First quarter inflation in Australia was lower than expected. Will the AUD/USD slide continue?

The Reserve Bank of Australia left the interest rate at 1.5% and the policy unchanged at its April 3 meeting. A major economic update after the central bank decision has been negative: the consumer price index in Australia increased 0.4% percent on quarter in the first quarter of 2018, slower than the 0.6% increase in the previous quarter. And before that the balance of trade surplus slipped in February though the decline was smaller than expected. Slowing inflation is bearish for AUD/USD.

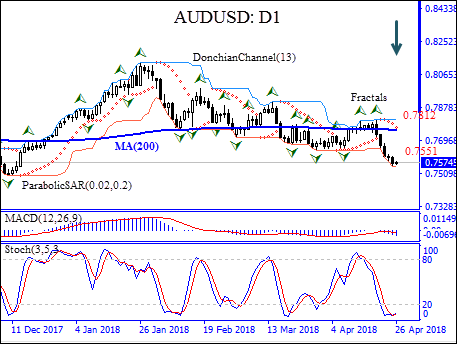

On the daily timeframe AUD/USD: D1 is trading with negative bias after hitting thirty-five-month high in the end of January. The price has fallen below the 200-day moving average MA(200).

- The Parabolic indicator has formed a sell signal.

- The Donchian channel indicates no trend yet : it is flat.

- The MACD indicator is below the signal line with the gap widening. This is a bearish signal.

- The stochastic oscillator is in the oversold zone, this is a bullish signal.

We believe a bearish momentum will continue after the price breaches below the lower Donchian boundary at 0.7551. This level can be used as an entry point for placing a pending order to sell. The stop loss can be placed above the upper Donchian channel at 0.7812. After placing the pending order the stop loss is to be moved every day to the next fractal high, following Parabolic signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. If the price meets the stop-loss level (0.7812) without reaching the order (0.7551) we recommend cancelling the order: the market sustains internal changes which were not taken into account.

Technical Analysis Summary

Position Sell

Sell Stop Below 0.7551

Stop loss Above 0.7812