Mr. Market always has a view. Many, in fact. They’re not always right, but they keep coming. That includes views on the macro outlook. While there are no formal forecasts, there are implied estimates of various big-picture trends. One way to read the tea leaves: calculating the ebb and flow with various pairs of proxy ETFs.

The main takeaway: the macro outlook remains challenged, based on ETF prices through yesterday’s close (Oct. 10). That’s old news. The question is when will the cycle change and begin to price in better days? That shift is well beyond the near-term horizon, according to Mr. Market. When the shift does commence, Mr. Market will probably drop some early clues. Here are four that deserve close attention on that front.

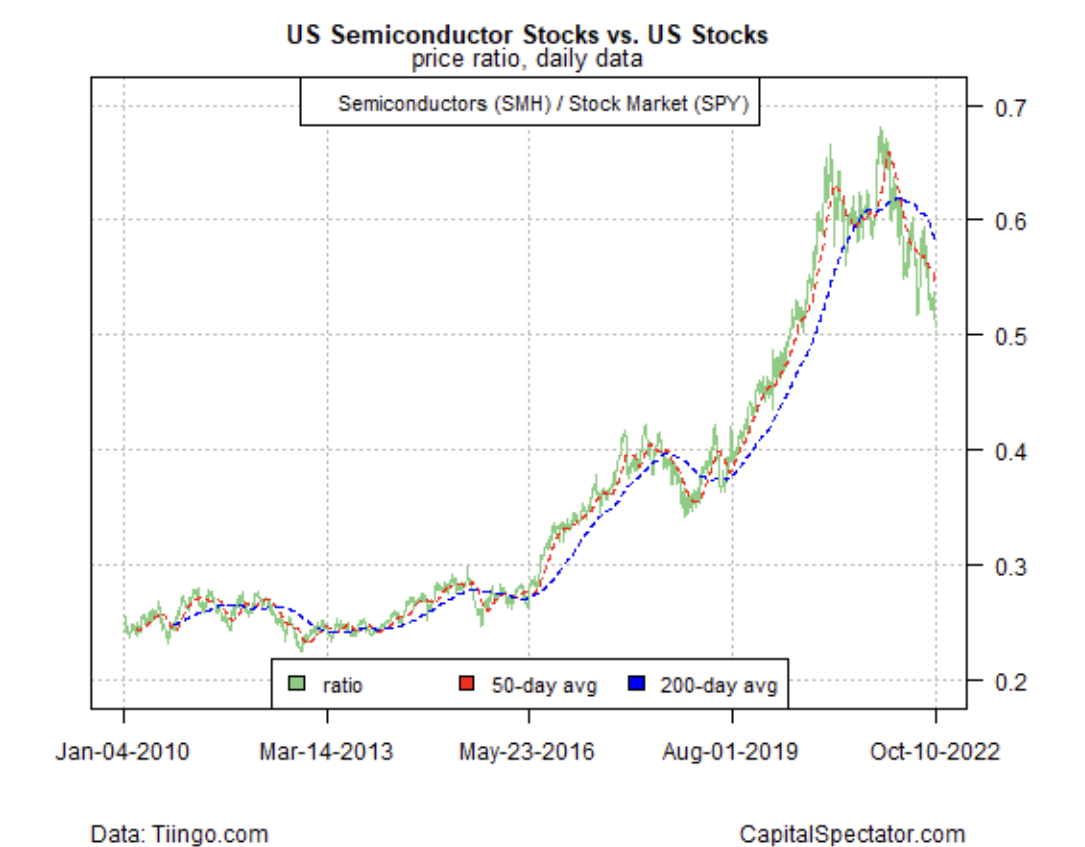

Let’s start with the view from the vantage of semiconductor stocks (VanEck Semiconductor ETF (NASDAQ:SMH)) relative to the broad market (SPDR® S&P 500 (NYSE:SPY)). The logic here: sales of semis, which are core components in computers, phones and a range of digital technologies used by companies, are highly sensitive to changes in economic activity. The key message from this corner: the macro trend continues to slide. When this ratio finds a bottom and begins to rebound, the switch will signal a brighter outlook for economic conditions. But that pivot is nowhere on the near-term horizon, according to SMH:SPY.

