The Interpublic Group of Companies, Inc (NYSE:IPG) reported healthy third-quarter 2016 results with GAAP earnings of $128.6 million or 32 cent per share, up from $74.9 million or 18 cents per share in the year-earlier quarter. The year-over-year increase was primarily due to higher revenues.

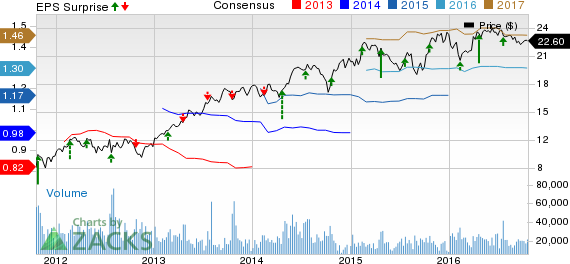

Adjusted earnings came in at 31 cents per share compared to 27 cents in the prior year quarter, beating the Zacks Consensus Estimate of 28 cents.

Revenues

Revenues for the quarter were $1,922.2 million, up 3% from the prior-year period. Revenues beat the Zacks Consensus Estimate of $1,903 million. The company recorded 4.3% growth in organic revenues over the prior-year period despite a negative foreign currency translation effect of 1.7%. Net acquisitions positively impacted revenues by 0.4%.

Geographically, Interpublic saw organic growth of 1.8% in the U.S. and 8.1% in the international markets. Results were triggered by new business wins and strength in all geographic regions, led by a notable performance in the domestic market.

Margins

Operating income increased to $207.2 million, compared with $191.9 million in third-quarter 2015, driven by better cost-management efforts. Operating margin also improved to 10.8% from 10.3% in the prior-year quarter. Total operating expenses in the quarter were $1,715 million, up 2.5% year over year, due to higher salary and other expenses.

Acquisition

During the quarter, the company acquired a U.K.-based company, Flipside. The acquisition will enable Weber Shandwick deliver a fully integrated, modern digital offering that will be profitable for both B2C and B2B marketers.

Balance Sheet

As of Sep 30, 2016, cash, cash equivalents and marketable securities were $894.6 million compared with $881.2 million as of Sep 30, 2015. Total debt was $1.74 billion at the quarter end.

Share Repurchase Program/Dividend

During the third quarter, the company repurchased 3.5 million shares for $80.8 million at an average price of $23.01 per share, bringing its tally for the first nine months of the year to 8.5 million shares, at an aggregate cost of $193.3 million and an average price of $22.69 per share.

Interpublic paid a dividend of 15 cents per share for a total consideration of $59.5 million during the reported quarter.

Guidance Updated

Interpublic reiterated its 2016 financial targets. For 2016, the company updated its organic revenue growth expectations to 4–5% from 3%-4% expected earlier, with operating margin improvement of 50 basis points or more over the previous year.

Interpublic currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Among other stocks in the industry Acacia Research Corp. (NASDAQ:ACTG) will release its results on Oct 27, Social Reality, Inc. SRAX will report on Nov 7, while Harte-Hanks Inc. (NYSE:HHS) will come up with its numbers in Nov 1.

Confidential from Zacks

Beyond this Analyst Blog, would you like to see Zacks' best recommendations that are not available to the public? Our Executive VP, Steve Reitmeister, knows when key trades are about to be triggered and which of our experts has the hottest hand. Click to see them now>>

HARTE-HANKS INC (HHS): Free Stock Analysis Report

INTERPUBLIC GRP (IPG): Free Stock Analysis Report

ACACIA RESEARCH (ACTG): Free Stock Analysis Report

SOCIAL REALITY (SRAX): Free Stock Analysis Report

Original post

Zacks Investment Research