This post has to do with something which may seem like an oxymoron: integrity in financial prognostications. What inspired me to address this topic? Oh, that’s easy:

As you can see, back on February 22nd, Dennis “Commodity King” Gartman went on CNBC to declare that, at long last, for the first time in about five years, he was bullish on crude oil.

Savvy traders jumped on this and, knowing Gartman’s tendency to generate reputational pratfalls, shorted the bejesus out of crude oil and were richly rewarded for it. But this is not about Gartman’s well-documented tendency to, shall we say, not have a perfect record. It has to do with this “five years” nonsense.

I’m not sure if Dennis thinks (1) we’re all really stupid or (2) we don’t have access to this here newfangled “Internet” thing, but it would only take a kindergarden student about 7 seconds to completely refute the aforementioned assertion. I offer Exhibit A:

So as you can see, in October 2015, Gartman declared himself the “most bullish I’ve ever been on crude”. My arithmetic skills are strong enough to know that February 2017 minus five years is long, long before October 2015.

(I would feel remiss if I didn’t take the opportunity to also point out that October 2015 preceded one of the most calamitous collapses in the history of crude oil, so once again, the contra-signal was money in the bank. Anyway, back to our regularly-scheduled program)

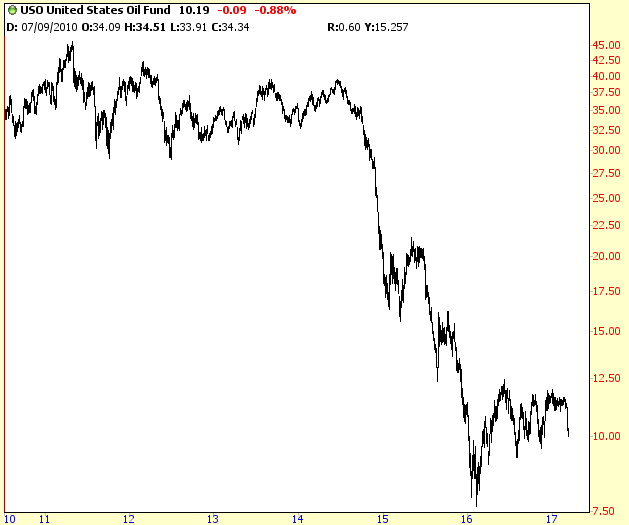

Now I can understand why someone would want you to think they’d been bearish for five solid years. After all, the past five years of crude oil looked like this:

So let’s just pretend that some person had indeed been persistently bearish on crude oil for this stretch of time, and then, just recently, he declared himself bullish. I’d sit up and take notice. After all, if someone is correct for five solid years, and then he has a different opinion, that’s worthy of attention.

But the claim of February 22nd was nothing short of insulting to the viewing public.

I would also add this is far from the only time such a thing has happened. i wrote a blow-by-blow account of a hilarious interaction Dennis had with the delicious Melissa Lee shortly after the October 2015 “never more bullish” when he tried to completely backpedal his story. And a month before that, I did a similar piece on some other yammerings of his.

This isn’t about Dennis being wrong Lots of us are wrong. Hell, I’ve been wrong more times than I can count. But the key difference is as follows:

(a) I would never permit myself being called, for instance, “The Equity King”, since it’s misleading and disingenuous;

(b) I would not claim on national television that I had been bullish equities for the past five years, since i absolutely have not, and, you know, there’s that whole “honesty” business;

(c) And, least important, if i was greeted with the salutation, “It’s good to see you”, I wouldn’t be such a dweeb as to offer back, “It’s good to be seen”, particularly since it wasn’t that funny the first 372 times I said the goddamned thing.

I don’t expect anything to change, but I had to get that off my chest. For the shrewd among us, Mr. G is an invaluable arrow in our quiver of trading tools. However, I think it’s simply immoral to throw unmitigated horseshit at the public since some of them might not know any better.