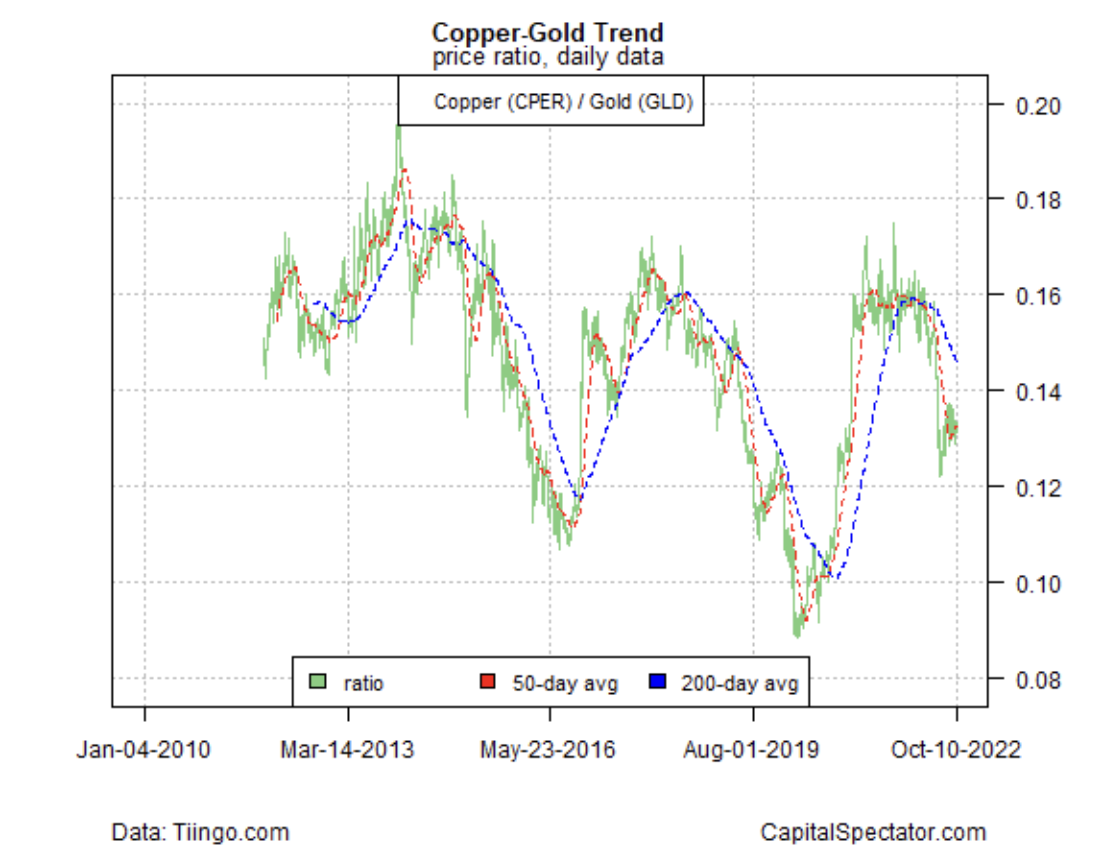

Another benchmark of the macro trend is the ratio of copper to gold. Copper demand is seen as a leading indicator of economic activity. By contrast, gold is considered a safe haven that’s prized as a risk-off asset. As a result, a rising copper/gold ratio is a signal of improving economic conditions. But here, too, the opposite is in play as the CPER:GLD (NYSE:GLD) drops sharply.

