Treasury yields and market-based inflation expectations have taken a sharp turn higher in recent weeks. Is the shift a sign of regime change… or just noise? A convincing answer is on hold until sometime in 2017. Meantime, let’s review what we know so far.

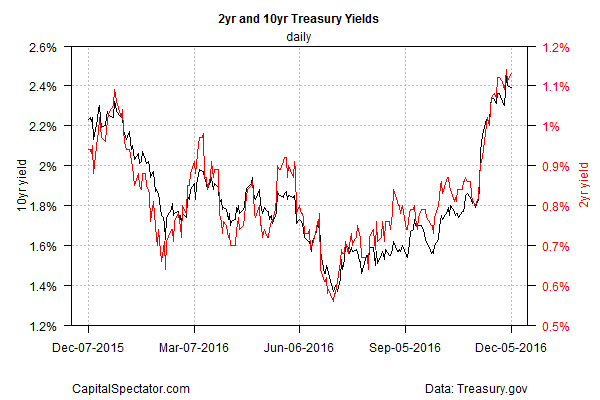

Treasury yields have jumped over the past month, lifting the benchmark 10-year rate to its highest level in a year-and-a-half at one point last week, based on daily data via Treasury.gov. Although the yield ticked down on Monday (December 5), dipping to 2.39%, it’s clear that sentiment has shifted in a meaningful degree.

The received wisdom is that last month’s election of Donald Trump convinced the crowd that a new wave of fiscal stimulus is coming in an effort to raise economic growth, boost employment, and generally fulfill the campaign promises to “make America great again.”

The economic updates since last month’s election have been strong enough to convince the market that the Federal Reserve remains on track to raise interest rates at next week’s FOMC meeting. Fed funds futures (based on CME data) are pricing in a roughly 95% probability that the current target range of 0.25%-to-0.50% will increase on December 14.

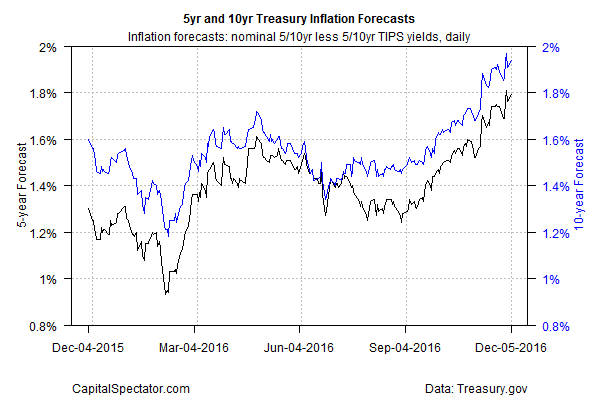

The Treasury market’s inflation forecast has taken flight too. The yield spread for the nominal 10-year note, less its inflation-indexed counterpart this month has been trading just below the 2.0% mark, which marks the highest level since April 2015.

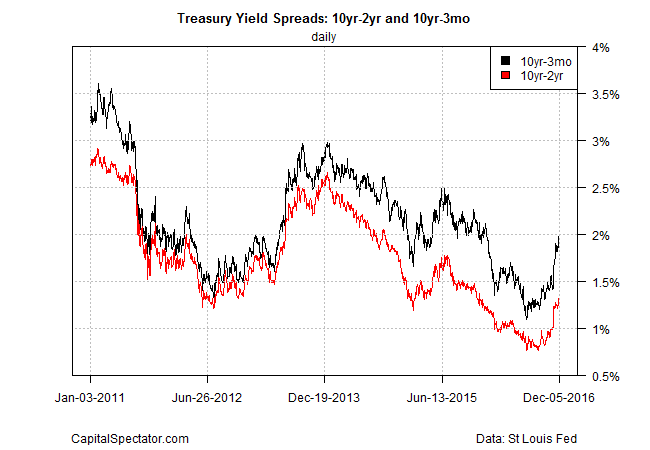

The attitude adjustment is no less conspicuous in Treasury yield spreads. The 10-year/3-month spread, for instance, has surged in recent weeks. After rising to 1.97% on December 1, the spread eased to 1.90% yesterday. The question is whether this is a temporary respite before the spread climbs to 2%-plus levels in the weeks and months ahead?

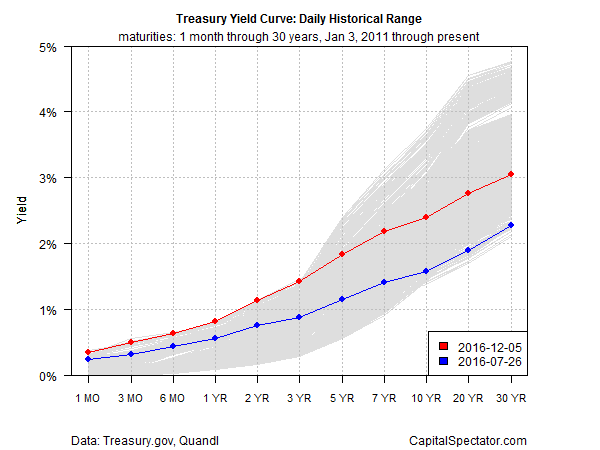

There’s also been a marked change in the shape of the Treasury yield curve lately, particularly on the short end. Yields on the 1-month-through-3-year section of the curve are now trading at or close to the highest levels in more than five years.

The great unknown at the moment: Is the recent past prologue for rates? Bond guru Jeffrey Gundlach of DoubleLine Capital has his doubts. The jump in Treasury yields (and commensurate increase in the stock market) appears to be “losing steam,” he said last Thursday. “The bar was so low on Trump to the point people were expecting markets will go down 80% and global depression — and now this guy is the Wizard of Oz and so expectations are high. There’s no magic here,” he explained in an interview with Reuters.

There is going to be a buyer’s remorse period. The dollar is going to go down, yields have peaked and will move sideways, stocks have peaked as well and gold is going to go up in the short term.

Perhaps, although the final arbiter will be the incoming economic data, as usual. On that front, the numbers at the moment are strong enough to support another round of monetary tightening at next week’s Fed meeting. It’s debatable, however, if a substantially firmer round of economic growth is in the cards for 2017.

The current outlook for Q4 GDP growth via the Atlanta Fed’s latest nowcast calls for a slight downtick in the trend as this year winds down. The December 1 estimate for the final three months of 2016: +2.9%, which is below Q3’s +3.2%. The New York Fed’s Q4 nowcast is even softer at +2.7% (as of December 2).

Will growth pick up next year, once the Trump stimulus kicks in? Economists are skeptical, according to a new survey of economists via the National Association for Business Economics.

“The slow pace of growth in recent years may be the ‘new normal,’ as more than 80% of survey panelists estimate that the potential rate of economic growth will be 2.5% or lower over the next five years,” NABE President Stuart Mackintosh said in a press release.

The question before the house: Will the numbers to come change Mackintosh and company’s expectations?