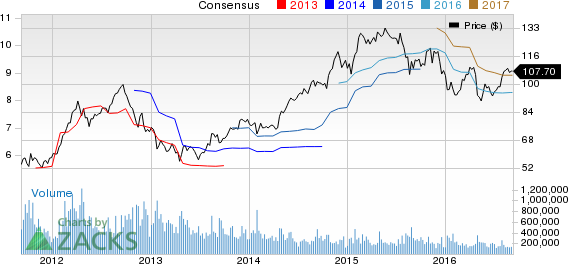

Shares of John Wiley & Sons Inc. JW.A fell 6.8%, as the company released dismal results for the first quarter of fiscal 2017, wherein both top and bottom lines declined year over year, alongside lagging our estimates.

The company’s adjusted earnings per share of 52 cents plunged 10.3% year over year and fell significantly short of the Zacks Consensus Estimate of 61 cents. The bottom line was primarily hurt by soft revenues and higher technology costs.

Further, the company reported revenues of $404.3 million, which missed the Zacks Consensus Estimate of $423.7 million, apart from dropping 4.4% on a year-over-year basis. While revenues improved at the Research segment, Education and Professional Development’s revenues were drab. Notably, the company’s revenues have lagged the Zacks Consensus Estimate in six out of the past seven quarters.

On a constant currency (cc) basis, adjusted earnings fell 9% year over year while revenues slipped 2%. Including one-time charges, earnings per share of 53 cents dropped 3.6% year over year.

Adjusted operating income came in at $42.9 million, down 11.2% (declining 9% at cc) from the year-ago quarter. Also, adjusted operating margin contracted 80 basis points to 10.6%.

Segment Details (at cc)

Research: The division’s adjusted revenues of $234.4 million climbed 2% year over year, fueled by a rise in Journal Revenue, somewhat offset by a drop in Books and References revenue. The segment’s adjusted direct contribution to profit was $106.4 million that increased 2% from last year. After accounting for shared services and administrative expenses, the division’s adjusted contribution to profit was $63.2 million, flat with the prior-year quarter. Further, on ruling out the favorable impact of time-based subscriptions, the division’s adjusted contribution to profit went down by 6%.

Education: Revenues at the division declined 14% to $73.8 million, as dismal Books and Custom Material revenues could not be compensated by strength noted in Online Program Management. Adjusted direct contribution to profit by the division slumped 23% year over year to $17.7 million. In addition, contribution after allocating shared services and administrative expenses was a loss of $1.9 million, against the year-ago profit of $5 million.

Professional Development: Revenues dropped 2% year over year to $96.1 million, owing to lower Books revenues, partly compensated by growth in Corporate Learning, Online Test Preparation and Assessment revenues. The division’s adjusted direct contribution to overall profit was nearly $40.2 million, down 1% year over year. Adjusted contribution to profit after allocating shared services and administrative expenses improved 7% from the year-ago quarter to nearly $20 million.

Other Financial Details

The company ended the quarter with cash and cash equivalents of $185.9 million, inventories of $54.8 million, and long-term debt of $653 million. The company recorded shareholders’ equity of $1,016.4 million in the quarter under review.

John Wiley, which shares space with Pearson (LON:PSON) plc (NYSE:PSO) and Thomson Reuters Corporation (TO:TRI) , used free cash flow of $165.5 million in the first quarter of fiscal 2017, compared with $154.6 million used in the year-ago period. Management stated that the free cash flow is usually negative in the first quarter, owing to the cash collection timings for journal subscriptions that occur on an annual basis.

Nevertheless, the company bought back 221,305 shares for $11.3 million in the reported quarter, leaving more than 4.5 million shares pending under the standing authorization. Apart from this, John Wiley declared a 3.3% hike in its quarterly cash dividend, to 31 cents per share. Notably, this marks the company’s 23rd annual dividend hike in a row.

Other Developments

John Wiley penned a deal to acquire California-based Atypon for nearly $120 million. This publishing-software and service provider helps publishers and scholarly societies to improve, provide, advertise and handle their content online. Atypon, which generated revenue of more than $31 million in 2015, is expected to be acquired by Oct 1, 2016.

Outlook

Concurrent with the earnings release, John Wiley reiterated its previously announced fiscal 2017 guidance. The company still expects earnings to be down by mid-single digits and revenues to be flat on a year-over-year basis, excluding foreign exchange, the favorable impact from the shift to time-based journal subscription agreements and impact from Atypon’s buyout. Moreover, the impact of the shift to time-based journal subscriptions will boost revenues and earnings by nearly $37 million and 42 cents per share, respectively.

Zacks Rank

John Wiley carries a Zacks Rank #3 (Hold). A better-ranked stock in the Consumer Staples sector is Castle Brands Inc. (NYSE:ROX) , with a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

Confidential from Zacks

Beyond this Analyst Blog, would you like to see Zacks' best recommendations that are not available to the public? Our Executive VP, Steve Reitmeister, knows when key trades are about to be triggered and which of our experts has the hottest hand. Click to see them now>>

THOMSON REUTERS (TRI): Free Stock Analysis Report

PEARSON PLC-ADR (PSO): Free Stock Analysis Report

CASTLE BRANDS (ROX): Free Stock Analysis Report

WILEY (JOHN) A (JW.A): Free Stock Analysis Report

Original post

Zacks Investment Research