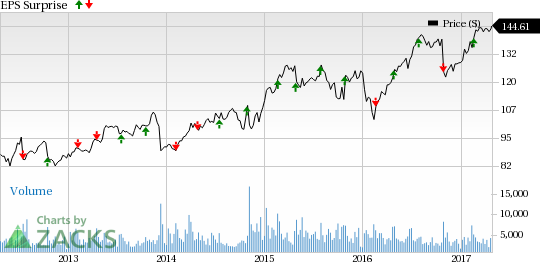

Laboratory Corporation of America Holdings (NYSE:LH) or LabCorp reported first-quarter 2017 adjusted earnings per share (EPS) of $2.22, up 8.3% from the year-ago quarter. The quarter’s adjusted EPS also exceeded the Zacks Consensus Estimate by 1.4%. On a reported basis, LabCorp’s net earnings came in at $1.84 per share, a 16.5% jump year over year.

Net revenue for the first quarter increased 4.9% year over year to $2408 million. However, the quarterly number lagged the Zacks Consensus Estimate of $2411 million. Strong growth in companion diagnostics and significant increase in organic volume growth contributed to the year-over-year top-line growth, which was partially offset by poor show in Covance Drug Development. This apart, adverse currency exchange movement hampered the quarterly top-line number to the tune of 40 basis points (bps).

Organic revenue growth (net revenue growth less revenue from acquisitions excluding the currency impact) was 2.7%.

Quarter Under Review

Currently, LabCorp reports under two operating segments: LabCorp Diagnostics and Covance Drug Development.

In the reported quarter, LabCorp Diagnostics reported net revenue of $1.72 billion, up 8% year over year, fueled by price, mix, tuck-in acquisitions and organic volume. The company reported 4.3% increase in total volume (measured by requisition) and a 3.8% increase in revenue per requisition in the quarter.

Covance Drug Development reported a 1.8% drop in net revenue to $690.3 million in the first quarter. This was due to slower revenue conversion from the backlog and the impact of cancellation by sponsors of two large clinical studies in late 2016 for which Covance Drug Development used to provide central laboratory services, and 150 bps negative impact from foreign currency translation. At Constant Exchange Rate (CER) net revenue declined 0.3% year over year.

Gross margin improved 106 bps to 31.8% in the quarter. Adjusted operating income increased 18.9% year over year to $345.3 million. Adjusted operating margin expanded 170 bps from the year-ago quarter to 14.3% despite a 1.2% rise in selling, general and administrative expenses to $419.4 million.

LabCorp exited the quarter with cash and cash equivalents of $365 million compared with $433.6 million at the end of 2016. Operating cash flow for the quarter was $233.8 million, up from $127.6 million in the year-ago period. Free cash flow came in at $161.6 million, significantly up from $56.2 million in the year-ago period. During the quarter, the company returned $150 million to shareholders through share repurchases and currently has $589.6 million of authorization remaining under its existing share repurchase plan.

Outlook

Based on a dull show within Covance Drug Development, the company lowered its earlier provided 2017 outlook. The guidance considers expansion of LaunchPad in this segment as well as currently anticipated capital allocation, including acquisitions, share repurchases and debt repayment.

Net revenue growth is now expected to remain in the band of 3.5% to 5.5%year over year, lowered from earlier band of 4.5−6.5%. This includes a 40 bps impact (earlier the projection was 60 bps impact) from unfavorable foreign exchange headwind resulting in constant currency revenue growth of 3.9% to 5.9% (earlier projection was 5.1% to 7.1%). The current Zacks Consensus Estimate for revenues is pegged at $9.94 billion.

Adjusted EPS guidance for 2017 has also been lowered to the range of $9.20−$9.60 ($9.35−$9.75). The current Zacks Consensus Estimate of $9.60 falls at the upper-end of the guided range.

Free cash flow expectation, however, remains unchanged in the band of $925−$975 million (up 3–9% from the prior year).

Our Take

LabCorp kick started 2017 on a mixed note. While the first-quarter earnings topped the Zacks Consensus Estimate, revenues marginally missed the mark. While LabCorp Diagnostics business was strong, Covance Drug Development provided dull numbers, dampening the overall top-line performance. According to the company, slower revenue conversion from the backlog and the impact of the cancellation by sponsors of two large clinical studies in late 2016 impacted the results. This apart, unfavorable foreign exchange continues to hamper the company’s overall results. The reduced guidance for 2017 also fails to indicate chances of respite anytime soon.

Nonetheless, we believe that with the integration of newer acquisitions, LabCorp is perfectly positioned to drive long-term profitable growth through a combination of world-class diagnostics, drug development expertise and knowledge services.

Zacks Rank & Key Picks

LabCorp currently has a Zacks Rank #4 (Sell). Better-ranked stocks in the broader Medical space include Inogen, Inc. (NASDAQ:INGN) , ZELTIQ Aesthetics, Inc. (NASDAQ:ZLTQ) and Hill-Rom Holdings, Inc. (NYSE:HRC) . While Inogen and ZELTIQ sport a Zacks Rank #1 (Strong Buy), Hill-Rom carries a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

Inogen gained 54.7% in the last one year, compared with the S&P 500's gain of 11.4%. The company reported a stellar four-quarter positive average earnings surprise of over 49.08%.

ZELTIQ Aesthetics surged 92.3% in the last one year, compared with the S&P 500's gain. Its four-quarter average earnings surprise was a positive of 12.30%.

Hill-Rom gained over 29.3% in the past one year, better than the S&P 500 mark. It posted a trailing four-quarter positive average earnings surprise of 3.1%.

Zacks’ Best Private Investment Ideas

While we are happy to share many articles like this on the website, our best recommendations and most in-depth research are not available to the public.

Starting today, for the next month, you can follow all Zacks' private buys and sells in real time. Our experts cover all kinds of trades… from value to momentum . . . from stocks under $10 to ETF and option moves . . . from stocks that corporate insiders are buying up to companies that are about to report positive earnings surprises. You can even look inside exclusive portfolios that are normally closed to new investors. Click here for Zacks' private trades >>

Inogen, Inc (INGN): Free Stock Analysis Report

Hill-Rom Holdings Inc (HRC): Free Stock Analysis Report

ZELTIQ Aesthetics, Inc. (ZLTQ): Free Stock Analysis Report

Laboratory Corporation of America Holdings (LH): Free Stock Analysis Report

Original post

Zacks Investment Research