The Madison Square (NYSE:SQ) Garden Company (NYSE:MSG) reported fourth-quarter fiscal 2019 results, wherein both earnings and revenues lagged the Zacks Consensus Estimate. With this, the bottom line fell short of the Zacks Consensus Estimate after registering a beat in the trailing three quarters. Meanwhile, the top line missed the consensus mark for the second straight quarter.

In the quarter under review, the company incurred a loss of $3.08 per share, wider than the Zacks Consensus Estimate of a loss of $2.34. In the prior-year quarter, Madison Square Garden had incurred a loss of $1.94 per share. Net revenues totaled $263.6 million, which missed the consensus mark of $276 million and declined 17% year over year.

Following the quarterly results, shares of the company decreased 8.9% on Aug 20. Moreover, in the past six months, the stock has decreased 10.1% compared with the industry’s 9.4% decline.

Segmental Performance

Madison Square Garden operates under two segments — MSG Entertainment and MSG Sports.

Revenues from the Entertainment segment totaled $174 million, down 6% year over year. The downside can be mainly attributed to decrease in event-related revenues at the company's venues, soft event-related revenues for the Boston Calling festival, the impact of ASC Topic 606 on suite license fees. The winding down of Obscura Digital’s third-party business too impacted the segment’s revenues.

The segment’s adjusted operating income came in at $1.1 million, down 87% year over year. The metric decreased primarily due to a sharp decline in revenues.

Revenues from the Sports segment declined 32% to $90 million primarily due to the impact of ASC Topic 606, which hurt professional sports teams' regular-season ticket-related revenues, local media rights fees, suite license fees, league distributions and sponsorship and signage revenues.

The segment incurred an adjusted operating loss of $5.7 million due to higher direct operating expenses and soft revenues.

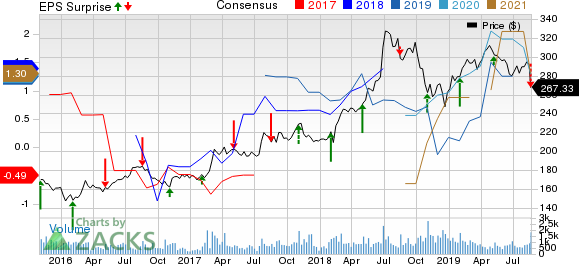

The Madison Square Garden Company Price, Consensus and EPS Surprise

Operating Income

In the quarter under review, Madison Square Garden incurred adjusted operating loss of $79.9 million compared with operating loss of $44.2 million in the year-ago quarter.

Balance Sheet

Cash and cash equivalents totaled $1.1 billion as of Jun 30, 2019, compared with $1.22 billion as of Jun 30, 2018. The company ended the fiscal fourth quarter with long-term debt of nearly $48.6 million compared with $101.3 million at the end of fiscal 2018.

Zacks Rank & Stocks to Consider

Madison Square Garden, which shares space with Hudson Ltd. (NYSE:HUD) , has a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks worth considering in the same space include SeaWorld Entertainment, Inc. (NYSE:SEAS) and OneSpaWorld Holdings Limited (NASDAQ:OSW) , each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

SeaWorld Entertainment and OneSpaWorld Holdings have an impressive long-term earnings growth rate of 7% and 20%, respectively.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft (NASDAQ:MSFT) in the 1990s. Zacks’ just-released special report reveals 7 stocks to watch. The report is only available for a limited time.

See 7 breakthrough stocks now>>

The Madison Square Garden Company (MSG): Free Stock Analysis Report

SeaWorld Entertainment, Inc. (SEAS): Free Stock Analysis Report

Hudson Ltd. (HUD): Free Stock Analysis Report

Haymaker Acquisition Corp. (OSW): Free Stock Analysis Report

Original post

Zacks Investment Research