The OECD released their latest global growth forecast this week, calling for a slight uptick in overall activity. OECD GDP is projected to be 3.5% this year – the highest in four years. Russia and Brazil are projected to grow as well.

But global structural issues remain. Trade and investment are still weak. The OECD argues week capital expenditures are a root cause of low employment growth, which is contributing to lower spending. Additionally, the report states that weak supply growth—not stronger demand—is the largest contributor to declining global slack. But despite the reports misgivings about certain growth aspects, the overall increase is projections is welcome news to the financial community.

The Bank of Japan maintained their current interest rate posture in their latest policy announcement. One of the more interesting aspects of the bank's policy analysis is their focus on income, where they routinely speak of two “virtuous cycles:”

“On the domestic demand side, business fixed investment has been on a moderate increasing trend with corporate profits improving. Private consumption has increased its resilience against the background of steady improvement in the employment and income situation.

Here, they’re relying on standard Keynesian analysis: rising business income leads to higher investment and lower unemployment creates higher income, leading to increased consumption. They have consistently expressed their belief in this relationship for most of the Abenomics experiment.

EU news was light. Inflation increased .2% to 1.5%, which is hardly enough to warrant inflationary concerns. Markit released their latest numbers, all of which increased: manufacturing was up .8 to 58.2; services increased .9 to 55.6 and the composite index rose a full point to 56.7.

The report's internals point to continued stronger growth: new orders and manufacturing output were the strongest since 4/11; rising exports and backlogs indicate stronger demand and employment increased at a record pace. In sum, it appears overall output is picking up at a stronger pace.

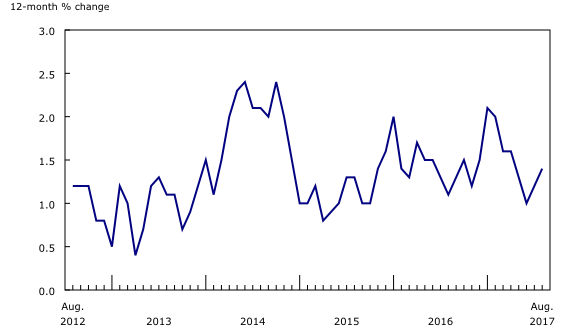

Canadian news continues to impress. Inflation is low; the latest reading was a paltry 1.4%. The following chart from the report shows that overall CPI has only been greater than or equal to 2% twice since 4Q14:

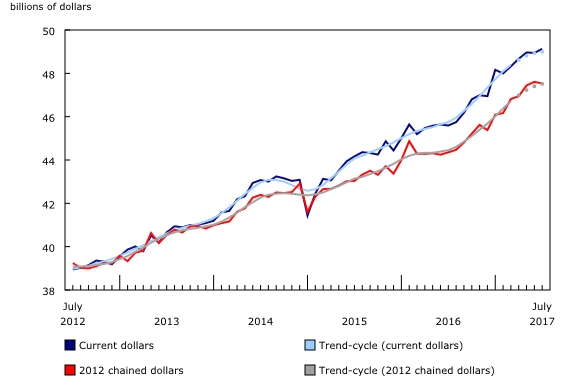

Retail sales continue to rise, this time by 4%. The overall trend for Canadian consumer spending points towards continued expansion:

The RBA released their latest meeting minutes. After noting strong employment growth but weak wage pressures, they offered the following analysis of the macroeconomy:

Members noted that the national accounts for the June quarter would be released the day after the meeting and that an increase in the quarterly growth rate of GDP was likely. Solid growth in retail sales suggested that household consumption growth was likely to have risen in the June quarter. However, retailers had discounted prices to achieve sales, which meant that growth in nominal retail sales had been more modest.

Non-mining business investment was expected to have increased in the June quarter, based on recent data. Forward-looking indicators such as capacity utilisation and investment intentions from business surveys suggested a further pick-up was in prospect, consistent with the Bank's forecast for growth in non-mining investment to strengthen gradually. Non-residential building approvals had picked up strongly over preceding months and non-mining investment intentions for 2017/18 reported in the ABS capital expenditure survey had been revised upwards. The data still pointed to modest growth at best, but the survey covers only around half of non-mining investment; growth in investment in the other parts of the non-mining sector, such as education and health, had been stronger.

In short, the Australian goldilocks economy continues. Thanks to their symbiotic relationship with China, they avoided global recession of 2007-2009. But their economy is still rebalancing from one that is heavily reliant on mining and to a lesser extent housing, to one more dependent on consumption.

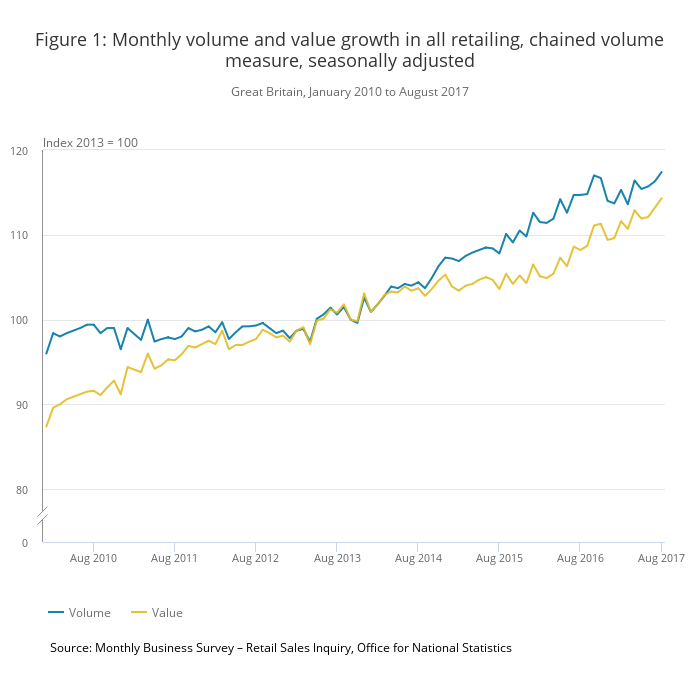

Finally, we have the UK, where the only data released was retail sales. There were up 1$ M/M and 2.4% Y/Y. The multi-year trend remains positive:

Global economic news continues its bullish trend. Abenomics has finally taken hold to some extent in the Japanese economy. Australia continues to consistently grow. Canada has clearly emerged from its mild recession. The EU has emerged from its post-recession weakness. Finally, the UK has avoided recession. All that matters now is consistency.