Research Highlights:

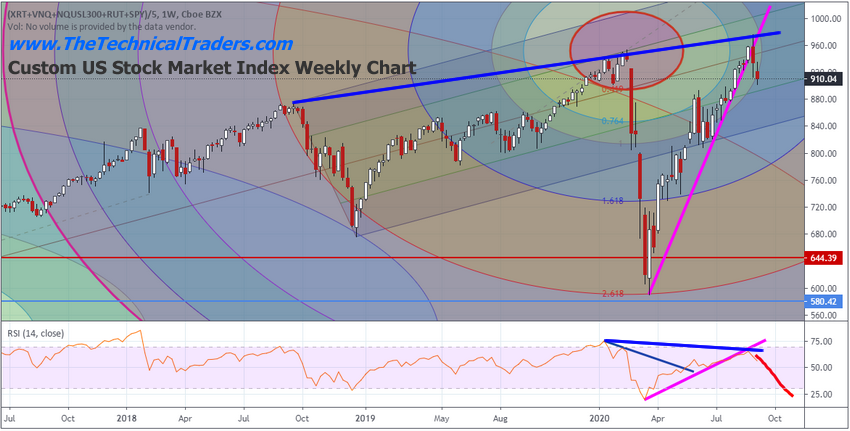

- Although our modelling systems have recently switched into bullish trending mode, we are still very cautious of a bull trap pattern.

- Bearish technical divergences between price and RSI with an election 50+ days away indicates market weakness and money rotating out of FAANG stocks. FAANGs are at make-or-break levels – it's time to act not react.

- 11% to 22% price rotation ranges are in play – are you ready?

My research team recently highlighted the current market trend setup over the past few weeks as cautiously bullish while watching for a potential bull-trap setup. We have been warning our followers of the risks associated with a presidential election year event as well as the continued disconnect between the market rally and the real-world economy. These next few days and weeks will make or break the markets, so we encourage you to pay attention to this article.

Fasten Your Seat Belts – We're About To Go For A Ride

Although our longer-term proprietary price modelling systems have switched into bullish trending mode, we are still very cautious of a bull trap pattern in the markets. This happens when price attempts to rally beyond recent high price levels (previous peaks) and stalls. It becomes a bull trap when price accelerates beyond the previous highs on moderate volume – pulling in unsuspecting traders who think this new price high is a breakout upside trend.

In many cases, when price rotation ranges are rather muted and volatility is lower, a breakout of a previous high is technically a bullish trending signal. When price range rotation is extreme and volatility is high, it can become a trend trap for unsuspecting traders. When we add the typical election year price consolidation factors, which we've been attempting to clearly illustrate for our followers over the past 16+ months, we start to get a setup that more closely resembles a bull-trap than a breakout trend.

If you have not been following our research over the past few weeks, please take a moment to review the following research posts from our research team, including:

Sept. 6: Traders' Dreams Come True – Big Technical Price Swings Pending On S&P 500

Sept. 2: SPX To Gold-Silver Ratios Explored - What To Expect Next

Sept. 1: Are FANGs Going To Breakdown Soon?

We believe the next five to 10 trading days will be a make-or-break event for the markets. Very clear support has set up in the FAANG Index and our Custom U.S. Stock Market Index has set up a very clear technical divergence pattern after reaching a new price high. Either support will hold near current price levels and the U.S. stock market will continue to rally higher or a big breakdown in price will setup, which may prompt an 11% to 16% downside price correction. This is why my research team has continued to push the “cautiously bullish” term and highlighted the potential for the bull-trap pattern over the past 30+ days.

Our research from June 1, 2020, also highlights how Election Year Cycles affect the markets:

“Currently, we are urging our friends and followers to stay overly cautious of this upward price trend in the U.S. stock markets. Even though we have seen the Nasdaq 100 and other sectors rally to near all-time highs, we believe the markets are still excessively volatile and the indecision leading up to a presidential election cycle could prompt some really big price moves in the future. We are still trading the long side of the market and advising our clients to take very low-risk trades which have been properly sized. This is a traders market, where skilled technical traders can find incredible gains.

June through August will likely become critical in regards to the future price trends and will likely determine if the markets continue to push higher or rotate downward as concerns and potential crisis events continue to unfold. Historically, June through August prior to a Presidential election cycle are very important measures of what happens near and after the election event.”

Be sure to sign up for our free market trend analysis and signals now so you don’t miss our next special report!

Skilled technical traders should be concerned with risks at all times. The VIX is currently trading near 27. Historically, VIX levels below 15 have been considered “moderate/low volatility levels.” The current VIX level suggests volatility levels are, at a minimum, two times historically moderate levels.

The downward price rotation in the Technology and NASDAQ sectors over the past 10+ days sets up a nearly perfect bull-trap pattern. The technical divergence between price highs and the RSI adds another layer of technical confirmation to the bull-trap setup. This leaves us with a make or break scenario where current support must hold in order for any further upside price activity to continue – otherwise, we are looking at a technical breakdown in price.

Our Custom FAANGs Index chart, below, highlights a similar RSI technical divergence pattern as well as clearly shows the support level (the GREEN LINE) we believe is the active floor in price levels. If the FAANGs Index finds support above 900 and executes a “washout low” price rotation above the 900 level, we may see another upward price leg take place in the near future. Otherwise, if the FAANGs Index breaks downward and breaches the 900 level, we believe the 750 level, the peak before the COVID-19 collapse, becomes a very real target.

Headed into the last 50+ days before the U.S. presidential election event, uncertainty and concern related to future policy, tax rates, social unrest and other issues permeate investors sub-conscience. We may not believe it to be true, but many skilled technical traders are already thinking about and considering “what's next” in relation to the next 5+ months. Remember, the election takes place on Nov. 3, but the transitional process is typically not completed until after Jan. 21 or so. Therefore, we are looking forward to at least 5+ months of potentially extreme volatility and potentially large price rotations.

In closing, we urge all skilled technical traders to sit back, take a real hard look at these setups and prepare for what may become a very active few weeks and months of trading and price volatility. One way or another, the U.S. stock markets will either resume the upward price trend or break lower because of this technical bull-trap pattern. The opportunities lie in properly positioning, hedging and allocating capital effectively to take advantage of these big setups.