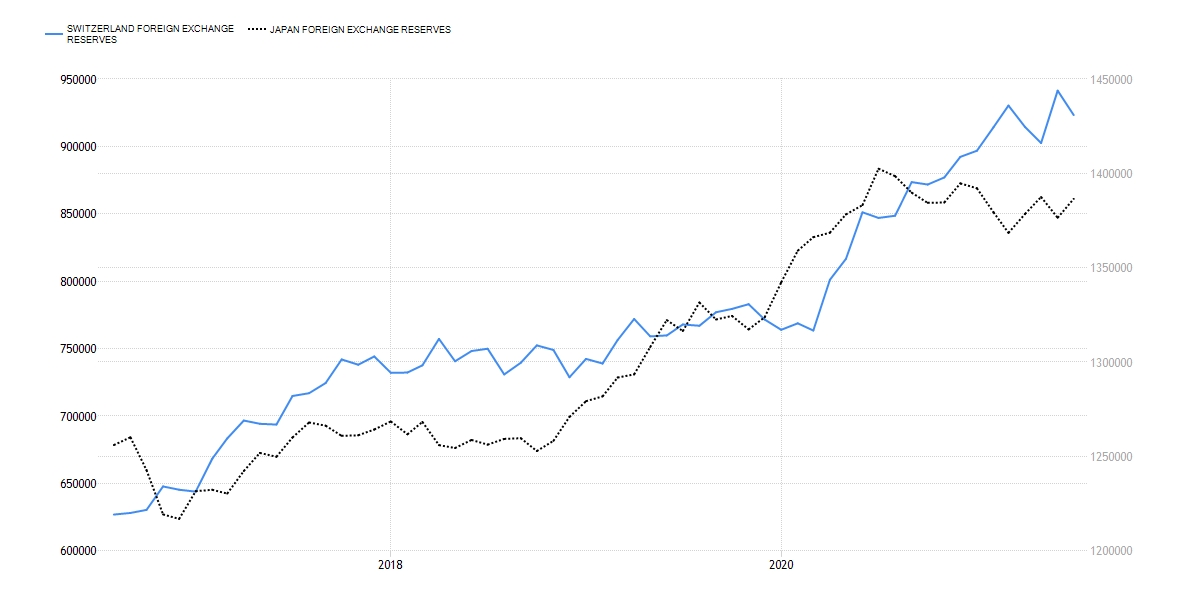

The Central Bank of Switzerland, the Swiss National Bank (SNB), is running very high on foreign reserve currency. Beginning in 2020, the SNB has been increasing the rate at which it sells Swiss francs (CHF) and subsequently buys foreign currency. Further, the SNB has recently passed a critical threshold for the first time: 1 trillion CHF of foreign currency reserves.

Since January 2020, SNB’s foreign currency reserves have increased by approximately US$170 billion. In the time immediately preceding January 2020, it had taken the SNB four years to add this much foreign currency reserves to its books. Although, during this time, you could argue that the SNB was still pursuing a rather aggressive foreign currency purchase program.

The printers of a similar safe-haven currency, the Bank of Japan (BOJ) and its Japanese yen (JPY) afford a suitable comparison for the SNB and its CHF. Since January 2020, the foreign currency reserves of the BOJ has increased US$50 billion, one-third that of the SNB. Moreover, BOJ foreign currency reserve growth has practically flat-lined/trended downwards since it peaked in July 2020.

Safe-haven currency- take the good with the bad

The SNB purchases foreign currency to suppress the value of the CHF and make its exports more competitive on price. Unfortunately, the demand for CHF is currently in overdrive, as is natural during a global economic upheaval. Seemingly, the CHFs safe-haven status is working against the impulse of SNB to help the country’s exports remain competitive.

When does it all end?

Now, what the SNB is doing is not all that uncommon. Effectively, all Central Banks around the world do this to some degree. The SNB is different because analysts are concerned that the bank’s selling of CHF is unsustainable. At the current rate, something might have to give soon enough.

