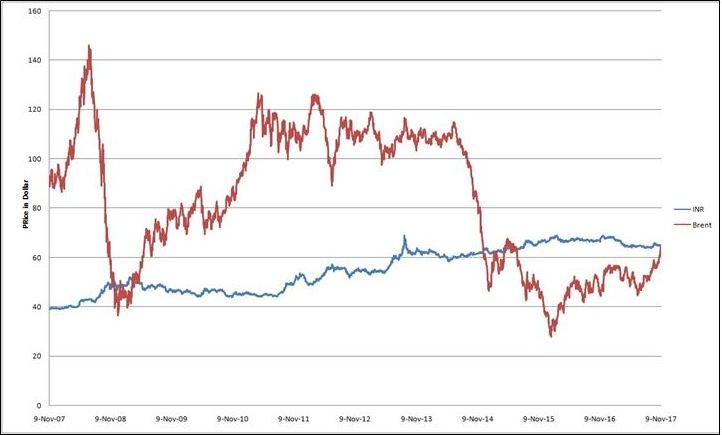

India like most countries has always been a net importer of oil. With the rising crude oil prices, the emerging markets’ names are back in the headlines. These countries have an inverse relation with oil prices, putting severe pressure on the economy. Here we have a 10-year analysis, understanding the historic trend between the Indian rupee and Brent Crude prices and if the correlation does exist.

3 Factors That Affect Oil Prices

The current supply, access to future supply and the third is the demand.

In 2008 when the oil prices were rising, it had a major impact on our economy causing the rupee to rise, and fuel dependent industries like the airline industry were seen laying people off just to cut costs. If the oil price would have continued increase, the growth of our economy wouldn’t have been able to sustain.

However at the same time, from 2009 up until 2010, we saw a strengthening rupee irrespective of the oil markets was because of the increase in the FIIs. The investors were investing in emerging markets, mainly India and China; this was because the US economy was still recovering from the global recession of ’08. Even the oil prices were in our favor i.e. they were seen fluctuating but not by too much.

In 2010, when they touched around $71a barrel, we saw a trend reversal, and marked the highest crude oil prices since 2008. Demand growth in emerging markets, notably China and the Middle East, along with the Arab spring and civil wars in Libya drove crude oil prices higher in 2011. 2011 was a dismal year for the Indian economy, the rupee was seen tumbling to a record low against the dollar, paired with high inflation and slowing growth.

Due to stagnant reforms, and declining foreign investment, rupee continued depreciating till 2013. After continued depreciation, and high inflation, the then Prime Minister of India, Manmohan Singh, made a statement in the Parliament of India on the issue. He was of the view that, the present depreciation is partly led by global factors as well as domestic factors.

In 2014 when the oil prices started to fall because of an oversupply our economy started to pick up again, the overall economic situation in the country was looking better and the basic parameters of the Indian economy were moving in the right direction. The growth was uneven and driven majorly by private consumption and public investment, but low oil prices helped a lot.

In 2016, we saw the Brent crude oil prices double because of OPEC agreeing to cut production, we saw a weakening in the rupee right after the hike but at the same time we have our own government trying to introduce economic reforms to increase FIIS/FDIs into our economy. The impact of the same was also seen our economic indicators like increase in fiscal spending and inflation. At the same time India has started importing oil from Non OPEC nations making it less reliant on only one economic scenario.

Even with the current oil prices crossing its estimate of $60 we can see a weakening rupee. However the same time we have the US trying to increase the oil production which would hopefully stabilize the oil price again.

India’s resilience towards the oil prices lately:

The repel effect of increasing oil imports are seen gradually and not as soon as the prices increase. This is mainly because the increasing oil prices are applicable for the newer imports only. The volatility of oil is extremely high and the effect of the same can be controlled in the following ways:

- Hedging: In august oil prices were around $47-$50 a barrel, currently the prices are around $63.84 a barrel, even a 3 month future contract taken back then, lowers the blow of the increasing import costs.

- Strategic Oil Reserves: India has approximately 5.33 MMT of emergency fuel reserves, which is just our 10 day’s requirement, the government has also been trying to increase our reserves, in our this year’s fiscal budget meeting Arun jaitley announced an expansion plan which would take our reserves to 15.33 million tons.

- Our government had budgeted for oil to be around $55-$60, this caused the oil to be comparatively less reactive when oil hadn’t crossed $61, when it crossed $61 we saw a weakening rupee.

- US is a net importer of oil. Hence, even though it produces its own, it gets affected by oil prices. It is also the currency of international trade. When oil prices appreciate, there are more number of dollars leaving the country, which leads to a weaker dollar, automatically reducing the downward pressure on the rupee. However, US is also one of the biggest oil producer - so when oil price will go up, its own oil revenue will also go up – but since it’s a net importer, it isn’t able to absorb the blow.

To conclude, not only do oil prices affect the currency directly but they affect the economy as a whole, which indirectly impacts the rupee as well, making it a dual effect. Oil and Indian Rupee very clearly have an inverse relation. However at the same time oil isn’t the only factor that affects our economy. Hence, the only time we see this inverse relation very prominently is when the oil prices are low, when they are high there are always measures which are taken which reduce the impact of the same, unless the prices are on a constant rise for a prolonged period.