The first time we wrote about Illumina (NASDAQ:ILMN), the life sciences tools and systems manufacturer, was over seven years ago, in March, 2015. The stock was approaching $200, but a complete five-wave impulse on its weekly chart convinced us that Illumina was “not as healthy as it seems“. Less than a year later, in February, 2016, ILMN had already fallen below the $140 mark.

Fortunately for the bulls, once a correction is over, the larger trend resumes. Illumina was clearly in an uptrend prior to its fall, so we wrote another update, positive this time. We thought “the upcoming rally should be powerful enough to exceed the top at $242“. Less than two years later, in January, 2018, Illumina stock reached a new record of $245.

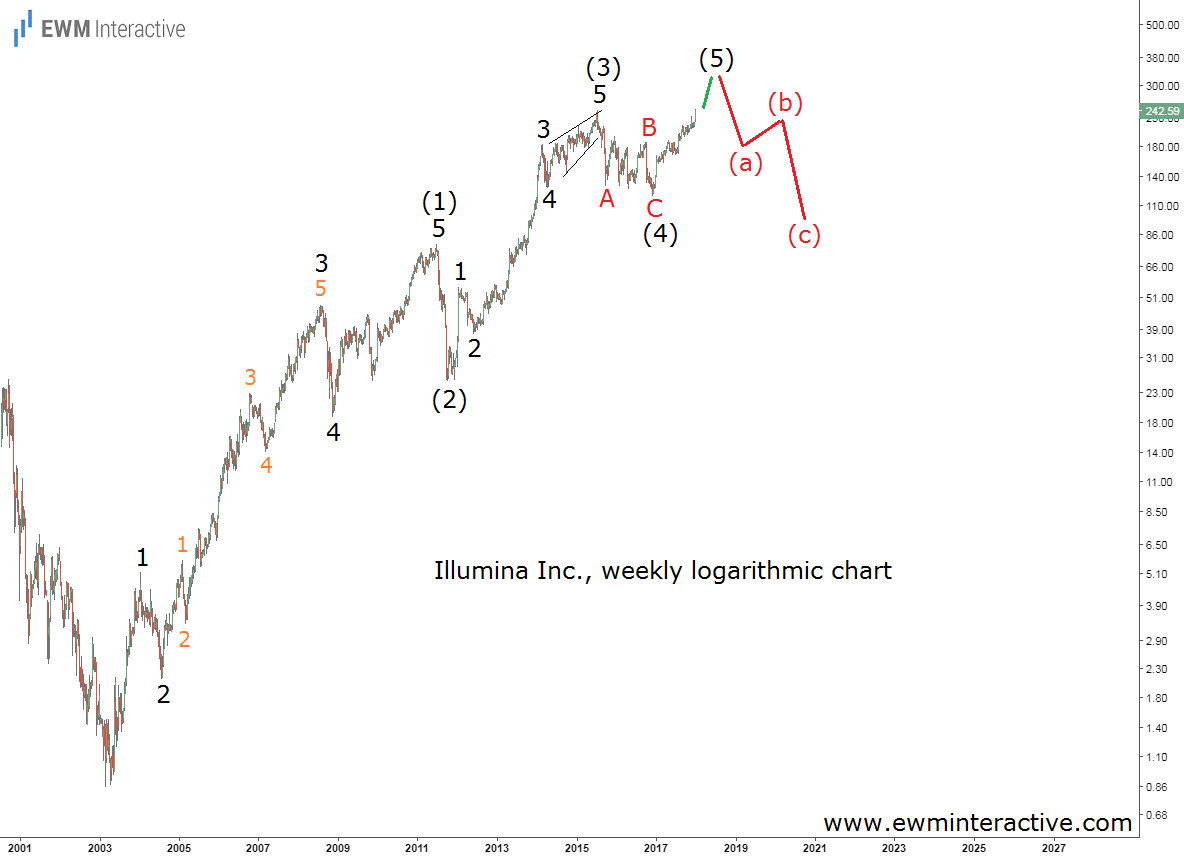

So, in yet another article we opined that it can reach and exceed the $300 level. However, we thought the bulls were walking on thin ice. The weekly logarithmic chart below showed Illumina was in its fifth and final wave.

Nearly Five Years Later, It Is Time for Another Look

A lot of things happened in the four and a half years since our last examination of Illumina stock. Wave (5) ended at $381 in July, 2019, and a notable correction did follow. However, the price only fell to $197 amidst the Covid panic of March, 2020. Instead of moving even lower, it shot up to $556 by February, 2021.