The SNB cannot keep trading CHF for foreign currency and suppressing the CHF’s fair value indefinitely. Once the SNB hit a threshold, the CHF could come to appreciate significantly beyond its current value. The SNB has simply been manipulating the CHF for too long. The risk for a significant correction for the CHF has been steadily increasing alongside the manipulation. For this reason, brokerages, such as BlackBull Markets, have increased the margins required to trade CHF pairs.

Knowing this, is the CHF the mother of all longs?

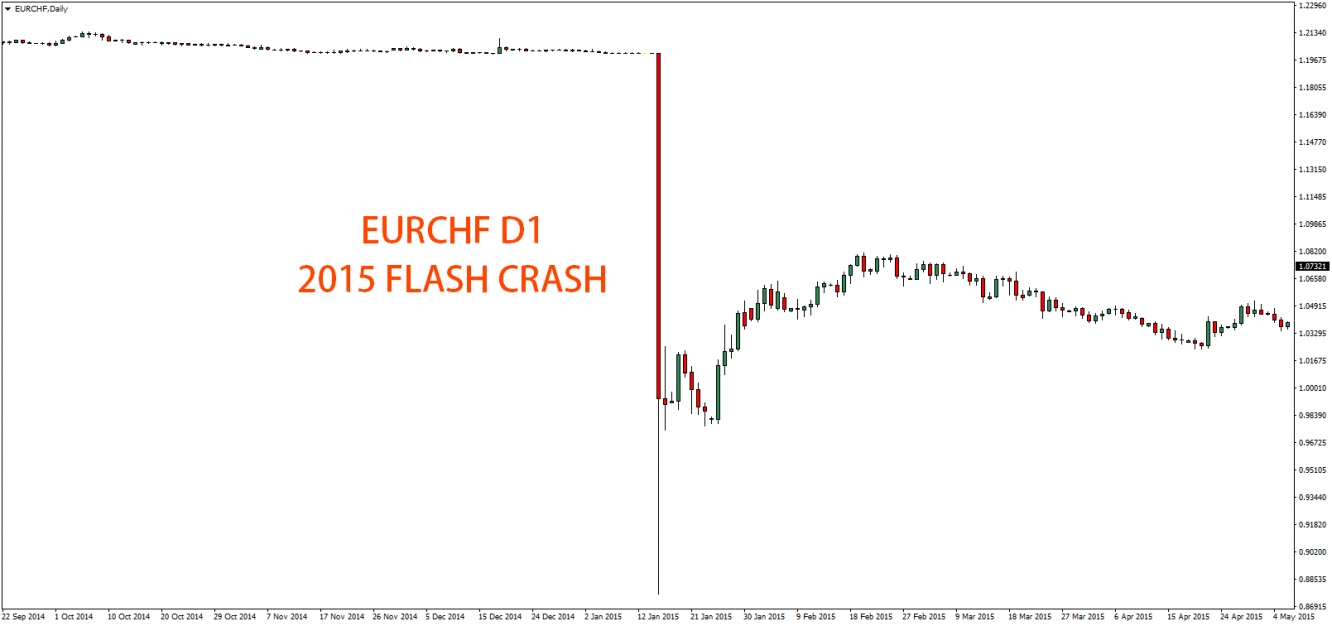

Traders of CHF will remember in 2015, when the EUR flash-crashed by 20% against the CHF after the SNB scrapped its unofficial peg to the single currency.

It may seem that the only way for the CHF is up, but this is not so. A genuine risk exists for both long and short traders of the CHF.

Traders' risk sentiment may change, and interest in the CHF might shift, and a devaluation might occur. A catalyst for this scenario might be sudden rising asset yields outside of Switzerland. Such a scenario would propel the SNB to offload some of its foreign assets for CHF. The CHF might keep stable if the SNB is fast enough, but a flash crash is always possible.