First of all, it has to be said that the crash theories surrounding the universally disliked euro are nothing new. Since 2008, these theories have been haunting the financial press like the Hound of Baskerville on Dartmoor. Until now, however, we can only state one thing, that it's still alive. The fact is, even 13 years after the 2008 crisis, the new currency continues to hold. To assess the likelihood of the euro's demise, let's first address the question:

Has the euro worked so far?

There are two sides to this question. Has the euro worked on a theoretical economic level, and has the euro worked for citizens? Let's address the latter problem first. The euro has been relatively stable compared to other major currencies such as the dollar yen, and sterling. Inflation was significantly higher in the days of the Deutschmark than after the introduction of the euro. The interest rate on savings deposits may have shrunk continuously since 2008, but this is not a euro phenomenon, but classic savers in countries such as the US, Japan, and the U.K. have also seen the last few years no country. For the consumer, then, it is fair to say that the euro is working. On an economic, academic level, one can, of course, initiate other discussions and outline doomsday scenarios such as higher inflation due to the expanded money supply.

Is higher inflation looming?

Inflation scenarios were already spread after the 2008 crisis, but these did not come true, even though the money supply increased. In economic terms, the coronavirus crisis and the effects of fiscal policy measures are both a demand and a supply shock. While the supply shock generally pushes prices up, the demand side has a deflationary impact and depresses prices. Here, an equilibrium could emerge so that no excessive inflation occurs. Another point is the sharp rise in government debt, which could pose a risk. Here too, we had a surge in the public debt ratio after the 2008 crisis that can be compared with that of the coronavirus crisis, which has not led to significant inflation. Higher unemployment and structural changes (higher digitalization and lower mobility) are more likely to have a deflationary effect in real economic terms. To the extent that increased government debt counteracts the collapse in demand, as is the case in the wake of the pandemic, this does not have to lead to increased inflation; instead, it is used to correct a deflationary trend. However, these are points that have nothing specifically to do with the euro and are treated the same way in other countries. We therefore see deflation rather than inflation looming.

Will the euro work in the future?

We would answer this question with a "yes", but the question "how well" arises. The differences between the individual countries in terms of economic strength could also be better reflected with local currencies. However, we consider these "what if" considerations a waste of time since there can be no return to local currencies. The reason we rule this out is that if the Deutschmark was reintroduced, Germany would have a robust currency relative to other EU countries. This would hurt Germany's export-driven economy significantly. The "weaker" countries could see the opposite effect, devaluing their local currencies, which would drive up their debt even further. Apart from the deterrent effect on inward investment and the mood of uncertainty, the cost of returning to local currencies would be immense. In other words, the cost of switching back to the older local currencies would be tremendous, undoubtedly in the shorter term.

So the task now is to manage the euro as best we can; we think a return to local currencies is out of the question. We also do not share the opinion of all the crash prophets who have been conjuring up the euro's demise for years. In reality, the system is far more dynamic and complex, so one parameter getting out of hand will not be sufficient to sink the ship. We therefore consider the not-so-popular euro to be more robust than many would assume.

Overall, we expect a stronger euro, which will also translate into rising rates against other currency pairs such as EUR/USD and EUR/GBP. Below we will present expectations and upcoming trades from a technical chart perspective.

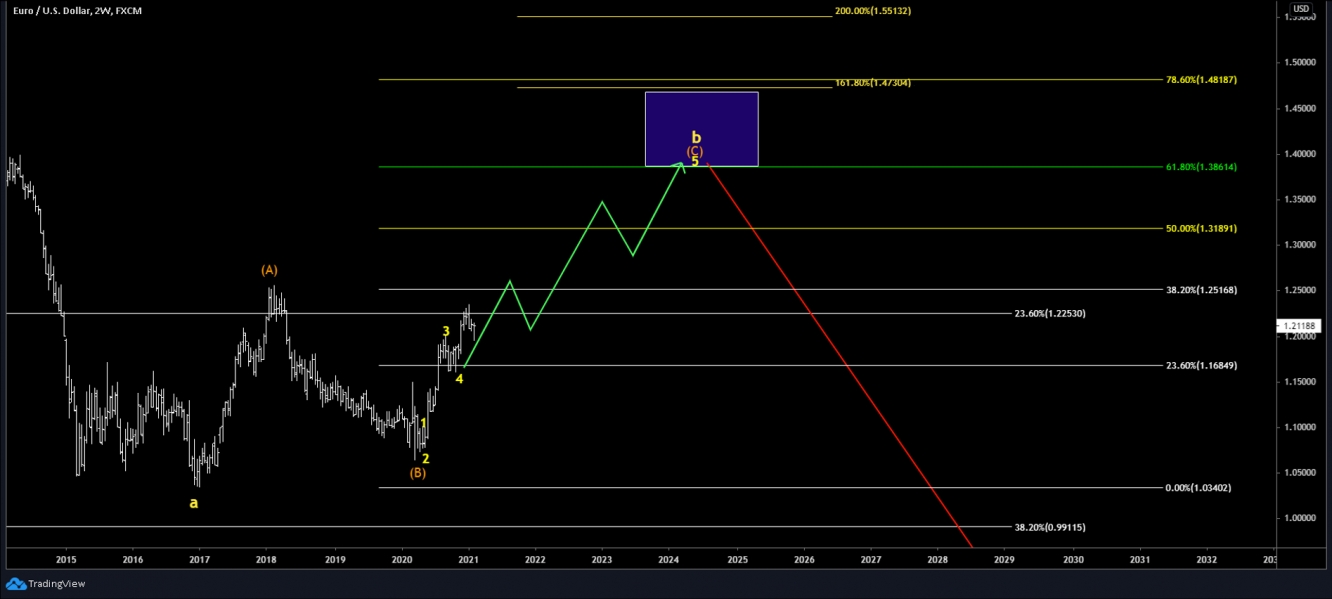

EUR/USD Technical Analysis

For the exchange between euro and USD, we expect to return to an upward movement to reach marks past $1.25 in the course of the yellow wave 5. The according setup seems to be in progress already. Imminently, we have to expect that the bears pull the price back to around $1.20. However, as long as we do not fall under the preliminary low point at $1.19524, we believe that the green wave iv's corrective movement is completed. It remains exciting, and adding a long position in the EUR/USD should be on everyone's watchlist. The indicators also support this, more specifically the RSI and MACD. In the longer-term, we expect EUR/USD to rally towards $1.40, before a more significant sell-off sets in, which could move us towards parity.

EUR/USD 1h Chart

EUR/USD 1W Chart

EUR/GBP Technical Analysis

The EUR/GBP course is continuing its journey down South and is, thus, on the right track. Because of the stops, we had to forgo further shorting in this market. Now, we are concentrating on positioning ourselves on the long side in the area around 0.85 GBP, where we expect a rather longer-term turnaround in the motion. In the course of this trend, the bulls might be able to expand to new peaks above 0.95 GBP. Around 0.86 GBP is the zone where it gets exciting. Therefore, the bears still have some time to dominate, which is also supported by the indicators. A considerably hard resistance awaits us in the area around the highs of the white wave 1. In the mid-term, we see the euro gaining more value towards the British pound.