The global economy today is experiencing one of the longest expansion patches. Since the 2008 global financial crisis (GFC), the economy is now close to a decade of growth. This is remarkable given that the 2008 GFC started worse-off than the Great Depression of 1929 – 1938. The recovery started since about July 2009. Come July 2019, we mark the completion of a decade since the world markets buckled under the sub-prime mortgage crisis. Since 1929, there have been about 28 cycles of expansion and contraction, also known as boom and bust cycles.

Analyzing past data, on average, the boom cycle lasts for 38.7 months while the bust cycle lasts for 17.5 months. But that has changed quite a bit since the 2008 GFC. We have clearly overstayed the boom cycle. It is not surprising then that market watchers have raised alarms about fears of a recession. Market watchers and economists alike have been closely monitoring the markets for any clues about an impending recession. The most recent was the inverted yield curve which sent panic among investors.

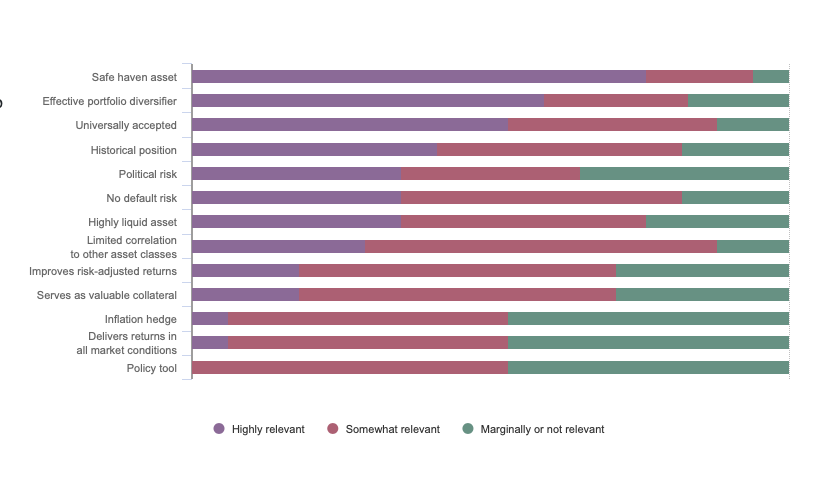

Traditionally, gold as an asset is considered to be a safe-haven asset. A safe haven asset is one that can either retain its value or increase in value during turbulent times.

The question that comes to mind is if gold is still relevant today?

Gold relevance as a safe haven: Highly relevant 76% (Source: World Gold Council)

Regardless of how far out the next crisis is, it pays to understand the relevance of gold in this day and age.Gold’s Historical Reaction to Global Crisis

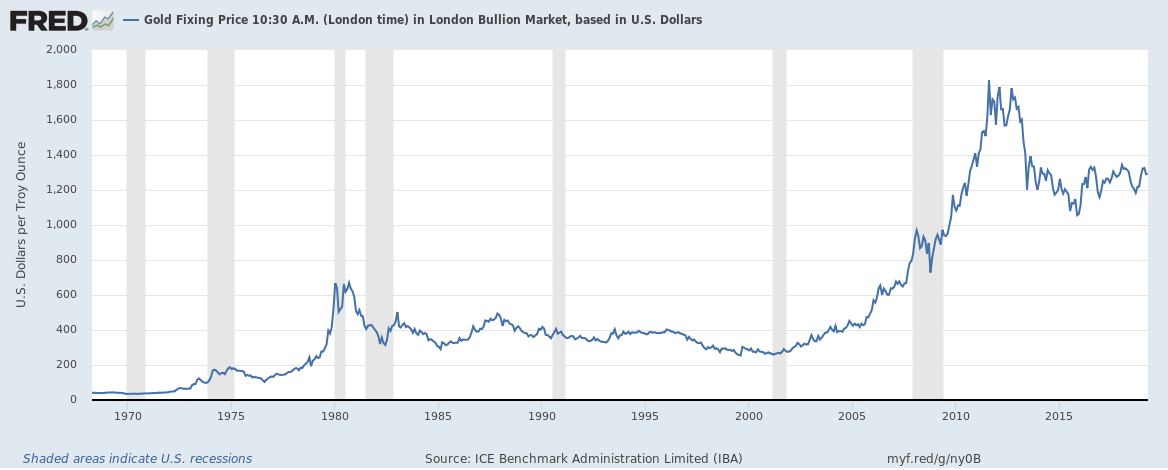

If history is something to go by, then gold’s reaction to the global crisis shows us its importance during recessions.