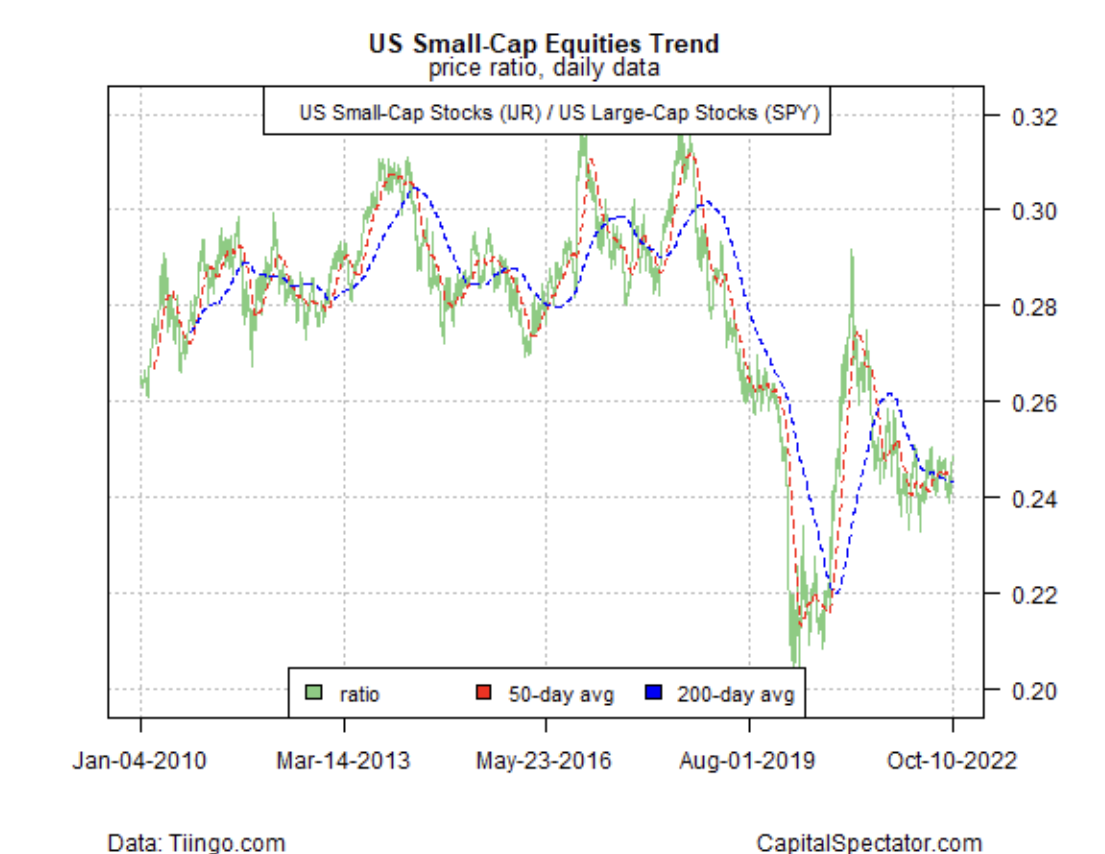

Another way to track the economic trend – for the US, in particular – is by monitoring the relative performance of small-cap shares (iShares Core S&P Small-Cap ETF (NYSE:IJR)) to the broad stock market (SPDR® S&P 500 (NYSE:SPY)). The rationale is that smaller firms tend to be more domestically oriented and so they’re more sensitive to US economic conditions. The broader equities market, by contrast, is dominated by larger firms, which often have a global focus. As a result, outperformance by small caps may be an indicator of an improving macro outlook for the US. On that basis, the IJR:SPY trend is mixed. The recent slide in this ratio has stabilized, which may be hint that investors are reserving judgment about recession risk.

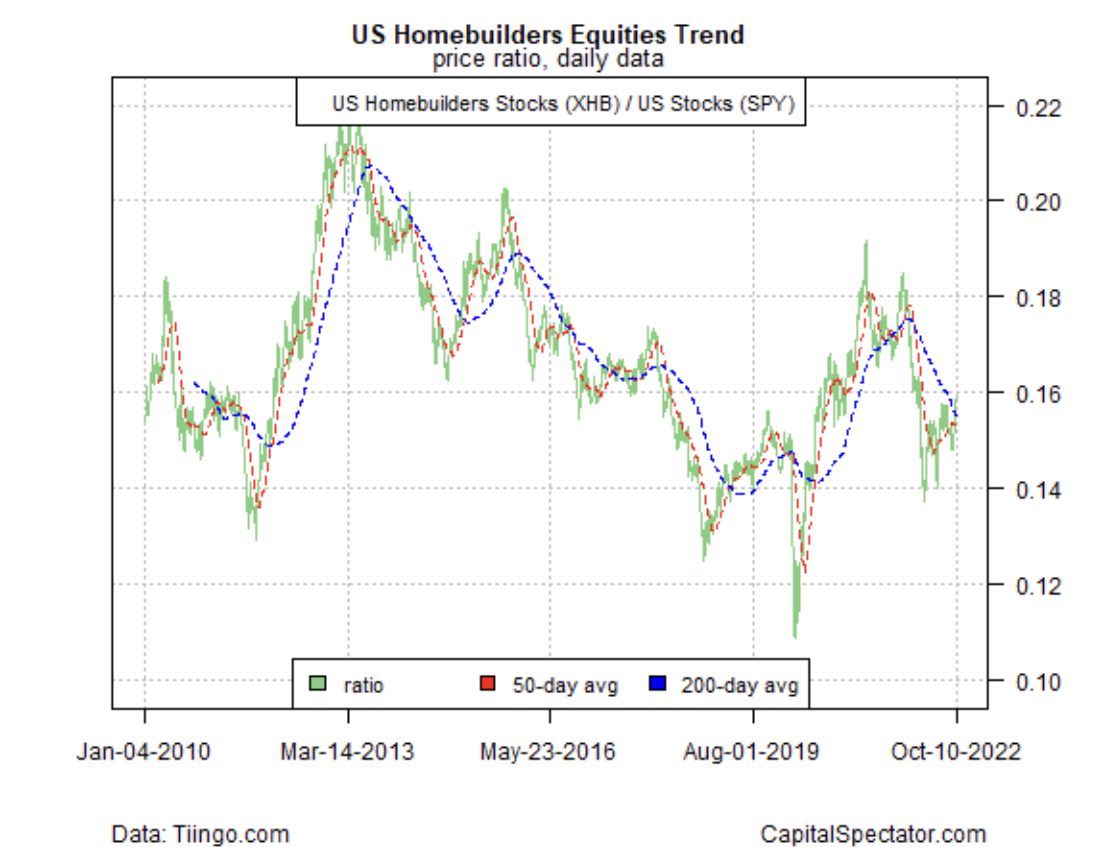

Another macro proxy is the relative performance of home-building stocks (SPDR® S&P Homebuilders ETF (NYSE:XHB)) vs. the overall equities market (SPY). Housing tends to be procyclical and so it often leads the business cycle. From this vantage, however, the trend remains bearish as the XHB:SPY trend continues to slide.