For many months now I have related to my subscribers that the pro-capitalist movement in Chile was growing stronger and that a rally could begin in the Chilean junior miners as the country turns more pro-business. I said for close to a year now that maybe Argentina is getting a bit overpriced and we should look at Chile for critical lithium supplies.

Chilean Politics

Over the weekend the runoff election was announced and my forecast of Chile turning pro business was spot on. Conservative candidate Pinera won by a huge margin pledging to rebuild the economy and open up the country to foreign investment. He won more votes than any other president, indicating the people of Chile want the economy to rebound.

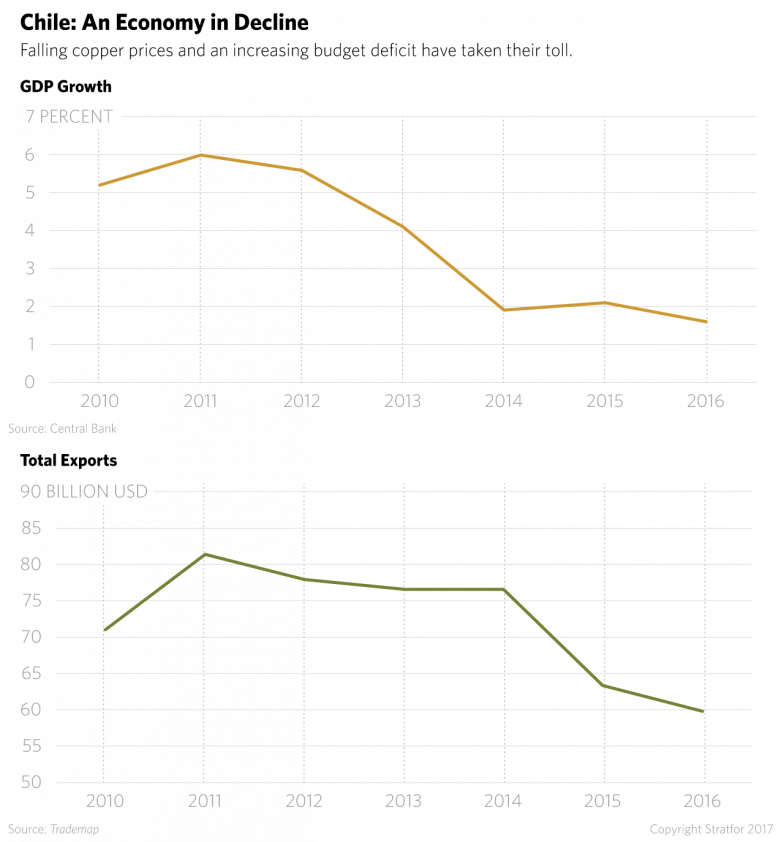

Pinera is known to be pro mining in a country that is the world's leader of clean energy metals, specifically copper and lithium. He wants to cut bureaucracy and regulations that have bogged down development projects to grow the country economically. As you can see, Chile has been in decline for years and the people want a pro-mining change.

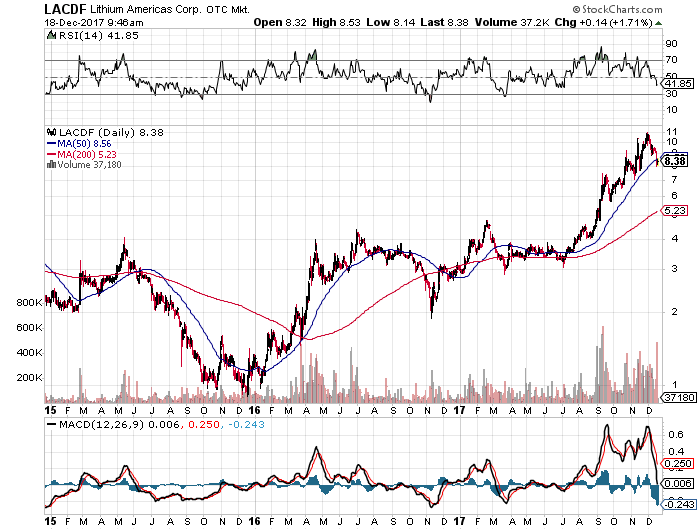

Chile was weighed down by socialist policies for several years, similar to Argentina before the Macri election. A few years ago when investors abandoned Argentina, I was one of the few that encouraged Western Lithium to takeover Lithium Americas (TO:LAC) for pennies as I also believed Argentina's economy would turn. Macri was elected and Lithium Americas went from pennies per share to dollars per share.

