Pharmaceutical giant Merck & Company (NYSE:MRK) stock exploded to the upside on news of its game-changing COVID-19 pill Molnupiravir (molnu). The interim phase three clinical trial results showed a 50% reduction in hospitalization and a 100% reduction in deaths with no severe side effects. These results were so compelling that the Company is moving forward with emergency use approval (EUA) with the FDA and has bolstered the production capacity to 10 million treatments by the end of 2021 at an estimated price of $700 per pill and 10 pills per treatment/course.

While COVID-19 vaccination makers initially saw their share prices fall, it turns out that vaccinations are still needed and won’t be replaced by the pill. The Company also secured a deal with the U.S. government for 1.7 million courses upon FDA approval. Australia has agreed to a 300,000-course purchase. The mere announcement sent pandemic epicenter and reopening stocks back up spiking travel, lodging, hospitality, and retail stocks. The date for the FDA advisory committee review has been set for November 30, 2021. Prudent investors looking for exposure in this COVID-19 game-changer treatment can watch for an opportunistic pullback in shares of Merck.

Q2 FY 2021 Earnings Release

On July 29, 2021, Merck released its fiscal second-quarter 2021 results for the quarter ending June 2021. The Company reported an earnings-per-share (EPS) profit of $1.31 versus $1.35 consensus analyst estimates, a (-$0.04) miss. The Company saw revenues grow 21.9% year-over-year (YoY) to $11.4 billion beating analyst estimates for $11.2 billion. Keytruda sales rose 23% YoY to $4.2 billion. Gardasil sales grew 88% to $1.2 billion. Animal Health sales rose 34% to $1.5 billion.

Conference Call Takeaways

Merck CEO, Rob Davis, set the tone:

“Let me spend a moment speaking about KEYTRUDA, which again experienced very strong growth this quarter. I'm confident that KEYTRUDA will continue to be a foundational cancer therapy and achieve strong growth for years to come. We are a leader in immuno-oncology and are determined to leverage this into sustained success. We are rapidly advancing a diverse set of oncology assets, many of which we highlighted in our recent ASCO investor presentation. Across our oncology portfolio, we expect over 90 potential new indications by 2028, more than tripling our current base. We have a wide array of clinical partnerships, providing valuable insights into the biology of disease and into important potential external innovation. With our expanding oncology portfolio outside of KEYTRUDA, we will extend our leadership in cancer long into the future. I also strongly believe we will successfully navigate the eventual KEYTRUDA loss of exclusivity, given the breadth of opportunity in areas both within, as well as outside of oncology. Internally, our leaders are intensely focused on this period and efforts are underway.”

He concluded:

“We will be unbounded by therapeutic area, though we are mindful of the need to have a balanced portfolio over time. We'll seek new products, modalities, and platforms that allow us to establish beachheads in important areas. Our recent acquisition of Pandion and its potentially foundational immunology asset is a good example of this. We will look at both early and late-stage opportunities, and we have the financial flexibility to consider deals of all sizes, particularly given the $9 billion distribution from the Organon spinoff. And given our strong operational momentum, we are most interested in transactions that are easily integrated and less disruptive, where value is principally derived by the introduction of innovative new products that address patient needs instead of through cost energies.”

MRK Opportunistic Pullback Levels

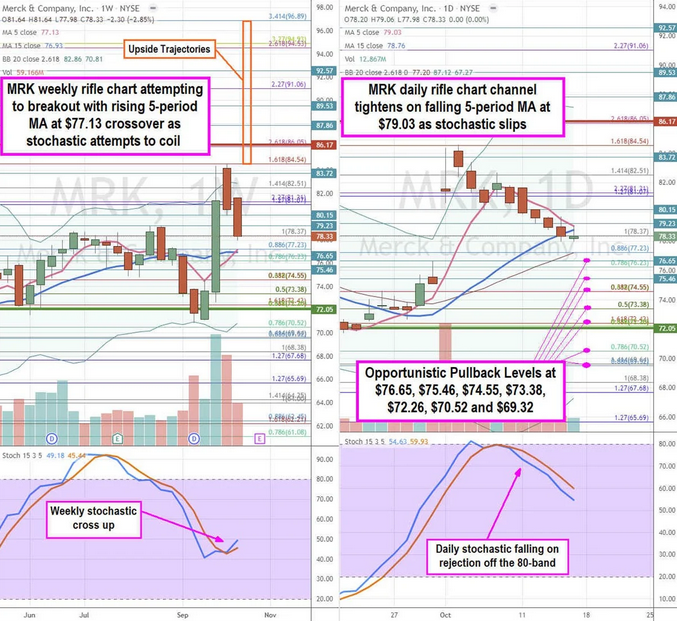

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for MRK stock. The weekly rifle chart peaked out near the $84.54 Fibonacci (fib) level. Shares have since been in pullback mode. The weekly breakout is attempting to form with a rising 5-period moving average (MA) crossover at $77.13 as the weekly stochastic crosses back up. The weekly upper Bollinger Bands (BBs) sit at $70.81. The weekly market structure high (MSH) sell triggered below $86.17 while the weekly market structure low (MSL) buy triggered on the breakout through $72.05. The daily rifle chart is forming a channel tightening and potential gap fill with the falling 5-period MA at $79.03 while testing the 15-period MA overshoots at $78.76. The daily gap fill area is the $76.65 when the news was announced. Prudent investors can look for opportunistic pullback levels at $76.65 fib, $75.46 fib, $73.38 fib, $72.26 fib, $70.52 fib, and the $69.32 fib level. Upside trajectories sit at the $84.54 fib upwards to the $96.89 fib level.