Talking Points:

- Australian, New Zealand Dollars Tumble as Chinese Trade Data Disappoints

- Bets on China Stimulus Boost May Fuel Risk-On Sentiment, Send Yen Lower

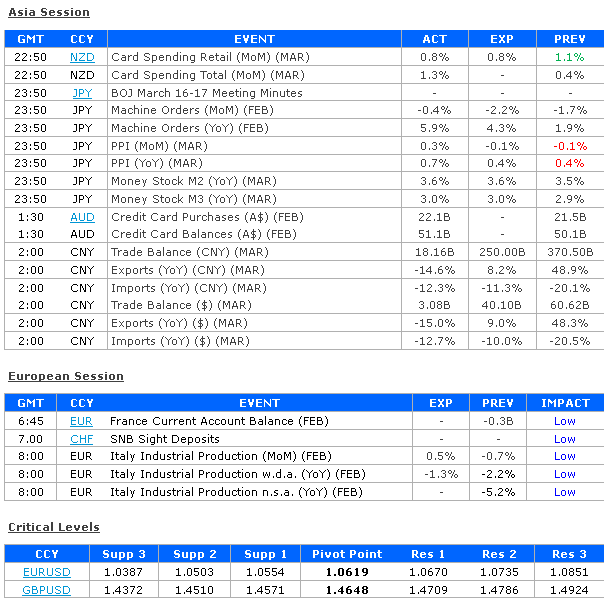

The Australian and New Zealand Dollars underperformed in overnight trade, falling as much as 1.0 and 0.86 percent on average against their leading counterparts. The selloff followed a disappointing set of Chinese Trade Balance figures that showed exports slumped 15 percent year-on-year in March, falling dramatically short of expectations calling for a 9 percent increase and yielding the largest drawdown in over a year.

China is Australia and New Zealand’s largest trading partner. A slump in the East Asian giant’s overseas sales points to ebbing demand for raw materials from the two Oceanic countries, warning of mounting headwinds to economic growth. That in turn has scope to translate into interest rate cuts from the RBA and the RBNZ. Indeed, the overnight slide in the Aussie and Kiwi Dollars played out alongside down moves on the two countries’ benchmark 2-year bond yields, pointing to building stimulus expansion bets.

Looking ahead, a quiet economic calendar in European and US trading hours is likely to see risk sentiment trends in charge of price action. The Shanghai Composite and Hang Seng Index stock benchmarks moved conspicuously higher after the dismal Chinese trade data, hinting investors may have interpreted the outcome to mean that Beijing will see the slump as a trigger to top up stimulus measures. The prospect of expanded policy support in the world’s second-largest economy may fuel broader risk-on sentiment later in the day, trimming Aussie and Kiwi losses while applying pressure to the safety-linked Japanese yen.