Earlier this week, Amazon.com (NASDAQ:AMZN) unveiled plans to split its stock for the first time in more than two decades. The move will boost the company’s outstanding shares in a 20-to-1 ratio, making the stock price more attractive for investors who were uncomfortable buying a stock with a four-digit value.

After the split announcement on Wednesday, Amazon soared as much as 11% in the after-hours trading. However, it gave back some of those gains amid a broad market selloff, closing Thursday at $2,936.57, up more than 4,000% since its last stock split in September 1999.

The Seattle-based e-commerce giant, in an emailed statement, said the split aims at giving employees “more flexibility in how they manage their equity” and making the stock “more accessible” for average investors. Amazon’s split requires shareholder approval and would take effect in June if cleared.

Technically speaking, stock splits don’t change the value of a company or its investors’ holdings. However, this strategy reduces the price of individual shares, which can make a stock more accessible to a broad range of investors, especially when the price of shares reaches a level deemed too high for small investors.

Amazon’s split decision, following similar moves last year by Apple (NASDAQ:AAPL) and Tesla (NASDAQ:TSLA), also illustrates the growing influence of retail investors on the market where large institutional investors have taken a back seat since the COVID-19 pandemic.

That said, investors shouldn’t make their investment decisions based on stock splits. Instead, the company’s business fundamentals and its valuation matter the most. On that account, Amazon stock is a good buy, in our view.

Powerful Momentum

Amazon stock has become quite attractive after losing a quarter of its value since last July when it hit a record high. The downward move started as the giant warned about the cost pressures in the post-pandemic environment, spurred by supply-side hurdles, labor supply shortages, and increased freight and shipping costs.

But while the current environment doesn’t look too favorable for Amazon’s e-commerce business, investors shouldn’t ignore the powerful momentum in the company’s other units, including its advertising segment and gains from Amazon Web Services (AWS), the company’s cloud unit.

Sales for the cloud unit, which offers customers server capacity and software tools and generates a significant portion of the company’s operating profit, have been showing massive growth. In the previous quarter, this diversification in sales helped Amazon when cloud-computing and advertising businesses combined made up more than the decline in online store sales. As a result, the company posted a blockbuster earnings report.

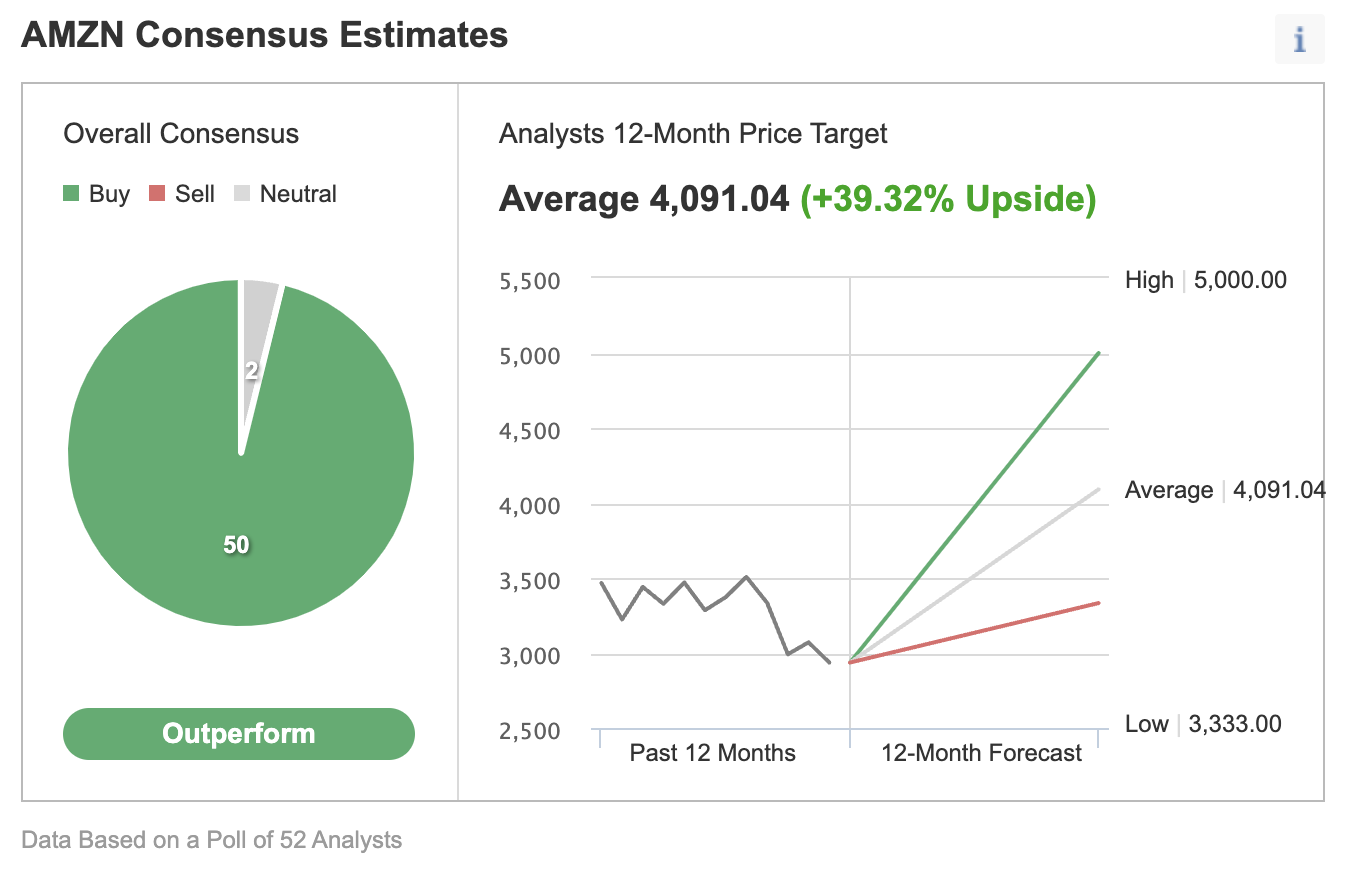

This strength in Amazon’s growth outlook is the main reason that analysts overwhelmingly support buying the stock on these levels. In an Investing.com survey of 52 analysts, 50 have an “outperform” rating on the stock with a 12-month consensus price target that implies about 39.3% upside.

Source: Investing.com

Barclays, this week reiterated Amazon as overweight, saying the company will revise its earnings outlook. Its note said:

“Retail margins are starting to show stabilization in 2022 and continued mix shift to higher-margin business units like AWS and Ads, we see upward estimate revisions as likely this year.”

Bank of America, in a recent note, named Amazon its top pick for 2022, saying that the retail behemoth should enjoy a “significant” expansion in profit margins from 2023 to 2025, helped by its cloud, advertising, and third-party marketplace.

Bottom Line

Amazon’s stock split decision will broaden the company’s appeal among retail investors who are more actively involved in trading in the post-pandemic environment. In addition, Amazon has a significant upside due to growth momentum in its cloud and other units.