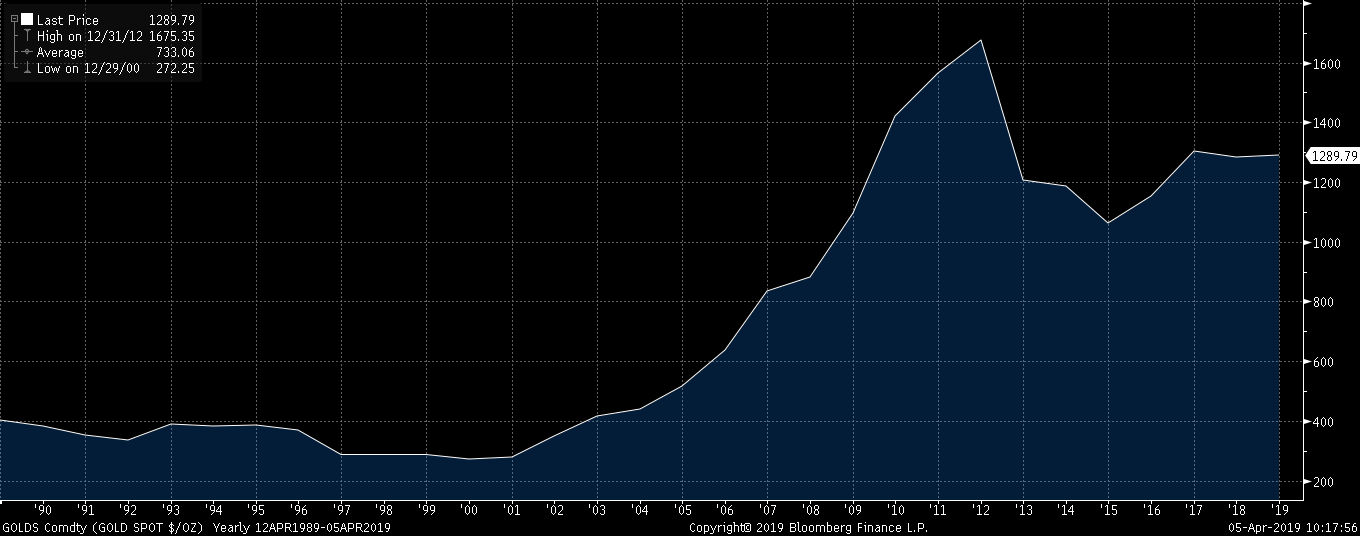

Gold historical chart incl. recession (Source: FRED)

Studies show that gold outperforms the broader market during such times. Except for the 1990 recession, gold has risen in five out of the seven most recent recessions.

Investors flock to safe haven assets such as gold because it can retain value, unlike equities. But it is not just this risk on/risk off move that determines the safe haven status of gold.

Besides acting as a hedge against inflation and the ability to retain its value during turbulent times, gold prices can be influenced in a number of ways.

Supply and demand are probably the first place to start.

Gold – Demand and supply

In a world that is constantly evolving with technology, gold’s use is shifting and changing. Perhaps the one area where gold still stands tall is its demand for jewelry.

Demand for gold as jewelry is dominated by India and China. But gold purchases in these parts of the world are not just because of an obsession with the precious metal, but also because it’s an investment. Although we live in a world of fiat currency, gold is still sought after by central banks. A study from the World Gold Council showed that central bank demand for gold rose 74% on the year in 2018. This was in response to geopolitical factors and the changing macro-economic environment.

A survey of 22 central banks by the World Gold Council’s data shows that about 18% of the central banks plan to increase their gold holdings over the next 12 months. That’s about 4 central banks. The appetite to increase gold holdings might not seem that much.

But interestingly, none of the central banks plan to decrease their gold holdings. On the contrary, demand from central banks for gold rose sharply in 2018.

