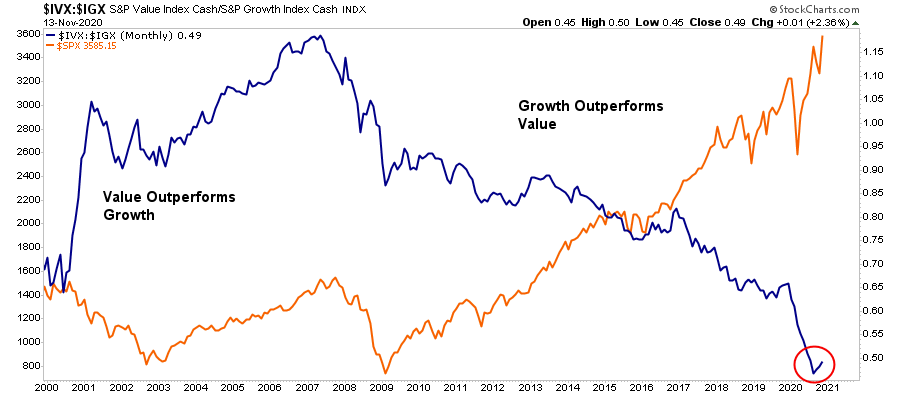

Notably, the rotation to “value” is likely premature as these companies specifically require a more robust economy to generate revenue and earnings growth. The current environment is not conducive to that. Expect a reversal of the trade soon, and money rotates back towards “pandemic” related companies.

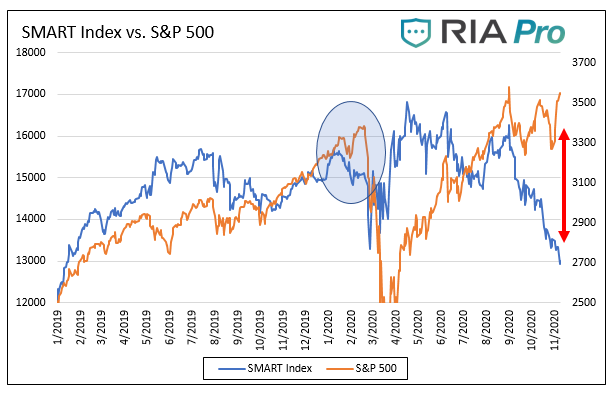

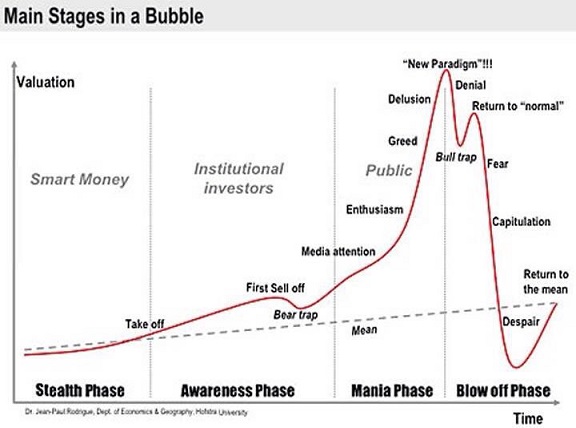

Such is also why the “Smart Money” has already been exiting the market.

The Smart Money Is Leaving Town

On Thursday, Mike Lebowitz posted an essential piece.

“Bloomberg’s Smart Money Flow Index is a measure of how ‘smart money’ is positioning itself in the S&P 500. The logic behind the index is that smart investors tend to trade near the end of the day, while more emotional-based traders dominate activity in the first 30 minutes of the trading day. The index is calculated as follows: yesterday index level – the opening gain or loss + change in the last hour.

As shown below, the Smart Index and the S&P were well correlated until late August. Since then, as highlighted by the red arrow, they have diverged sharply. Over the last ten years, the S&P 500 and the Smart Index have a strong correlation of .65. As such, we expect they will converge in time. The light blue circle shows they also diverged, albeit to a much lesser extent, in January and February as the smart money correctly sensed problems.”

