The Japanese yen has posted slight gains on Tuesday. In the North American session, USD/JPY is trading at 129.32, up 0.17% on the day.

The US dollar pummeled the yen in the months of March and April, but the yen has held its own in May. Still, USD/JPY remains at high levels and the 130 line, which has psychological significance, remains vulnerable. If there is a line in the sand for the Japanese government or the BoJ to intervene and prop up the yen, it certainly is not the 130 level, as the dollar broke through this line without a response. The yen is extremely sensitive to the US/Japan rate differential, and with the BoJ demonstrating that it will tenaciously defend its yield curve, the yen is at the mercy of Powell & Co.

Japan releases GDP for Q1 on Thursday. The markets are braced for a decline of 0.4%, after a respectable gain of 1.1% in Q4 of 2020. Investors never like to see negative growth, and a lower-than-expected GDP report will put downward pressure on the yen.

US Retail Sales Within Expectations

Over in the US, retail sales for April came in at 0.9%, just shy of the consensus estimate of 1.0%. Core retail sales rose 1.0%, above the forecast of 0.7% and close to the 1.1% gain in March. The numbers were not spectacular by any stretch, but were respectable, given that consumer confidence has weakened – the UoM Consumer Sentiment index fell to 59.42 in May, its lowest level since October 2011. US households continue to spend, despite a deterioration in consumer confidence. Wages are not keeping up with the cost of living, but consumers appear to be using savings which accumulated during the Covid pandemic.

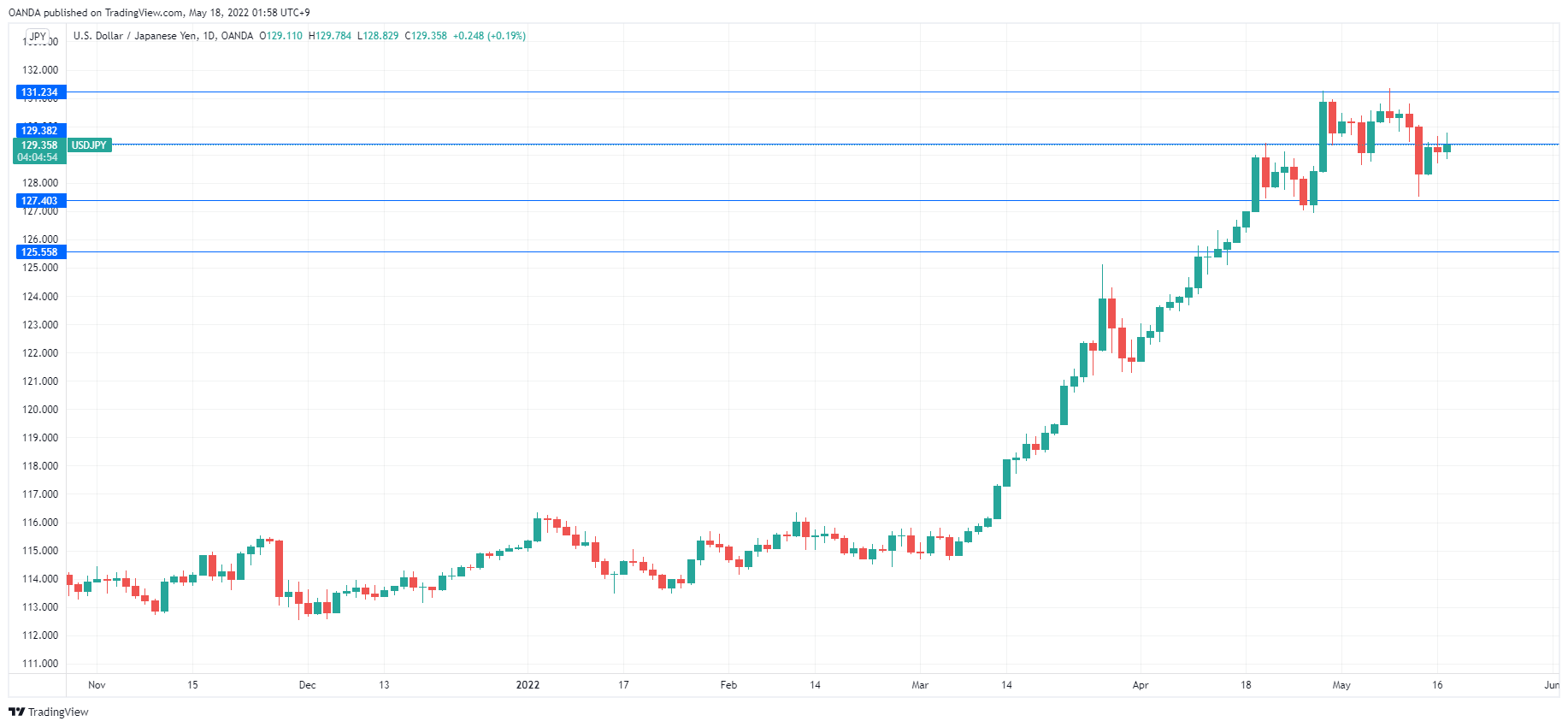

USD/JPY Technical

- USD/JPY is testing resistance at 1.2938, followed by resistance at 1.3123

- There is support at 1.3000 and 1.2918