The entire point of leveraged positions is the margin of safety. That is true on both sides of that equation, as for the provider and the borrower/user. In the most famous examples of collapse, from American International Group Inc (N:AIG) to LTCM losses were never really the issue. None of them could withstand instead collateral calls to their liquidity reserves. As noted last week, AIG’s “toxic waste” positions ended up registering some $20 billion profits to the Federal Reserve and the government via its (illegal) Maiden Lane SIV’s. AIG just could not withstand the liquidity demands brought about by increasing calculated volatility.

Another famous episode offers the same interpretation while providing some further insight into the world of leverage and liquidity as it exists now. Orange County went into bankruptcy with assets that were all still money good. The county’s investment fund, run by Robert Citron, was holding paper from mostly government agencies and even UST’s. Out of the nearly $20 billion in the fund close to its demise, $16.7 billion was UST’s, agency fixed rate bonds, agency floating rate bonds, CD’s and commercial paper. The problem was the combination of the floating rate FNMA’s and that the fund was increasingly leveraged as Citron’s bets were further imperiled.

Throughout the early 1990’s, Orange County’s fund was handsomely beating every benchmark. So much so that municipalities throughout the county were beating down Citron’s door in order to invest in his magic; some cities, such as Irvine, even borrowed through bond offerings just to make available cash to put in. S&P, as the bankruptcy transcript tells, even conditioned its highest investment rating on Irvine’s bonds such that they were placed in Citron’s “care.”

The manner of the outperformance was as it usually is in modern wholesale finance; available and easy leverage of all kinds and all forms. In this specific instance, Citron was building the fund’s bond portfolio not for general coupon returns but so that they were available for reverse repos. When the interest rate environment was in his favor, the Orange County fund was leveraged less than 2 to 1; when it started turning against, that was when the leverage piled up as almost a gambler’s view of doubling down to “make it back.”

As it turned out, even though Citron’s broker Merrill Lynch had warned him about both the increasing volatility risk of an increasingly homogenous portfolio and that interest rates might rise, Citron continued on his course regardless of the advice (and Merrill kept selling securities to him and funding those positions). Later grand jury proceedings even found evidence that Mr. Citron was using a “mailorder astrologer and a psychic for interest rate predictions.” He was, starting in 1994, quite wrong with those predictions.

Still, the fact that rates had gone up even sharply did not alone produce catastrophe; there were no losses to book based on credit defaults or skipped coupons in any of the underlying. The “inverse floaters” at the center of the controversy were simply designed as a mechanism for FNMA to reduce or hedge its own funding costs in the event of conditions just the kind produced by the Fed’s rate hikes in 1994.

The inverse floating rate notes integral to Citron’s strategy for leveraged outperformance were agency coupon bonds that reset them regularly by LIBOR. In December 1993, the fund held approximately $100 million inverse FNMA floaters maturing in 1998, offered in reverse repo to Credit Suisse (VX:CSGN) First Boston as collateral on $100 million funding (I haven’t seen anywhere descriptions of any haircuts, so it may just be or have been assumed 1 to 1). That was not the full extent of the leverage, as the bonds were repledged to total something like 3 to 1 leverage in other funded positions. All told, there were about $800 million in FNMA floaters that spearheaded the fall from grace.

The coupon of the floaters varied inversely to the volatility of LIBOR. The coupon rate is set as the initial payment rate minus some LIBOR spread, meaning that any increase in LIBOR reduces the coupon payments. For FNMA, it is funding protection; for Orange County and Citron, the bonds paid typically a much higher initial rate and in some cases might increase (up to a preset ceiling). The lowest possible rate was, conversely, 0%.

Because of this structure, the convexity of the bond is enormous, particularly when compared to the change in value of any fixed rate investment. In January 1993, the coupon on the FNMA 1998’s was 8.25%, but by 1994 the coupon rate was cut all the way to 2.3% and perhaps, via volatility calculations, on its way to zero. That didn’t mean that the bonds would default as they were agency paper, only that the current value of them would fall precipitously with the reset coupons being so far below the “market” interest rate.

If there had been no leverage involved, Citron’s run as something of a “guru” would have ended but at least not in a prison sentence; it would have continued in underperformance but absent loss as at maturity, in every underlying bond, principal would have been returned in full. As it was, given the repos, the current values of the securities pledged as collateral matters more than whether those prices actually mean credit losses or not. The more “sensitive” to changes in prices the larger the adjustments that will be made as volatility rises. For Orange County, the floaters that were pledged in reverse repos meant collateral calls and then eventually collateral seizure when prior demands for additional collateral were not met. Bankruptcy was the only means to stop the seizures (it was alleged), and even then banks viewed it within their rights to liquidate what they could at current (depressed) prices.

Thus the huge losses for Orange County were really produced because the fund could no longer fund itself; once liquidated, the assets were about $1.64 billion less than total liabilities including the nearly 3 to leverage employed near the end. For the overall fund of $20 some billion, even then $1.64 billion isn’t huge except that the underlying “equity” was just $8 billion.

It is not just a tale of woe and a lesson about the nature of leverage, it speaks to the nature of the whole idea of wholesale finance. Banking is no longer about lending and boring loans, it is about leveraged spreads and leveraged capital and leveraged capacity. When leverage is plentiful and in all types, there is great profit on all sides; from those doing the “investing” to those providing the funding and the advice. That is what built the eurodollar system before August 2007, the idea of plentiful leverage not just in repos and funding, but also in capital ratios and regulatory leverage provided by accounting rules (gain-on-sale for one) and math-as-money. The major conduit through which it all flowed was proprietary trading, where banks would mingle all sides of the leverage equations – as “investors” holding securities (in warehousing) and then testing the line of what might count as “hedging” those positions (which so often drew into outright speculation).

