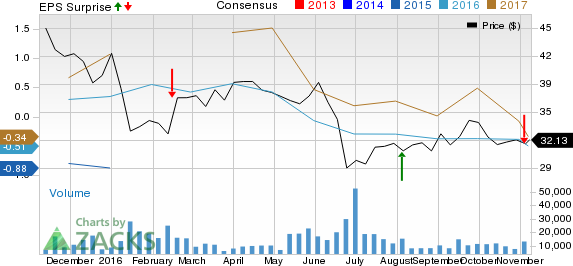

Liberty Global Plc. (NASDAQ:LBTYA) reported mixed financial results in the third quarter of 2016.

GAAP net loss in the reported quarter was $137 million or 18 cents per share versus net earnings of $111 million or 8 cents in the prior-year quarter. Loss per share of 18 cents was way wider than the Zacks Consensus Estimate of a loss of a penny.

Meanwhile, quarterly total revenue of $4,313 million was up 0.6% year over year and above the Zacks Consensus Estimate of $4,295 million.

Total segment operating cash flow in the reported quarter was $2,060 million, up 3% year over year. Quarterly operating income was $764 million, up 60% year over year.

In the third quarter of 2016, Liberty Global generated $1,253 million of cash from operations compared with $3,184 million in the year-ago quarter. Free cash flow, in the reported quarter, was $558 million compared with $970 million in the prior-year quarter.

At the end of the third quarter of 2016, Liberty Global had $1,286.3 million of cash and cash equivalents and $49,500.7 million of outstanding debt on its balance sheet compared with $982.1 million and $44,211.2 million, respectively, at the end of 2015.

Subscriber Statistics

As of Sep 30, 2016, Liberty Global had 25.7584 million subscribers, which constituted 54.143 million RGUs (revenue generating units). Of the total, 22.477 million were video RGUs, 17.287 million were broadband Internet RGUs and the remaining 14.378 million were telephony RGUs. Moreover, the company had 6.8 million mobile subscribers with a quarterly addition of 65,000 customers.

Total Single-Play customer count was 9.298 million, down 1.2% year over year. Total Double-Play subscriber base totaled 4.538 million, up 1.3% year over year. Triple-Play customer base exceeded 11.924 million, up 0.7% year over year.

During the reported quarter, Liberty Global added a total of 256,500 RGUs, including net gains of 178,000 and 117,000 subscribers for broadband Internet and telephony services, respectively. However, the company lost 38,500 video customers. In the reported quarter, Liberty Global added a net of 278,000 customers for its flagship Horizon TV-platform and 67,000 for the TiVo Inc. (NASDAQ:TIVO) developed TV-platform.

Segment-wise Results

Total revenue at the European Operations division was $4,307.9 million, up 0.5% year over year. Within this segment, revenues from Western Europe totaled $4,035 million, up 0.4% year over year. Revenues from Central and Eastern Europe came in at $274.5 million, up 3.5% year over year. Corporate and other revenues totaled $18 million, up 116% year over year.

Zacks Rank & Stocks to Consider

Liberty Global currently carries a Zacks Rank #4 (Sell). Better-ranked stocks in the same sector include Liberty Broadband Corp. (NASDAQ:LBRDA) and AudioCodes Ltd. (NASDAQ:AUDC) . Both the companies carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Confidential from Zacks

Beyond this Analyst Blog, would you like to see Zacks' best recommendations that are not available to the public? Our Executive VP, Steve Reitmeister, knows when key trades are about to be triggered and which of our experts has the hottest hand. Click to see them now>>

AUDIOCODES LTD (AUDC): Free Stock Analysis Report

LIBERTY GLBL-A (LBTYA): Free Stock Analysis Report

TIVO CORP (TIVO): Free Stock Analysis Report

LIBERTY BRDBD-A (LBRDA): Free Stock Analysis Report

Original post

Zacks Investment Research