Litecoin could go parabolic after it smashes through previous all-time highs.

Key Takeaways

- Litecoin has been up more than 46% in the past three days.

- Further upward pressure could result in a retest of its 2021 high at $413.

- Still, LTC must overcome one crucial resistance barrier.

- Litecoin looks primed for further gains after breaking out of its current trend.

- LTC has cleared significant resistance but faces another hurdle before rising further.

Litecoin Enters New Uptrend

Litecoin is trying to regain $300 as support for the first time in nearly six months. The thirteenth-largest cryptocurrency by market cap has enjoyed bullish price action over the past few days, gaining almost 100 points in market value. The sudden upswing allowed LTC to slice through several resistance barriers and build a strong foothold for prices to advance further.

40-year trading veteran Peter Brandt believes that Litecoin is only getting started. The breach of the Sep. 13 high at $238 could have marked the beginning of a new uptrend. Brandt maintains that further buying pressure could see LTC retest its 2021 high of $413.

More importantly, the technical analyst affirmed that a target of $1,000 is “quite conservative” for Litecoin. He indicated that LTC could be forming a cup and handle pattern on the weekly chart, which is considered a bullish signal extending an uptrend. It projects that upon the break of the $420 all-time high, prices could rally by nearly 1,800% towards $8,000.

Such a bullish target is determined by measuring the distance between the bottom of the cup and the pattern’s breakout level and extending that distance upward from the breakout.

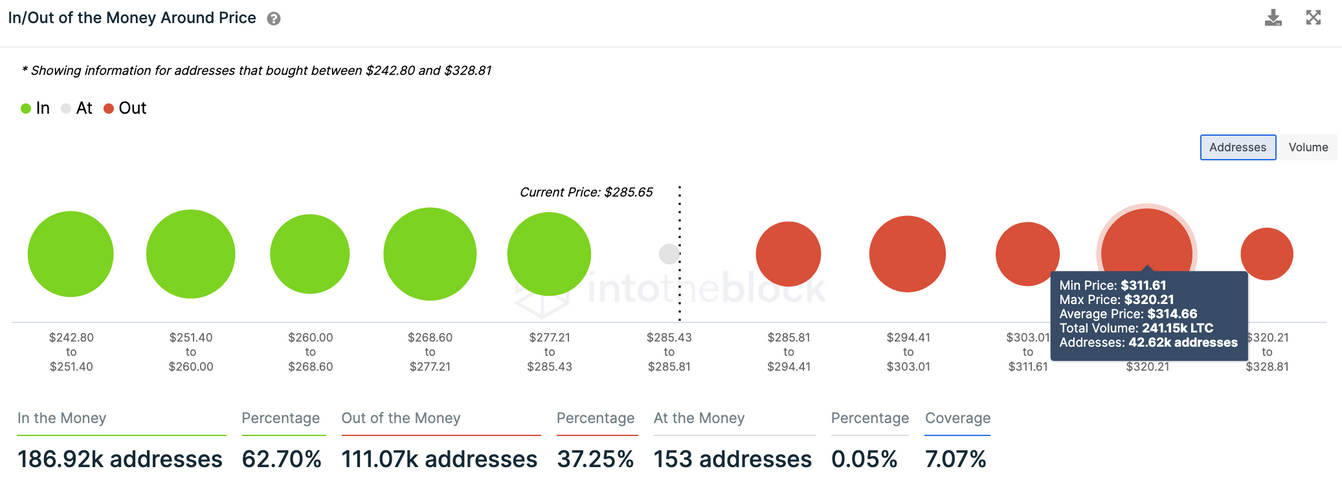

While $8,000 is a lofty target for Litecoin, a technical retest of the 2021 high at $413 could be next in the short-term. IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model shows that Litecoin faces only one hurdle ahead. Roughly 42,600 addresses had previously purchased over 240,000 LTC between $311 and $320.

Such a critical supply barrier could slow down the uptrend as traders who have been underwater may try to break even on their long positions. Still, a decisive close above this resistance wall would likely result in an upswing towards $413, as Brandt pointed out.

It is worth noting that Litecoin must hold above $240 for the bullish outlook to unfold. Any signs of weakness at this price level could encourage investors to sell to prevent losses. Based on transaction history, a spike in selling pressure that pushes LTC below $240 could translate into a correction to $200 or lower.