Junior miners may soon suffer a breakdown of the short-term support line. So, what’s responsible for their underperformance of gold and stocks?

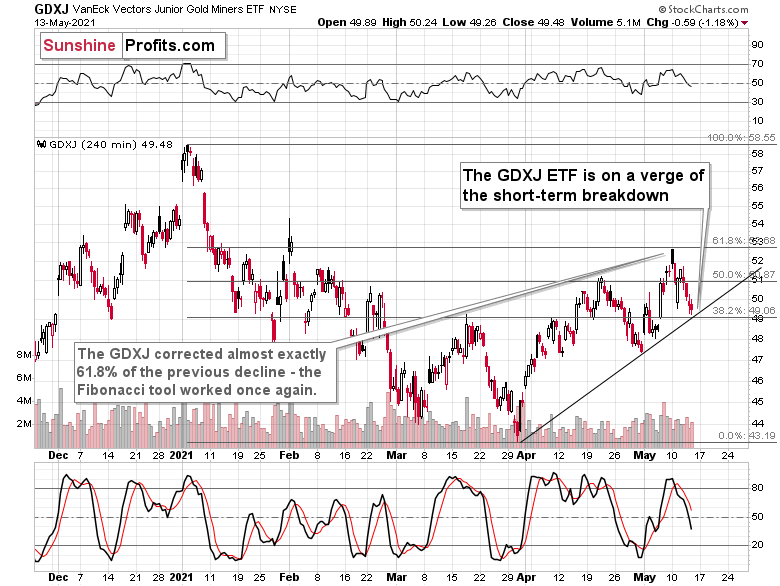

Today’s technical part of the analysis is going to be brief, as I have discussed multiple things this week and my comments remain up-to-date. There’s not much to add today, and we’ll go over only one technical chart – the one where we have trading positions – the VanEck Vectors Junior Gold Miners ETF (NYSE:GDXJ) chart. Unlike in the previous days, today I’m going to look at it from the more short-term point of view – through the four-hour chart.

Before looking at it, please note that yesterday’s (May 13) session was relatively boring in the case of gold futures (they ended the day $1.20 higher), and quite positive for the GLD (NYSE:GLD) ETF, at least at first sight, as it closed $0.70 higher. The seemingly odd discrepancy between the two is just a result of different times that are taken into account for calculating both markets’ performance. All in all, yesterday’s session was positive for gold.

The S&P 500 index ended yesterday’s session 1.22% higher. At face value, this seems positive. Technically, it was just a comeback to the previously broken lows (mid-April and early May ones), which was followed by a small move lower before the end of the day, so from this point of view, this session was bearish.

Taking day-to-day price changes, though, yesterday’s session was positive for both: gold and the general stock market. Consequently, the GDXJ ETF should have rallied as its price is generally influenced by both. And what actually happened?

The GDXJ ETF declined by 1.18%.

This is an extremely bearish short-term sign as its obvious that exactly the opposite happened to what was actually supposed to happen. The most likely reason? Junior miners simply can’t wait to decline.

Junior mining stocks (the GDXJ ETF is often used as a proxy for them) declined to their rising short-term support line yesterday and ended the session close to it. There was no breakdown, but given the weak trading performance compared to gold and stocks, it seems that we won’t have to wait for it to materialize.

And speaking of relative performance – it’s not just the day-to-day performance. Yesterday’s intraday low in the GDXJ ETF was just one cent above the intraday March high. For comparison, gold’s intraday low yesterday was over $50 above its intraday March high. And the S&P 500 was 91.12 index points (over 2%) above its intraday March high.

My May 11 comments on the additional reason behind juniors’ weakness remain up-to-date:

But what about juniors? Why haven’t they been soaring relative to senior mining stocks? What makes them so special (and weak) right now? In my opinion, it’s the fact that we now – unlike at any other time in the past – have an asset class that seems similarly appealing to the investment public. Not to everyone, but to some. And this “some” is enough for juniors to underperform.

Instead of speculating on an individual junior miner making a killing after striking gold or silver in some extremely rich deposit, it’s now easier than ever to get the same kind of thrill by buying… an altcoin (like Dogecoin or something else). In fact, people themselves can engage in “mining” these coins. And just like bitcoin seems similar to gold to many (especially the younger generation) investors, altcoins might serve as the “junior mining stocks” of the electronic future. At least they might be perceived as such by some.

Consequently, a part of the demand for juniors was not based on the “sympathy” toward the precious metals market, but rather on the emotional thrill (striking gold) combined with the anti-establishment tendencies ( gold and silver are the anti- metals, but cryptocurrencies are anti-establishment in their own way). And since everyone and their brother seem to be talking about how much this or that altcoin has gained recently, it’s easy to see why some people jumped on that bandwagon instead of investing in junior miners.

This tendency is not likely to go away in the near term, so it seems that we have yet another reason to think that the GDXJ ETF is going to move much lower in the following months – declining more than the GDX (NYSE:GDX) ETF. The above + gold’s decline + stocks’ decline is truly an extremely bearish combination, in my view.