Yields Have It

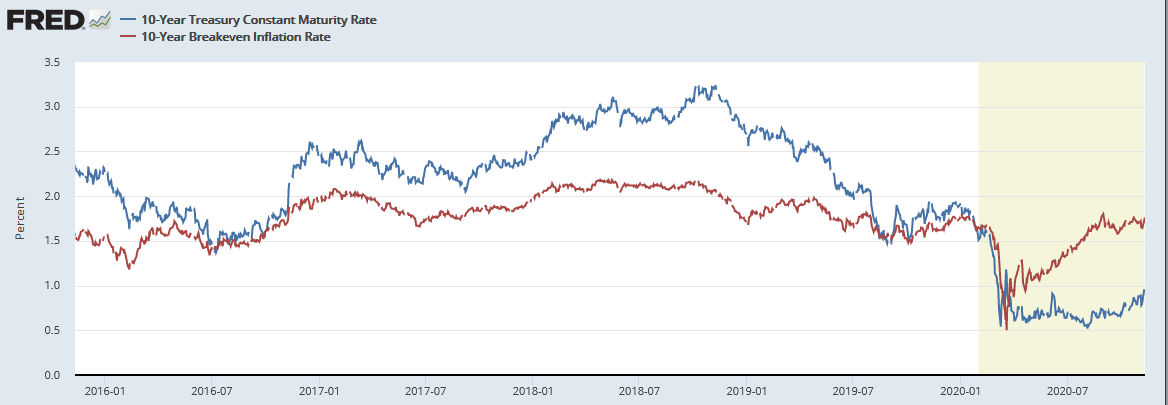

“The graph below compares 10 year UST yields versus 10 implied breakeven inflation rates. The current gap between the two is relatively wide but even wider, considering that UST yields are usually higher than the inflation rate, not lower. In other words, real rates are negative.

If the economy is going to fully recover, we should expect the UST yield to gravitate to and above the inflation rate. If that were to happen, it would imply 10-year yields of approximately 1.50-2.00%. We do not think the odds of that occurring are high because such “high” rates would heavily weigh on the economy. It is more than likely the Fed continues to aggressively buy bonds to keep yields much lower than where they should be.

The other way the gap potentially closes is if the market has inflation expectations wrong and the implied inflation rate falls. Such a scenario suggests the recovery falters.”

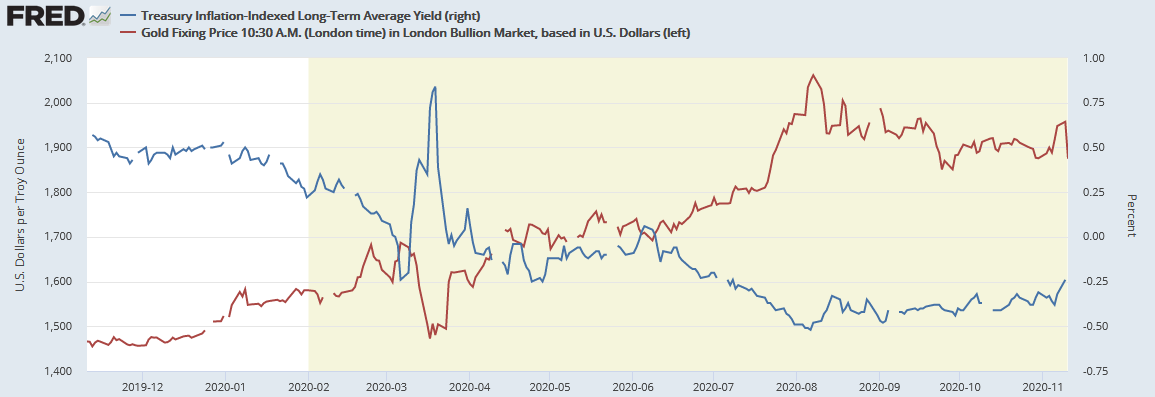

“Finally, the graph above shows the two components used to calculate real yields. As shown above, the blue line (UST yield) has made recent progress toward closing the gap with inflation expectations, ie real rates are now less negative.

