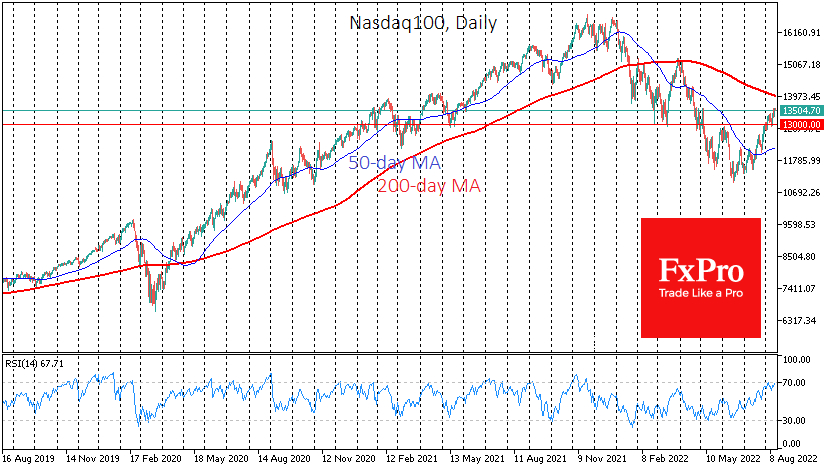

The US stock market recorded the third week of gains, allowing the Nasdaq 100 to add 2.1% and overcoming several meaningful resistances, potentially clearing the way for a further leg up. At the same time, local technical overbought conditions have accumulated.

Much of the growth is centred around expectations of a Fed move, which may not materialise.

The following factors are on the side of the stock market bulls at the start of the new week. The S&P 500 has already regained more than half of its losses from the peak to mid-June lows. The Nasdaq 100 is up over 20% from the lows. The 13000 level has moved back into support from resistance.

The risk sentiment improves after positive macroeconomic data: considerable job growth with tempered wage increases and inflation slowdown. That was the goldilocks combination investors wanted to see.

However, this week markets should put the hope of solid macroeconomic fundamentals to one more test. The Fed will release its industrial production data on Tuesday and the last FOMC meeting minutes on Wednesday. In addition, on Wednesday, we see July retail sales, and on Thursday, existing home sales. The Fed and retail sales may be enough for the indices and overall market sentiment to turn lower on Wednesday, disappointing investors.

We also note the overbought conditions on RSI at Nasdaq 100 daily timeframes. The 200-day moving average now runs near the 14000 level. It worked effectively as resistance in February and April. And by the new test of this level, critical for managers and traders, the market evolved rather tired after two months march. In such an environment, a correction or a prolonged consolidation to clarify the economic and monetary outlook is more likely.

Should the Nasdaq 100 close above 14000 by the end of the week, we would say another bull run and more likely end the bear market in US equities. Coming back below 13000 would suggest that last week was a false break-up, and the bears but not the bulls are returning to the markets after the summer break.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Impressive Nasdaq 100 March Hits Obstacles

Published 08/15/2022, 06:00 AM

Updated 03/21/2024, 07:45 AM

Impressive Nasdaq 100 March Hits Obstacles

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.