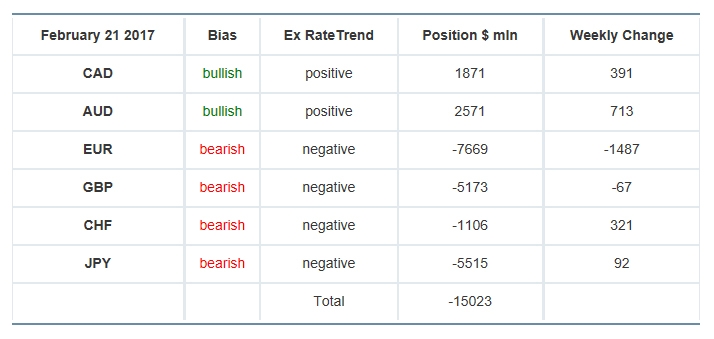

US dollar bullish bets rose slightly to $15.02 billion from $14.93 billion against the major currencies during the previous week, according to the report of the Commodity Futures Trading Commission (CFTC) covering data up to February 21 released on Friday February 24. No new initiatives or policy details were announced by President Trump’s administration during the week but economic data were quite positive, reinforcing Fed chair Yellen’s upbeat assessment of US economy at her Congressional testimony.

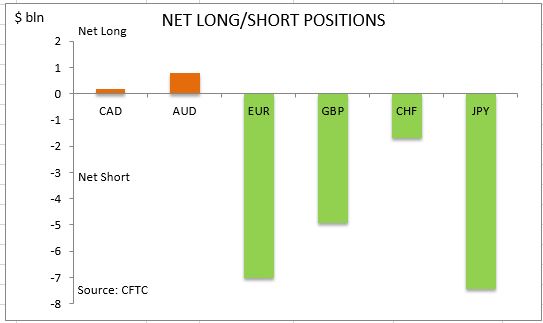

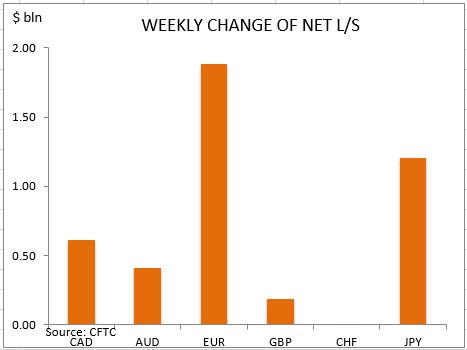

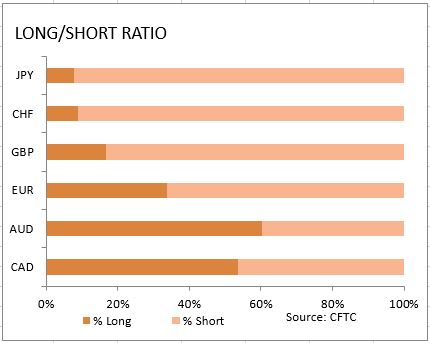

Headline inflation rose more than expected in January to 2.5% from 2.1% in December with core inflation, excluding volatile food and energy prices, rising to 2.3% from 2.2%. As Fed officials stated at FOMC last meeting they are ready to hike rates if inflation above the target 2% rate is sustained. Retail sales in January also rose compared with a year ago: 5.6% from 4.4% though the increase on month was less than in December - 0.4% after upwardly revised 1% in December. On the negative side industrial production fell 0.3% on month from downwardly revised 0.6% in December as it remained steady over year following 0.7% growth the previous month. Nevertheless manufacturing production rose 0.3% over year though the increase was less than the 0.5% gain in previous month. At the same time expansion in services and manufacturing sectors slowed in February according to Markit’s preliminary readings of Manufacturing and Services PMIs for February. Investors increased marginally dollar bullish bets. As is evident from the Sentiment table, sentiment improved for all currencies except for the euro and British Pound. And Canadian dollar together with the Australian dollar are still the two major currencies held net long against the US dollar.

The euro sentiment deteriorated on heightened political uncertainty about France’s membership in European Union as polls show little lead of centrist presidential contenders Francois Fillon and Emmanuel Macron over the leader of The National Front Marine Le Pen, who has vowed to take France out of the European Union if she wins the French presidential election this spring. The net short euro position widened by $1.5bn to $7.7bn. Investors built considerably both the gross longs and shorts by 5648 and 17135 contracts respectively. The British Pound sentiment continued to deteriorate as retail sales fell 0.3% on month in January instead of an expected rise following 2.1% slump the previous month. The net short position in British Pound increased $67 million to $5.17bn as investors reduced the gross longs and increased shorts by 786 and 38 contracts respectively. The Japanese yen sentiment improved marginally as the net short position narrowed $92 million to $5.5bn. Investors increased both the gross longs and shorts by 2253 and 1131 contracts respectively.

The Canadian dollar improved as wholesale sales grew more than expected on moth in December. The net longs increased by $0.4bn to $1.87bn against the dollar. Investors built both the gross longs and shorts. The bullish sentiment further improved for the Australian dollar as unemployment declined to 5.7% in January from 5.8% the previous month. The net longs rose by $0.7bn to $2.57bn. Investors increased the gross longs and shorts. The sentiment toward the Swiss franc continued to improve with the net shorts narrowing by $321 million to $1.1bn. Investors increased the gross longs and covered shorts.

CFTC Sentiment vs Exchange Rate