With all these avenues for profit available, it was simply accepted (and modeled in ridiculously low volatility) that it would continue forever and ever. And if recession were to result and interrupt the leverage festival, it was assumed the “Greenspan put” would work enough to keep it mild and temporary as was the case in 2001 (stocks may have suffered, but even the credit cycle did not interrupt the mortgage boom and eurodollar “hot money” pushing into every EM with access to the global financial network). It was the fatal flaw in the whole thing, assuming little or no volatility.

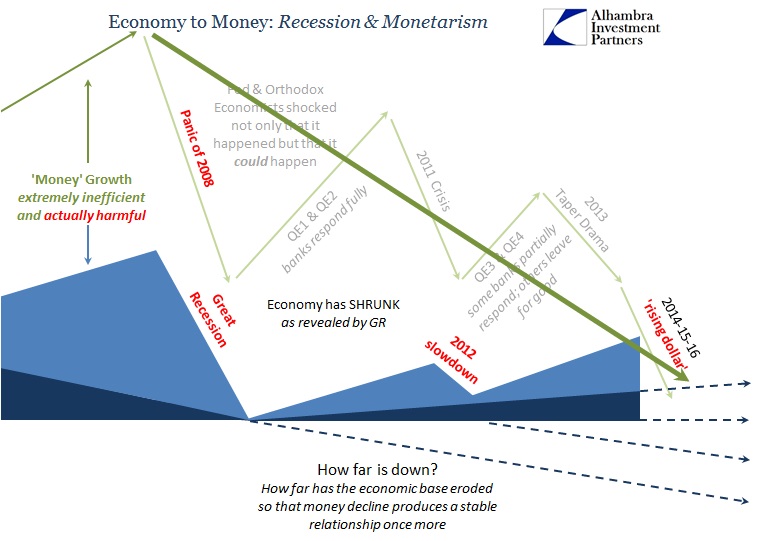

Without free flowing leverage on all sides, money dealing profits simply dried up. Banks have tried to make the most of it in the various QE’s and intermittent circumstances, but for the most part the world as it existed before 2008 just cannot be rebuilt. Again, it wasn’t losses so much as math (recalculated, post-crisis, volatility and “capital” efficiency that systemically sapped leverage capacity especially as reinforced by the events of 2011). It was, like Citron’s game, all an illusion based upon “perfect” circumstances that will never be repeated. It might have been possible had a real recovery started after the Great Recession was over, given enough time of a full and robust fundamental rebound, but as I wrote yesterday, that, too, was an illusion predicated on the lie of orthodox economics and the Phillips Curve view of economic potential.

Without leverage there is no money dealing, and without money dealing there will only be increasing volatility (leading to less leverage and so on). Some banks, such as United Bankshares Inc (O:UBSI) and Wells Fargo (N:WFC), worked that out early on; others, like Deutsche Bank (DE:DBKGn) AG NA O.N. (N:DB), Credit Suisse Group AG (N:CS) and Goldman Sachs (N:GS), saw the potential rebirth of pre-crisis wholesale in Bernanke’s/Yellen’s fairy tale ending for QE and ZIRP. Like Citron’s psychically-derived interest rate forecasts, it was just a terrible idea and all the more so as leverage conditions have only worsened and worsened.

The difference now is, obviously, that EM debt and US corporate junk (including leveraged loans) are the center of the current and gathering liquidity storm. We might likely never know exactly what those banks have been doing, but through examples like American International Group Inc (N:AIG) and Orange County Bancor (OTC:OCBI) we can see the destructive capacity and potential of volatility no matter if ever the credit cycle truly blasts apart this time – it is never losses that do it; it is illiquidity and lack of margin of safety. In the case of these particular banks though, there is a ready feedback that plays directly into quickening the process – they are both leveraged in their holdings and activities but also suppliers into those “dollar” conduits. It’s as if Orange County were not just reverse repo counterparty borrowing cash for its own portfolios but also then providing a good part of that cash or financial resources to the next guy. That is really what scared the Fed and the Treasury in 2008 into TBTF; which, of course, has only gotten worse over the intervening years.

I think that explains somewhat the trajectory of the eurodollar decay past the panic; that initially leverage restraint (including and especially collateral shortage) as compared to pre-crisis meant the downward baseline to begin with. Since 2013, increased volatility has only quickened that pace in the same manner as we have seen in all sorts of prior episodes. Again, some firms instead doubled down and are being undressed especially recently, which will only make it all the more difficult further on.

Restoring the eurodollar system as it was just wasn’t possible. That is why the collapse in oil and commodities is especially relevant as a signal about leverage and hidden liquidity capacity that otherwise goes unnoticed. The “thing” that made the eurodollar appear to work and work so well (at least as it was rapidly expanding to ridiculous proportions, in both quantitative and qualitative terms) were these artificial channels of leverage flow and capacity; the same kinds of ideas and “products” that made Robert Citron a hero are no different than what eurodollar banks had been up to all throughout their structures before the final reckoning in 2008. That might be the most important point about unwieldy and unconstrained leverage, that there is always an endpoint and then the cleanup.

Unfortunately, we remain stuck in the cleanup phase so long as economists and their ability to direct policy continue to suggest the Great Recession was anything other than systemic revelation along these lines; a permanent rift between what was and what can be. It is and was never about oil; only now that oil projects volatility into the dying days of eurodollar leverage.