A similar possibility exists with the advanced lithium miners in Chile as I expect business to pick up quickly with the new president, a Harvard trained economist who introduced credit cards to Chile back in the 1980s. Pinera has a mission to turn Chile into South America's economic powerhouse and he may do that with clean energy, using Chile's vast resources of copper and lithium to generate huge amounts of capital that could be reinvested in infrastructure and education.

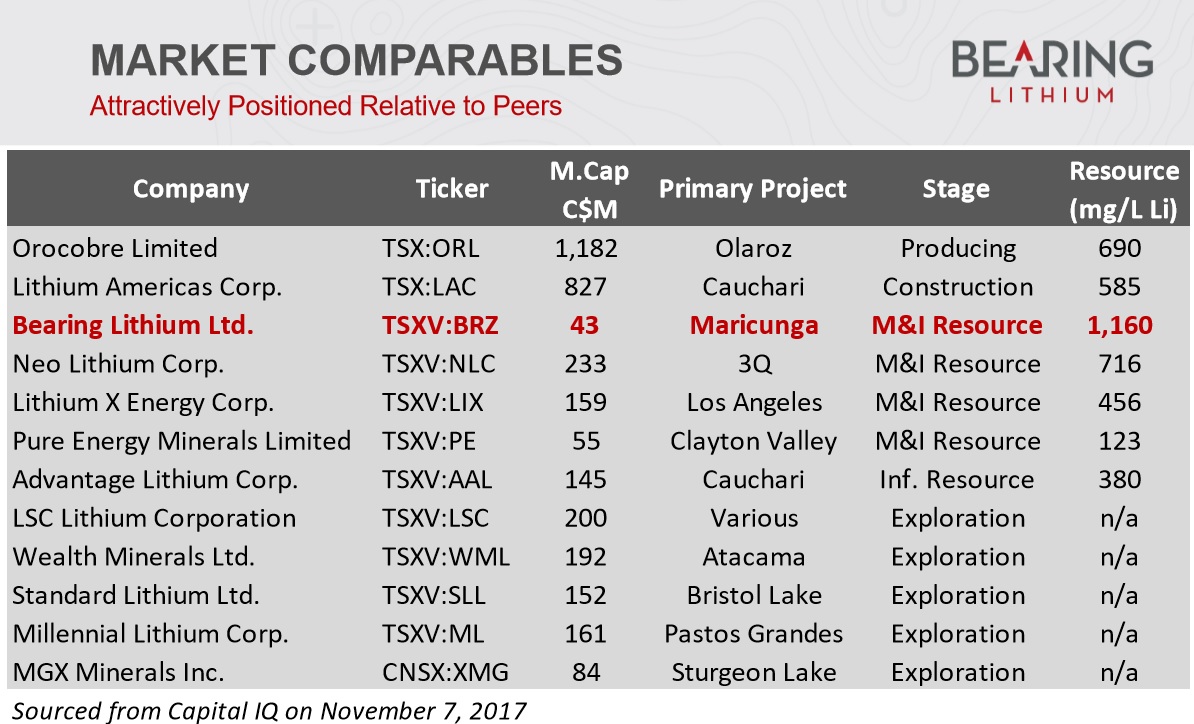

What is the next Lithium Americas of Chile? For months, I have been watching Bearing Lithium (V:BRZ), which has a stake in the #maricungaproject, one of the highest-grade lithium brines in the world and the only pre-production project in Chile, which is known to host some of the best lithium brines in the world (including the Atacama, which produces over 40% of global lithium supply).

The project has a huge high-grade lithium resource. Bearing has a free carry-on-expenses-through-feasibility that is expected in the first half of next year. Korean's Posco (KS:005490) own a bunch of Bearing but I expect China or some other country to try to pick up Bearing's stake for possibly a large premium.

Disclosure: I own securities in this company. They are a website sponsor which means I have a conflict of interest and am biased as I would benefit if the share prices goes up in value. Please do your own due diligence as I am not a financial advisor. This contains forward looking statements which may not come to fruition as mining is risky and investors can lose all their money. I may buy or sell shares at any time without notice. This is based on public information and management conversations but there may be inaccuracies or errors so make sure you do your own due diligence. This should be considered an advertisement and not financial advice.