The next graph shows the strong negative correlation between the level of real rates (blue line) and the price of gold. If real rates continue to rise and become less negative or even positive, we should expect the price of gold to suffer, and vice versa if real rates reverse the recent trend.”

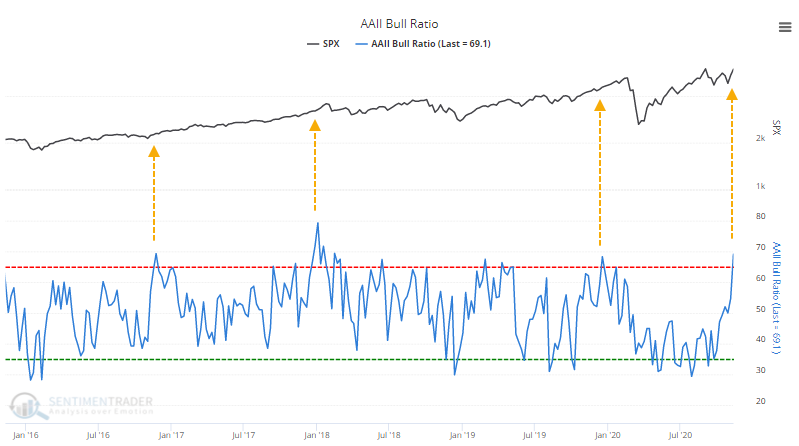

Mom & Pop Finally Turn Optimistic

As noted, while “Smart Money” is leaving town, the bullishness of retail investors has finally spiked to the highest level in years. Such is months after the recovery from the lows. Historically, such has also been an excellent short-term contrarian indicator.

“The percentage of bulls in the American Association of Individual Investors (AAII) survey rose to 55.8% while bears dropped to 24.9%, pushing the Bull Ratio, a more accurate measure of optimism, above 69%. The last 2 times it got this high, stocks ended up running into trouble eventually.” – SentimenTrader

As Bob Farrell once quipped:

“Investors buy the most at the top, and the least at the bottom.”

Portfolio Positioning Update

When the market does things that are entirely unexpected, irrational, or just plain illogical, such is any living organism’s behavior. The stock market is just that.

The wild rotation from growth to value and back again was undoubtedly one of the unexpected events. Our job is to adjust our allocations to capture these rotations when trends are changing as portfolio managers. However, the difficult part is knowing the difference between a “kneejerk reaction” and a “trend change.”

On Monday, we decided to remain with our allocations, which already has some “value” to allow the market time to play out. That decision proved correct as our portfolio’s growth portion quickly came back into play after a rough couple of days.

