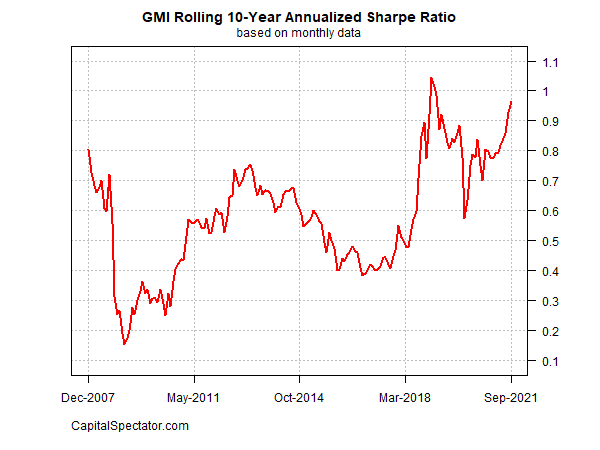

Risk-adjusted performance continued to rise in September for the Global Market Index (GMI), an unmanaged, market-value-weighted portfolio that holds all the major asset classes (except cash). But the widespread losses in markets last month suggest that GMI’s trailing 10-year Sharpe ratio may have peaked for this cycle.

GMI’s 0.97 Sharpe ratio is close to the highest levels reached in recent history. In early 2019 GMI’s Sharpe ratio briefly rose (slightly) above 1.0. But that’s nosebleed terrain for a multi-asset-class portfolio and maintaining that level—or even approaching it—is rare. As a result, a near-1.0 level is probably a sign that GMI’s risk-adjusted performance has probably hit its high for the foreseeable future.

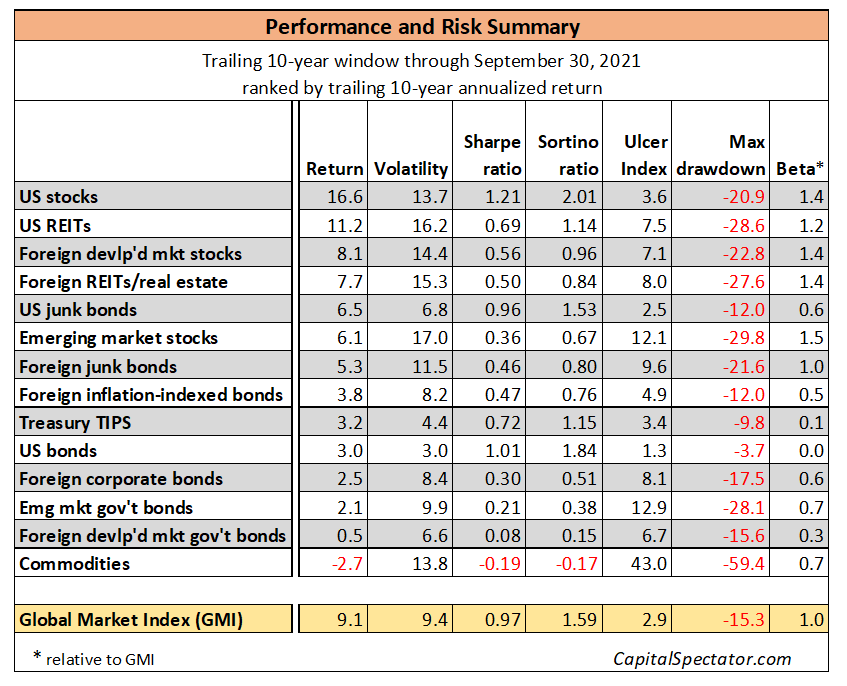

Another reason to expect that GMI’s Sharpe ratio has peaked: the index’s risk-adjusted performance exceeds most of the equivalent for the major asset classes. Only US stocks and US real estate investment trusts are posting higher Sharpe ratios for the trailing 10-year period (see table below).

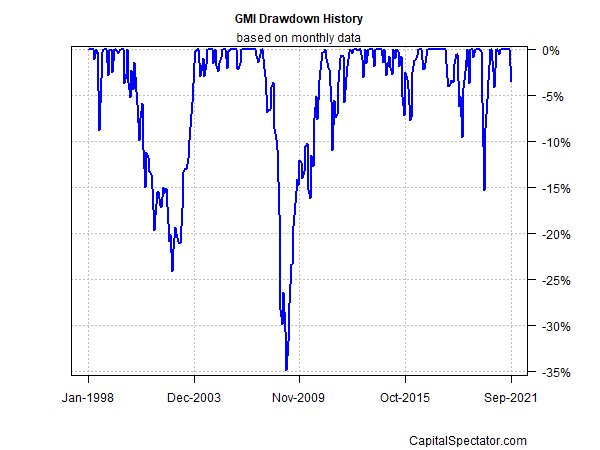

Profiling GMI through a drawdown lens shows that the recent run of peak performance has cracked. After seven straight months of hitting new highs, GMI fell sharply in September, ending the month with a 3.4% drawdown.

GMI represents a theoretical benchmark for the “optimal” portfolio. Using standard finance theory as a guide, this portfolio is considered a preferred strategy for the average investor with an infinite time horizon.

Those assumptions are, of course, unrealistic in the real world. Nonetheless, GMI is useful as a baseline to begin research on asset allocation and portfolio design. GMI’s history suggests that this benchmark’s performance is competitive with active asset-allocation strategies overall, especially after adjusting for risk, trading costs, and taxes.

For added context, readers can use this basic risk profile for GMI alongside the current monthly updates on performance and expected return for the benchmark and its components.

The table below presents additional risk metrics for GMI and its underlying asset classes, based on a trailing 10-year window through last month.

Here are brief definitions of each risk metric:

- Volatility: annualized standard deviation of monthly return

- Sharpe ratio: ratio of monthly returns/monthly volatility (risk-free rate is assumed to be zero)

- Sortino ratio: excess performance of downside semivariance (assuming 0% threshold target)

- Ulcer Index: duration of drawdowns by selecting negative return for each period below the previous peak or high water mark

- Maximum Drawdown: the deepest peak-to-trough decline

- Beta: measure of volatility relative to a benchmark (in this case GMI)