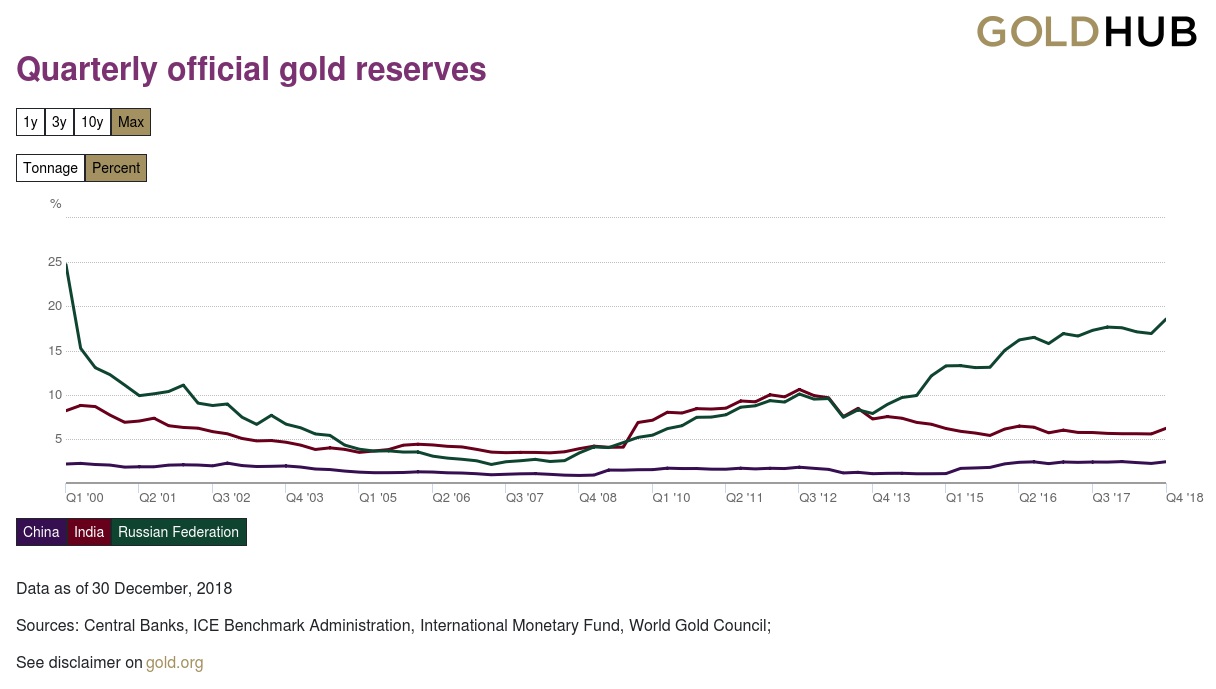

When it comes to central banks, it is, of course, Russia and China that are making the news. Below is a chart from Russia, China, and India on the central bank gold purchases in percentage terms.

Quarterly gold reserves. (Source: Gold.org)

In 2018, demand for gold was dominated by the jewelry industry, followed by investments, central bank purchases, and technology.

During turbulent times, demand in technology and industry can understandably decrease. The key areas to follow are, of course, the central bank purchases and people’s appetite to buy physical gold.

Trading Gold CFD’s for speculation

Considering all things this brings us back to the question of whether gold still maintains its relevance as a safe haven status. The answer is a resounding yes! Among the different ways you can diversify into gold, speculation can also be used for short term trading.

Contracts for difference or CFD for short is a type of a derivative product. Gold CFDs derive their value from the underlying security which is spot gold.

The distinct advantages of trading gold CFDs are listed below.

- Gold CFDs allow you to trade on leverage

- With gold CFDs, you can go long and short on the instrument

- Unlike gold futures which roll over every quarter, gold CFDs are continuous

- Trading gold CFDs is somewhat cheaper both in terms of capital and margin requirements and overnight fees

- The downside with Gold CFD is that you do not own the physical asset and settlement is done in cash (so you end up with fiat money anyway)

On a year to date basis, gold has risen just 1.14% and has been lower since retreating from the highs above $1600 in 2012. But that could change with the economic cycles.