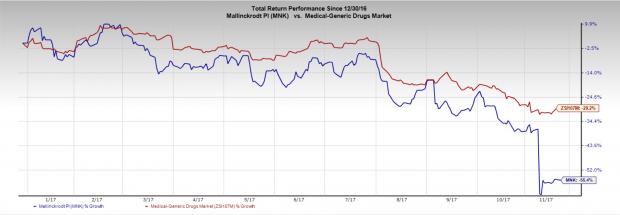

Shares of Mallinckrodt plc (NYSE:MNK) have tumbled 55.1% year to date, compared with the industry’s decline of 29.2%.

Dublin, Ireland-based Mallinckrodt is a specialty biopharmaceutical with a worldwide presence. The company develops, manufactures, markets and distributes branded and generic specialty pharmaceutical and biopharmaceutical products and therapies along with nuclear medicine products.

The company suffered a setback after a U.S. District Court invalidated 11 patents covering its second-largest product Inomax. We remind investors that in February 2015, Mallinckrodt along with its subsidiaries filed suit in the U.S. District Court for the District of Delaware against Praxair, Inc. (NYSE:PX) following receipt of a January 2015 notice from the latter. The notice was regarding Praxair’s submission of an ANDA containing a Paragraph IV patent certification with the FDA for a generic version of Inomax.

Subsequently, in July 2016, Mallinckrodt filed a second suit against Praxair following receipt of a Paragraph IV notice concerning three additional patents recently added to the FDA Orange Book regarding its ANDA for a generic version of Inomax. Thereafter, a third suit was filed in September 2016. Mallinckrodt plans to appeal against the decision and stated that Inomax has patent protection till 2018.

The company’s largest product, Acthar’s, sales declined in the third quarter as the payer environment has become increasingly complex for specialty drugs. A large number of prescriptions were unfilled beyond the level management expected. The weakness in the sales is expected to persist in the fourth quarter.

Moreover, the generic segment continues to face weakness as various product categories are witnessing stiff competition, which is hurting both volumes and prices. The company expects double-digit declines in revenues from this segment. In addition, continued expected weakness in this segment will adversely impact gross profit margins also.

The company is currently streamlining its business. The company aims to focus better on its specialty pharmaceutical business after having sold its Nuclear Imaging business.

Earlier in the month, Mallinckrodt announced that it will acquire a clinical stage biopharmaceutical company Ocera Therapeutics, Inc. Ocera's experimental product OCR-002, an ammonia scavenger, is being evaluated for the treatment of hepatic encephalopathy, a neuropsychiatric syndrome associated with hyperammonemia, a complication of acute or chronic liver disease.

The candidate is currently in phase II. Mallinckrodt will discuss with the FDA to confirm the regulatory pathway to gain FDA approval and subsequently launch the IV formulation, expected by 2022, and the oral formulation, expected by 2024.

While these recent acquisitions will expand the company’s portfolio, the decline in legacy product sales will adversely impact revenues.

Zacks Rank & Key Picks

Mallinckrodt currently carries a Zacks Rank #3 (Hold).

Some better-ranked health care stocks in the same space are Ligand Pharmaceuticals Inc. (NASDAQ:LGND) and Corcept Therapeutics Incorporated (NASDAQ:CORT) carrying a Zacks Rank #2 (Buy) each. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Ligand’s earnings per share estimates have moved up $3.68 to $3.70 for 2018 over the last 60 days. The company delivered positive earnings surprises in two of the trailing four quarters, with an average beat of 8.22%. The share price of the company has increased 39.4% year to date.

Corcept’s earnings per share estimates have moved up from 45 cents to 47 cents for 2017 and from 77 cents to 88 cents for 2018 over the last 60 days. The company delivered positive earnings surprises in two of the trailing four quarters, with an average beat of 14.32%. The share price of the company has increased 162.4% year to date.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Praxair, Inc. (PX): Free Stock Analysis Report

The Medicines Company (MDCO): Free Stock Analysis Report

Ligand Pharmaceuticals Incorporated (LGND): Free Stock Analysis Report

Corcept Therapeutics Incorporated (CORT): Free Stock Analysis Report

Mallinckrodt PLC (MNK): Free Stock Analysis Report

Original post

Zacks Investment Research