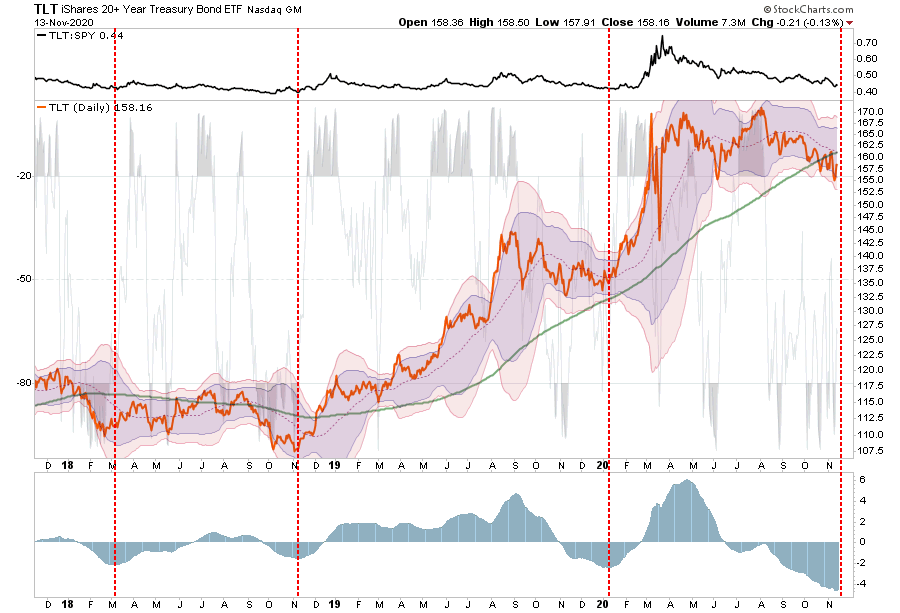

More importantly, we took the opportunity to buy Treasury bonds, which got deeply oversold and 3-standard deviations below their moving average, as shown in the chart below. Such deep oversold conditions rarely last for long and generally lead to decent trading opportunities. That additional bond exposure played out well for the remainder of the week.

What’s The Biggest Mistake Investors Make?

My friend and trading colleague Victor Adair penned a great note last week:

“Interest rates are currently the lowest they’ve been in hundreds of years. In the early 1980s, people could get 13% interest on a bank account, but now ‘high interest’ accounts pay less than half a percent.

You might say that it’s wrong for savers to suffer because the Central Bank has cut interest rates to zero to support the economy. I’d agree, but the fact is that ultra-low interest rates have forced many otherwise cautious people into taking “a little more risk” to earn a decent return on their investments.

When people believe that they need to take ‘a little more risk’ to generate greater returns, they may be making a very BIG mistake if they underestimate what ‘risk’ really means to them.”

His point is incredibly important. As we noted in “Moral Hazard,” the Federal Reserve believes that insuring people against investment losses is a dangerous one. While investors are encouraged to take more risk currently, as prices rise, they begin to disregard risk for what it is.

When people take “a little risk” and get rewarded for it, they are then encouraged to take “a little more risk.” As Victor notes, “People in the ‘crowd’ don’t appreciate the risks they are taking because they’re surrounded by people who believe the market will keep going up.”

What Is The “Risk?”

“One way to measure ‘risk’ in today’s markets is to think of it as the difference between current market prices and the price where ‘value investors’ like Howard would start buying. Believe me; the difference is HUGE.” – Victor Adair.

The incredible stock market rally of the last 40 years has occurred while falling interest rates have forced more and more people to shift from being savers to being “investors.”

It’s not just the stock market. Virtually all asset prices have gone up as interest rates have tumbled. When there is no “hurdle rate” to the cost of money, then a lot of money gets “invested” poorly. There are very few bargain-priced assets these days.

As Victor notes, if we are indeed in another stock market bubble, then “valuations” don’t matter much. The only thing that matters is “confidence,” and if people are confident that the market will keep going higher, it will until something triggers a “loss of confidence.”

“In a bull market, the Fear Of Missing Out (FOMO) is so strong that people see marketing schemes such as “passive investing” as brilliant ideas. They willingly sign up to have money clipped off their paycheck and invested in the stock market every month, regardless of price. They do this because they have chosen to believe (or have been sold on the idea) that stock prices will only go higher.” – Victor Adair

Manage The Risk

Victor is correct when he states there has been much irrational exuberance in the past few years. Along with that exuberance, asset prices got bid aggressively higher. There is nothing wrong with that except that the “risk of loss’ from these levels is much greater now.

It is essential to have a strategy and discipline that can minimize downside volatility. If you don’t have one, then work with your investment advisor to assess your portfolio, risk, and risk tolerance. Decide if it is time to make portfolio changes. If not, then make plans to reduce risk systematically if the market starts to fall. That way, you won’t panic and make ‘spur of the moment” decisions if the market takes a tumble.

If you don’t have a disciplined investment strategy and are just part of the crowd, here are 10-rules of risk management to get you thinking.

Originally published Nov 13, 2020