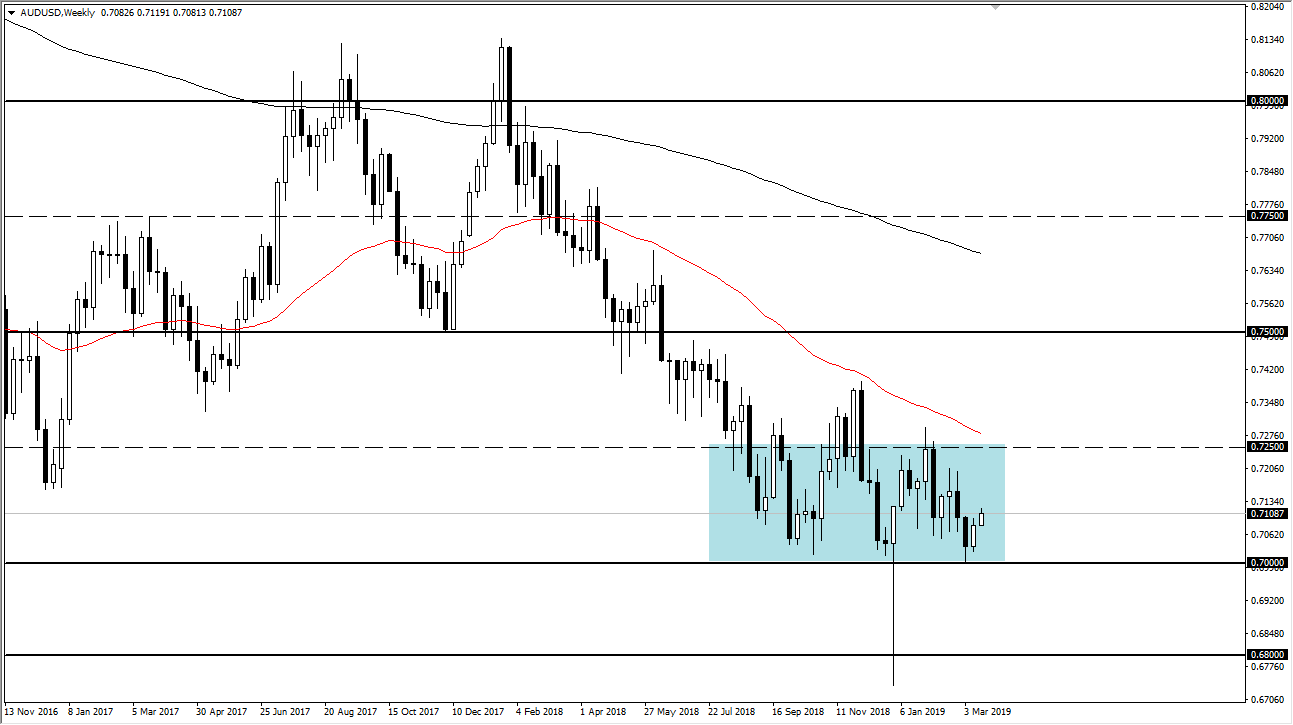

Recently, we have seen the Australian dollar bounce off of the 0.70 level several times. Most drastically we had seen a massive hammer form a couple of months ago that pierced the 0.68 level underneath. This of course has caught our attention as the 0.68 level is a long term support level that extends all the way to the previously mentioned 0.70 level.

Monthly support

If you zoom out to the monthly chart, you can see that there is roughly a 200 PIP range of support. This was demonstrated by the massive hammer that had formed, which most of it had happened in just a handful of hours. That is a scene of strong institutional demand, be it a central bank, hedge funds, major trading desks, it doesn’t really matter - we know that somebody with size is sitting there.

It’s not overly common to see these levels, and they are quite often the scene of a major turnaround. With that in mind they tend to be very noisy, but these tend to be the moves that when you look back at the charts, you think “if I had only been involved back then, it would have been easy money!”

The Reality Of These Levels

This is a situation where you have a lot of volatility just waiting to happen, and it will take a certain amount of conviction and wherewithal to deal with these types of levels. However, if the trade does work out we will have finished a major “W pattern”, which of course is very bullish. If you look at the 50-week EMA, pictured in red on the chart, you can see that it sits just above and it will most certainly cause major issues on any attempt to break out to the upside.

When you look at charts like this, you should recognize that with all of the noise that is almost certain to be part of the situation, you will need to keep your position size relatively small, and then add on short-term dips. You also will need to be very patient as trend changes tend to be slow and messy affairs, so you can’t necessarily expect this the payoff right away.

The alternate scenario

There’s also the alternate scenario, as per usual. At this point, it’s likely that the most clear signal to start selling would be a break of that massive hammer, which extended almost all the way down to the 0.67 level momentarily. If we were to break down below there it would probably be in congruence with some type of major negative announcement with the US/China trade situation. That might be enough to send this pair tumbling lower.

Granted, there is a housing situation in Australia that is tenuous at best, but at the end of the day most currency traders ignore Australia altogether and simply trade this currency based on China. It’s a bit counterintuitive, but China is more important to the Australian dollar than Australia is under most circumstances. If there is a trade deal, and it’s very likely that most people expect that to be the case, then the idea is that the stimulus and the lack of barriers should build trade coming out of China, which in turn will start buying more commodities from Australia, which in turn brings up the value of the Aussie as its and more demand. Obviously though, if none of these things work out the exact opposite happens and then at that point perhaps the housing bubble in Australia suddenly becomes a major issue.