The activity on the Litecoin network suggests that higher prices are imminent.

Key Takeaways

- Litecoin has taken a 13.6% nosedive in the last 36 hours.

- Despite the significant losses, LTC looks bullish from an on-chain perspective.

- Prices could target $290 as long the $200 support level holds.

Volatility has taken over the cryptocurrency market, generating over $8 million in liquidations worth of Litecoin positions across the board over the last 24 hours. Regardless, on-chain metrics show that LTC is well-positioned for higher highs.

Network Activity Goes Through the Roof

Litecoin has plummeted 13.6% in the last 36 hours, but it looks undervalued from an on-chain perspective.

The recent dip has caused over $8 million worth of liquidations. However, the network activity suggests that new money is pouring into the digital asset, which is a sign of optimism.

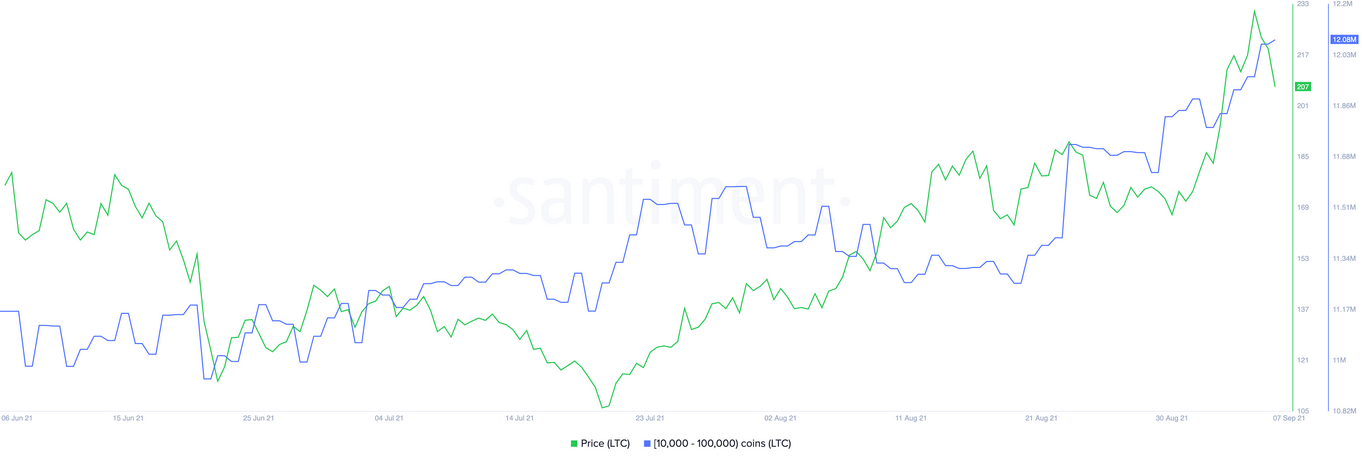

Addresses on the Litecoin network with 10,000 to 100,000 tokens have increased their positions over the last month. These large investors have added more than 720,000 LTC to their holdings, worth roughly $160 million.

The mounting buying pressure coming from whales coincides with a significant increase in the number of users on the network. The number of new addresses has risen by more than 79.5% since Aug. 7, with roughly 200,000 new addresses on the network at press time.

Network growth is often considered one of the most accurate price predictors. Generally, a steady increase in the number of new addresses created on a given blockchain leads to rising prices over time.

Litecoin Has One Barrier to Overcome

Further buying pressure could push LTC to higher highs.

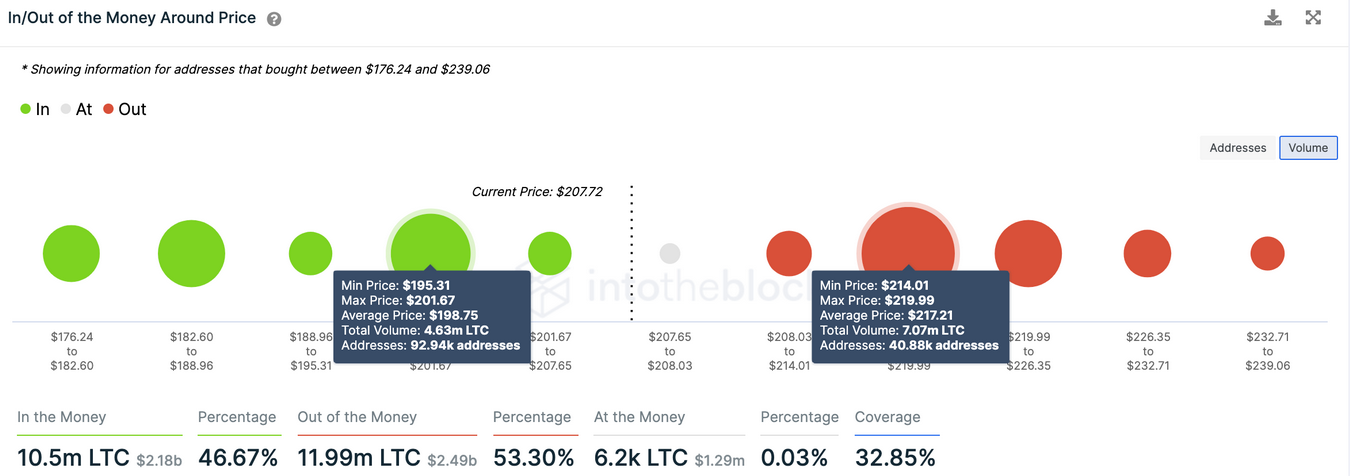

Still, IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model reveals that Litecoin has an obstacle to overcome before achieving its upside potential. Approximately 41,000 addresses have previously purchased 7.07 million LTC at an average price of $217.21.

This area may have the ability to absorb some of the recent buying pressure. Holders who have been underwater may try to break even on their positions, slowing down the uptrend. But if Litecoin can slice through this hurdle, it could climb to $290.

On the other hand, the IOMAP cohorts show that Litecoin sits on top of stable support. Nearly 93,000 addresses bought around 4.63 million LTC between $195 and $202. This crucial area of interest suggests that bears could struggle to push prices down. In other words, the odds favor the bulls.