Knight-Swift Transportation Holdings Inc.’s (NYSE:KNX) fourth-quarter 2019 adjusted earnings (excluding 16 cents from non-recurring items) of 55 cents beat the Zacks Consensus Estimate of 51 cents. However, the bottom line plunged 40.9% year over year due to persistent weakness in the freight environment and overcapacity of trucks in the market. Additionally, total revenues of $1,196.8 million lagged the consensus mark of $1,225.8 million and also decreased 14.2% year over year with sluggish revenues at each of its three segments.

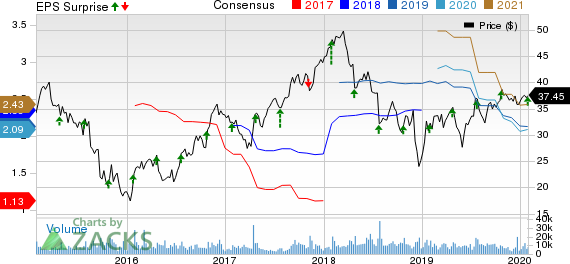

Despite this weak show, the company’s 2020 earnings guidance found favors with investors. Consequently, the stock gained 3.6% at the close of business on Jan 29. For the full year, adjusted earnings per share are anticipated to be $2-$2.15 (the midpoint 2.08 of the guided range lies marginally below the Zacks Consensus Estimate of $2.09). The company’s commentary that the freight environment is likely to improve in the second half of 2020 owing to capacity rationalization and other factors might have also boosted the stock. Even though the freight scene remains competitive, Knight-Swift believes that “evidence of capacity rationalization is mounting”.

Coming back to the fourth-quarter results, effective tax rate came in at 27.2% compared with 25% in the fourth quarter of 2018. For 2020, the same (before discrete items) is expected to be 25.5-27%.

From the first quarter of 2019 onward, the company started reporting under three segments, namely Trucking, Logistics and Intermodal following the realignment of its segments.

Segmental Results

Revenues in the Trucking segment totaled (excluding fuel surcharge and intersegment transactions) $861.43 million, down 11.2% year over year. Results were hampered by 10.6% decrease in average revenue per tractor (miles per tractor declined 5.4% in the quarter). Adjusted segmental operating income also dropped 35.8% to $118.95 million. Adjusted operating ratio (operating expenses as a percentage of revenues) deteriorated 530 basis points (bps) to 86.2% in the quarter under discussion. Notably, lower value of this key metric bodes well for the company.

Revenues in the Logistics segment (before intersegment transactions) amounted to $92.76 million, down 30.2% year over year due to 30.8% decline in brokerage revenues. While adjusted operating ratio deteriorated 360 bps to 93%, segmental operating income slumped 53.8% to $6.49 million.

Revenues in the Intermodal segment (excluding intersegment transactions) totaled $111.82 million, dropping 18.7% year over year as a result of 9.4% fall in load counts. Segmental adjusted operating ratio came in at 99.5%, deteriorating 910 bps while operating income contracted 95.4% to $0.6 million.

Operating Results

Total operating expenses decreased 7.6% year over year to $1.1 billion. Adjusted operating ratio (defined as operating expenses as a percentage of revenues) deteriorated to 87.8% from 82.5% in the year-ago quarter. Knight-Swift’s adjusted operating income declined 40.5% year over year to $131.97 million due to excess truck capacity amidst the soft freight environment and intense competition in the intermodal market.

Liquidity

This Zacks Rank #5 (Strong Sell) company exited the fourth quarter with cash and cash equivalents of $159.72 million compared with $82.49 million at the end of 2018. The company did not have any long-term debt (less current portion) as of Dec 31, 2019. During 2019, it repurchased shares worth $86.9 million and retuned $41.4 million to shareholders through dividends.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Outlook

For the first quarter of 2020, adjusted earnings per share are estimated between 35 cents and 38 cents compared with 42-46 cents expected earlier. The Zacks Consensus Estimate for the same stands at 40 cents.

For 2020, capital expenditures are predicted to be $550-$575 million with investments primarily in replacing the existing tractors and trailers as well as in terminal network and driver amenities.

Upcoming Releases

Investors interested in the broader Transportation sector are keenly awaiting fourth-quarter earnings reports from key players, namely Old Dominion Freight Line, Inc. (NASDAQ:ODFL) , Air Lease Corporation (NYSE:AL) and Copa Holdings, S.A. (NYSE:CPA) . While Old Dominion will release earnings numbers on Feb 6, Copa and Air Lease will announce the same on Feb 12 and Feb 14, respectively.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Copa Holdings, S.A. (CPA): Free Stock Analysis Report

Air Lease Corporation (AL): Free Stock Analysis Report

Knight-Swift Transportation Holdings Inc. (KNX): Free Stock Analysis Report

Old Dominion Freight Line, Inc. (ODFL): Free Stock Analysis Report

Original post

Zacks Investment Research