Are there any sweet surprises left for sugar bulls before the year wraps?

The commodity had one of its biggest rallies in 2020, gaining 15% as it rose virtually non-stop from May through December after COVID disruptions to production landed unusually low supplies on the global market.

This year has been even bigger, with a 25% gain booked thus far. But the run-up was far less even, with March being the worst month in a year (16% down) and a stalling since September of the upside.

With just two months left to 2021, it’s worth asking: Is sugar capable of a new high before the year is done, as some optimistic forecasters had predicted a few months back?

It’s an answer that probably depends as much on current crop cultivation, weather, harvest, delivery to market, and sales and demand as technical outlooks on price.

All charts courtesy of skcharting.com

‘Blurred’ Supply-Demand Outlook

As Munawar Hasan wrote in a commentary in The News of Lahore last week, “confusion, claims (and) counterclaims blur (the) sugar outlook for 2021/22.” He added:

“Whether it is (the) size of the crop, expected sugar production and a likely downward trend in price of commodity, there are (too) many guessworks by the stakeholders which may add to the already volatile sugar market.”

In Tuesday’s trade on ICE or the InterContinental Exchange, raw sugar’s benchmark front-month contract hit a high of 19.44 cents a lb, off the Oct. 11 peak of 20.61 cents, which marked a high since February 2017.

How much higher can it go from there, would be the question for anyone taking up a fresh long position in sugar.

“Renewed talk of inflation coming to all commodities markets has also supported sugar,” said Jack Scoville, chief crop analyst at Chicago’s Price Futures Group brokerage. “The reduced production potential from Brazil is still impacting the market.” Plus:

“India is not offering as world prices are well below domestic prices and has had some weather problems of its own. Consumption of sugar is said to be improving from previous low levels but still remains rather low.”

That said, to counter some of these bullish factors, fourth biggest sugar grower Thailand was expecting improved production, Scoville said.

Also, in Brazil, the world’s biggest producer of the crop, rains in the southern patch of the country were improving the outlook for sugar, he added.

Exhaustion Could Be Setting In, Charts Show

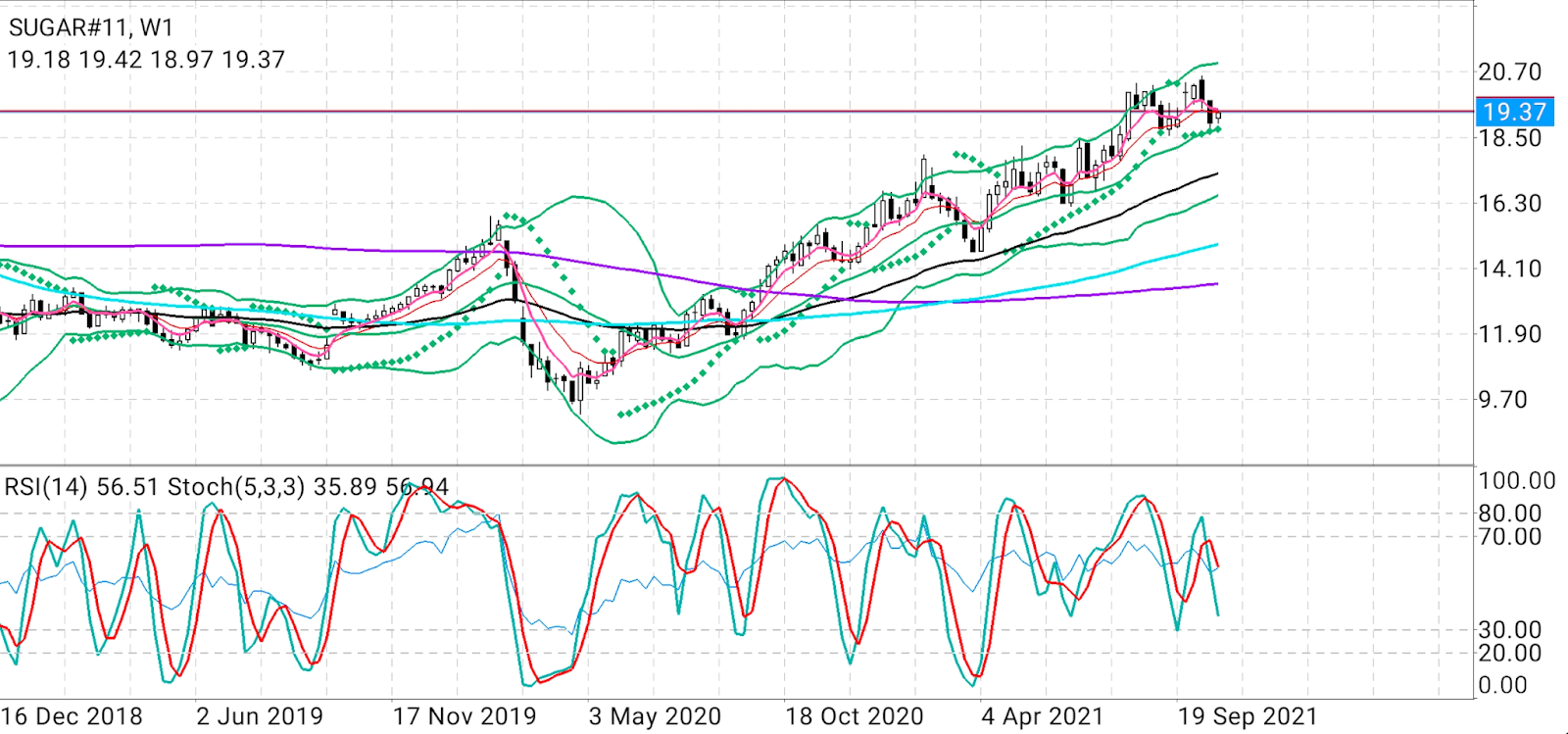

Technicals charts tell of a market that is likely to make it through the year end in consolidation mode, said Sunil Kumar Dixit, chief technical strategist at skcharting.com

“Sugar can continue its rebound from the lows, conditioned by holding above 50% Fibonacci level of 19.70 cents,” said Dixit. “Otherwise, the short term momentum can flip to bearish if the 18.78 support gives way.”

“The monthly chart picture has been looking encouraging until now. But current month prices are most likely to close below the previous month’s close and exhaustion is easily palpable,” he said.

Dixit said the recent bounce from 18.81 lows was the result of sugar rebounding from an oversold Stochastic RSI state on the daily chart.

“The weekly chart, which reflects the mid-term outlook, shows prices taking support at the middle Bollinger® Band. However, the trend can flip to bearish if prices break and sustain below the middle Bollinger Band and the parabolic SAR, both reading at 18.78.”

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold a position in the commodities and securities he writes about.