Stock bulls historically like to see junk bonds moving higher yet worry when they are weak. Some view junk bonds as a leading indicator to where stocks are headed. Others get concerned for stocks when junk bonds reflect a negative divergence to stocks and get aggressive in stocks when a bullish divergence in junk-to-stocks takes place.

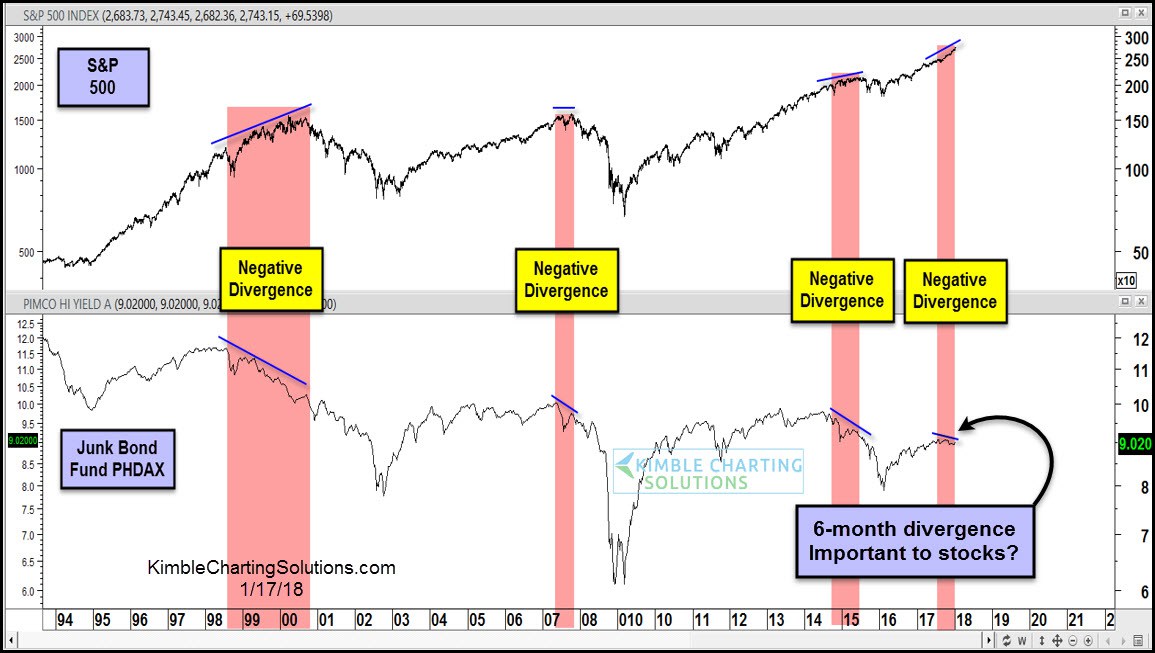

Below compares PIMCO Junk Bond Fund to the S&P 500 over the past 20 years. I like to monitor this fund because it has a much longer track record than junk ETF’s JNK and HYG.

Next month I am celebrating my 38th year in the business. Junk bonds first became important to me in the late 1990s as they started diverging against the S&P 500 in late 1998. They became a great leading indicator of the weakness in store for stocks.

The chart above looks at a couple of other times when “negative divergences” took place, as PHDAX was creating lower highs, while the S&P 500 was creating higher highs.

Over the past 6 months, a small negative divergence has been taking place, as PHDAX has created lower highs, while stocks continue to head higher. This small divergence doesn’t prove a thing, so far. If junk continues to show a negative divergence, it could be sending a caution message to the overall market.

If junk continues to diverge and the NYSE Advance/Decline line also diverges, which it isn’t doing at this time, then I would be concerned that junk is sending an important message to stock bulls.