This week will be interesting, with inflation data Tuesday and Wednesday and quadruple witching on Friday. There will be a lot of big Treasury auctions this week, which will move yields and stocks. The one wrinkle is that the VIX options expiration doesn’t take place until Wednesday, September 21.

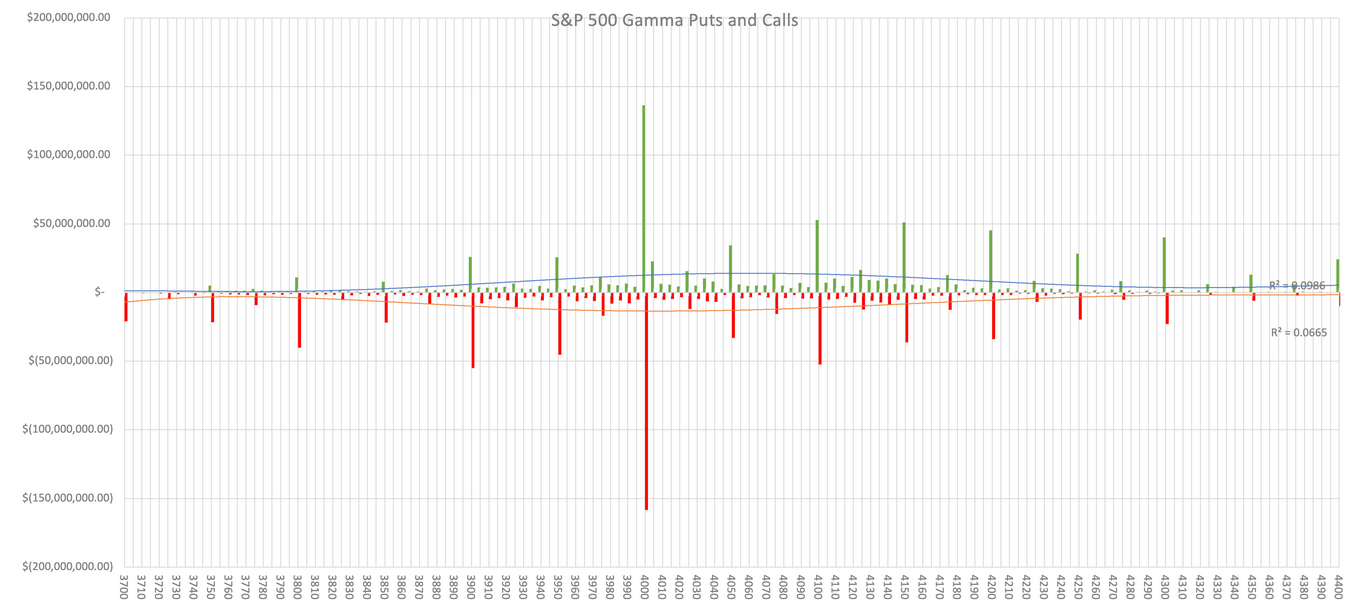

Options expiration will play a big part in what happens this week, and it could be more of an impact than the actual inflation data. At this point, the gamma levels suggest the S&P 500 is too far out in front of itself and needs to pull back down. Of course, these gamma levels change daily and could roll higher. But at this point, the region with the most significant amount of gamma on the S&P 500 is around 4,000, with 3,900 and 4,100 acting as the outside boundary for the puts and calls.

This tells us that depending on how these levels shift throughout the week, unless we see a significant amount of gamma start building up at higher levels, the S&P 500 could pull back towards 4,000. We also saw something similar happen in July and August, with the QQQ ETF running higher the week before options expiration and then falling back to its more significant gamma levels the week of options expiration.

A pullback would work from a technical perspective, as there are many strong Fibonacci relationships in the S&P 500 futures. The current move higher has retraced 50% of the drop from the mid-August highs to the September lows. Also, the rally has been a 1.618% extension starting on September 7.

An ending diagonal triangle also appeared to form on Friday afternoon and probably suggests we see the S&P 500 futures pull back to around 4,000.

If this is the start of an impulsive wave three down, the decline could go well below 4,000, take out the recent lows around 3,900, and eventually take the S&P 500 to new lows. The chart of the cash market has a clear rhythm to it and, on top of that, has a bearish ascending broadening wedge pattern.

Nasdaq

The QQQ has the same patterns as the S&P 500, with the ascending broadening wedge and the ending diagonal triangle, all suggesting we see lower prices. Like the S&P 500, the QQQ has merely retraced 38.2% of the recent drop. But unlike the S&P 500, the QQQ has already broken the lower bound of its broadening wedge, which may tell us what will happen next for the S&P 500.

TIP

The TIP ETF also has that same broadening wedge pattern as the S&P 500 and QQQ. Like the QQQ, the TIP ETF has also broken below the lower bound of the broadening wedge, which is a sign that the bearish pattern has already taken hold. Since we know that the QQQ ETF and the TIP ETF follow each other over time, it is not surprising to see the same pattern in the three charts.

2-Year

The 2-year rate pushed higher on Friday, closing at a new cycle high of 3.56%. The 2-year appears to have broken through resistance, and as I have noted before, if the Fed is serious about getting rates up to 4%, then the 2-year rate should have a four-handle in the not too distant future.

Biotech

Biotech did not participate in the rally on Friday, sure it was up, but fractionally compared to the outsized gains of the broader indexes. It also appears to have put in a potential reversal candle, while failing at its long-term downtrend.