The 10-year Treasury yield fell sharply yesterday, dropping to 1.37% — the lowest since late-February. The ongoing decline offers more support for arguing that the reflation trade is fading.

The final verdict will take time to sort out, however, in part because the debate over inflation’s trajectory remains a gray zone until convincing hard data brings clarity on the question of whether the recent surge in pricing pressure is transitory or persistent. That’s going to take several months at a bare minimum, and probably much longer. Perhaps in this year’s fourth quarter or early 2022 we’ll have a clearer sense of inflation’s trend as the pandemic-related noise fades from the data. Meantime, the Treasury market seems to be voting early, at least over the past several months.

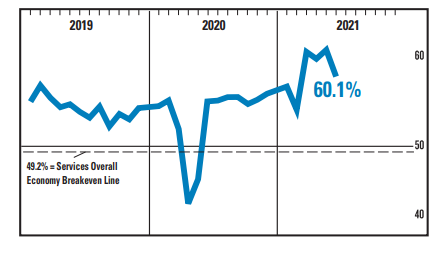

Yesterday’s catalyst: a softer-than-expected ISM Services Index report for June. This survey-based measure of economic activity in the services sector fell to 60.1 in June, down from a record high of 64.1 in the previous month. The drop still reflects a strong run of growth, but for whatever reason the Treasury market seemed to use the update as an excuse to buy bonds, which drove yields lower.

The ISM data followed Friday’s news that US unemployment ticked higher in June despite a robust acceleration in jobs creation.

Goldman Sachs’ Jan Hatzius weighed in via a note to clients yesterday, writing that ″we expect a sizable slowdown as reopening concludes and the fiscal impulse turns negative, with spending out of pent-up savings providing only a partial offset.”

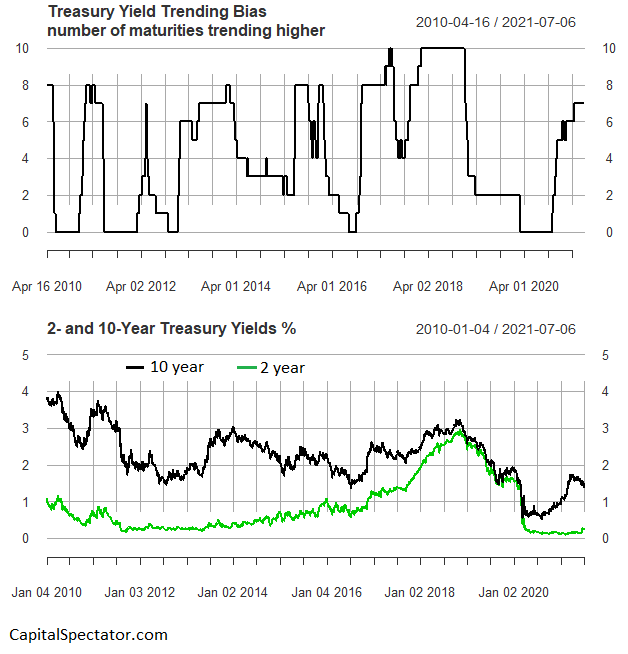

Forecasting the direction of interest rates is forever a humbling experience and the task is unusually challenging due to all the pandemic-related noise that still afflicts economic reports. Nonetheless, monitoring the trend in yields at least provides some context for managing expectations. On that front, let’s consider how ten Treasury maturities stack up in aggregate in the search for signal amid the noise.

The procedure here is to calculate exponential moving average (EMA) ratios via 50- and 200-day trailing periods. Why those trailing windows? Arguably it offers a reasonable if not perfect compromise in searching for timely data that reflects more signal than noise. When the 50-day average for a given yield is above its 200-day average, the trend is rising, and vice versa. This profile aggregates EMA ratios for the following maturities:

3-month

6-month

1-year

2-year

3-year

5-year

7-year

10-year

20-year

30-year

As of yesterday’s close (July 6), seven of the ten yields are still trending higher via the 50-day/200-day EMA ratio. Only the 3-month, 6-month and 1-year yields are trending down.

Note that in past episodes of rising yields, a higher number of maturities participated. At the moment, seven out of ten trending higher is below peaks in previous years. Is that a sign that upside bias is relatively weak?

Alternatively, it may still be early in the current rising-rate regime and so a higher peak awaits. But if the number of maturities posting an upward bias begins to reverse in the weeks ahead, that may indicate that we’ve seen the peak for this cycle.

Incoming inflation data will likely be the deciding factor, one way or the other. For now, it appears that the Treasury market is in the process of shifting from a reflationary bias to a neutral stance.