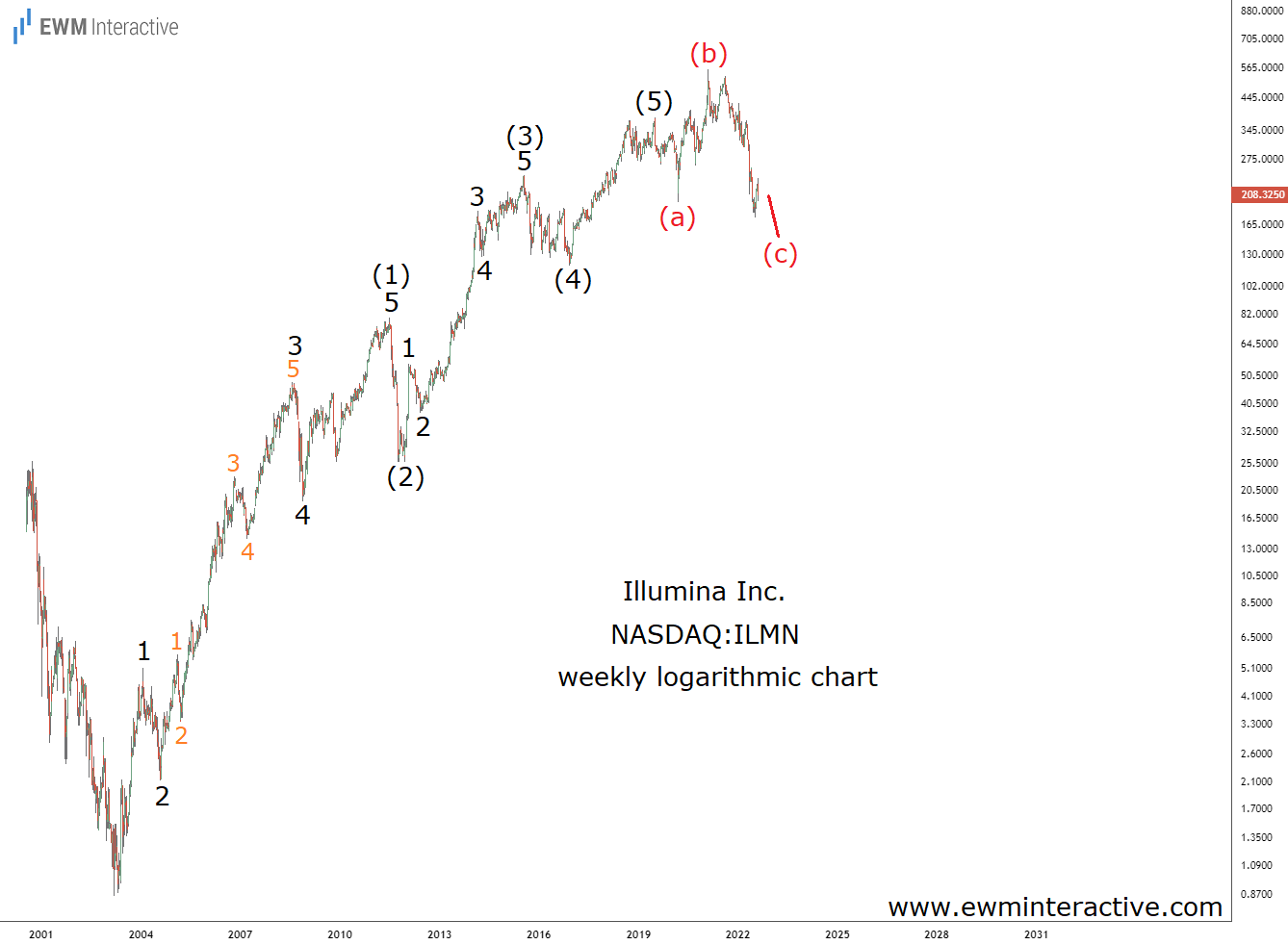

Alas, no trend lasts forever. Extremely high valuation and a few missteps by the company have resulted in a 63% crash so far. The updated chart below shows buy-and-hold Illumina investors have literally nothing to show for it over the last five years.

Similar Elliott Wave setups occur in the Forex, crypto and commodity markets, as well. Our Elliott Wave Video Course can teach you how to uncover them yourself!

It looks like Illumina ‘s five-wave impulse, which ended at $381, was followed by an expanding flat correction. Even on this rather rough chart it is visible that waves (a) and (b) are three-wave structures. According to the Elliott Wave theory, wave (c) is supposed to evolve into an impulse pattern.

Illumina Stock Can Lose Another 50%

But weekly log charts are not meant for accurate predictions. In order to see what is left of ILMN’s decline, we need to take a closer look on the daily chart below.

Waves (a) and (b) can only be counted as simple a-b-c zigzags. The anticipated impulsive structure in wave (c) doesn’t seem complete yet. It appears to have entered a sequence of fourth and fifth waves. Wave (iv) of 3 is currently developing. Once it is over, waves (v) of 3 and 5 should drag the stock lower, interrupted by a corrective recovery in wave 4.

Judging by this schematic, ILMN bears can reach not only $140, but also approach the $100 mark. Once there, however, the correction that began in July, 2019, would be complete. It would again be time for the larger uptrend to resume, depending on the company’s condition, of course. For now, though, the bears remain in charge with ~50% more downside ahead.